In the ever-evolving landscape of financial markets, investors are continually seeking reliable strategies to optimize their portfolios and secure steady income streams.Among the various investment avenues, fixed-income investments stand out for their stability and predictability. For those looking to navigate the complexities of bonds, treasury bills, and other fixed-income securities, understanding the fundamentals is crucial. This comprehensive guide aims to demystify fixed-income investing, equipping both novice investors and seasoned professionals with the knowledge to make informed decisions. From the mechanics of interest rates to the nuances of credit risk, we will explore the intricacies of this asset class, offering practical insights and strategies to help you master the art of fixed-income investing. Whether your goal is capital preservation, income generation, or diversification, this guide will serve as an essential resource on your journey to investment success.

Table of Contents

- understanding Fixed-Income Securities and Their Role in a Diversified Portfolio

- Evaluating Bonds: Key Metrics and factors for Making Informed Decisions

- Strategies for maximizing returns in a Low-Interest Rate Environment

- Risk Management Techniques for Fixed-Income Investments

- In Retrospect

Understanding Fixed-Income Securities and Their Role in a diversified portfolio

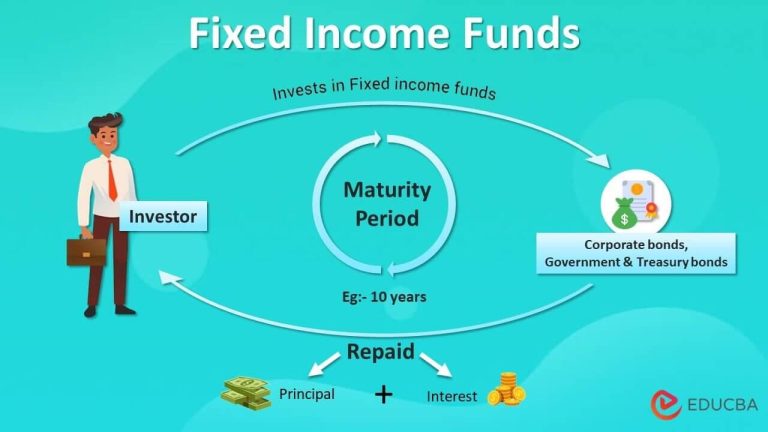

Fixed-income securities are financial instruments designed to provide investors with predictable income streams, making them a cornerstone of a well-diversified investment strategy. These instruments, including bonds, treasury bills, and certificates of deposit, typically offer regular interest payments and the return of principal upon maturity. The appeal of fixed-income securities lies in their ability to reduce overall portfolio volatility, thus serving as a buffer against the unpredictabilities of equity markets. Investors often choose these securities for their stability and reliability, especially during periods of economic uncertainty.

Incorporating fixed-income investments into a diversified portfolio can enhance risk management and optimize returns. By allocating a portion of the investment mix to fixed-income assets, investors can achieve a balance that mitigates risks associated with stock market fluctuations. A wise approach to structuring this allocation involves considering factors such as time horizon, risk tolerance, and market conditions. Below are some key reasons why fixed-income securities should be an integral component of your investment strategy:

- Steady Income: Regular interest payments provide predictable cash flow.

- Capital Preservation: They are generally less volatile then equities, providing a safety net for principal investments.

- Interest Rate Protection: Diversifying portfolios with various durations can help manage interest rate risks.

- Inflation Hedge: Some fixed-income securities, such as TIPS, offer protection against inflation.

Evaluating Bonds: Key Metrics and Factors for Making informed Decisions

When evaluating bonds, investors should consider a variety of key metrics that can significantly influence their decisions. Among these, the coupon rate, which represents the annual interest payment made by the bond issuer, is essential. A higher coupon rate may indicate a more attractive investment, but it’s essential to balance this against the bond’s credit quality.Additionally, the yield to maturity (YTM) provides insights into the total expected return if the bond is held until it matures. Understanding these aspects, alongside the bond’s duration, can help investors assess interest rate risk, as bonds with longer durations are often more sensitive to interest rate fluctuations.

Another crucial factor is the credit rating of a bond,which gauges the issuer’s creditworthiness and the likelihood of default. Ratings provided by agencies like Moody’s or Standard & Poor’s can range from investment grade to junk status, influencing both the risk level and potential returns. Investors should also consider the bond’s call provisions, which indicate whether the issuer can redeem the bond before its maturity date. These features can impact the bond’s value and return profile. Lastly, market conditions, such as inflation rates and economic outlook, should be monitored as they can affect bond prices and yields.

Strategies for Maximizing Returns in a Low-Interest Rate Environment

In today’s low-interest rate environment, traditional fixed-income investments often fall short in delivering the expected returns. To combat this challenge, investors can explore several innovative strategies to enhance yield while managing risk effectively. One approach is to diversify into corporate bonds with higher credit ratings, which can possibly offer better yields compared to government bonds. Additionally, consider high-yield bonds or emerging market debt; both can provide higher returns but come with increased risk, so careful selection is vital. Utilizing bond ladders can also help; by staggering maturities, you can mitigate interest rate risk while maintaining liquidity.

Another recommended strategy involves investing in fixed-income funds that actively manage bond portfolios to capitalize on market fluctuations. such funds often employ investment tactics like sector rotation, targeting bonds from sectors expected to perform well amid economic changes. Moreover, keeping an eye on inflation-linked bonds may shield investments from declining purchasing power, allowing for greater stability in returns. To further maximize potential gains, consider leveraging tax-advantaged accounts for bond investments to retain more of your earnings in a low-yield scenario.

Risk Management techniques for Fixed-Income Investments

Effective risk management in fixed-income investments is crucial for preserving capital and achieving steady returns. Investors can mitigate potential threats thru a variety of techniques, such as duration management, which focuses on the sensitivity of a bond’s price to interest rate changes. By aligning the portfolio’s duration with the investor’s risk tolerance and market outlook, one can minimize exposure to rate hikes.Other strategies include credit analysis, where thorough assessments of bond issuers help gauge the likelihood of default, allowing investors to select securities with adequate yield compensation relative to their assessed risk.

Diversification plays a pivotal role as well,spreading investments across various bond types,sectors,and geographies to reduce unsystematic risk. Techniques such as laddering—a strategy that involves purchasing bonds with different maturities—can also enhance liquidity and provide a buffer against interest rate fluctuations. Implementing stop-loss orders can protect capital by setting predetermined thresholds for selling securities, ensuring that losses are limited. Moreover, utilizing inflation-protected securities can safeguard purchasing power in inflationary environments, making these instruments an essential component of a well-rounded fixed-income strategy.

In Retrospect

As we wrap up our comprehensive guide to mastering fixed-income investments, it’s clear that this asset class holds notable potential for diversifying your portfolio and enhancing long-term financial stability. Navigating the world of bonds—whether government, corporate, or municipal—can be complex, but understanding the underlying principles and strategies can empower you to make informed decisions that align with your investment goals.

Remember, the key to success in fixed-income investing lies in thorough research, prudent risk management, and staying updated on market trends. By mastering these elements, you can effectively harness the power of bonds to generate reliable income, mitigate risk, and ultimately contribute to a well-rounded investment strategy.

We hope this article has provided you with valuable insights and practical tips to enhance your financial journey. If you have any questions or wish to share your own fixed-income experiences, feel free to leave a comment below. Happy investing, and may your financial future be filled with prosperity and growth!