In an increasingly complex financial landscape, managing a household budget can frequently enough feel overwhelming. As families juggle the demands of everyday life—ranging from groceries and bills to unexpected expenses and savings goals—it becomes crucial to approach family finance with clarity and strategy. This budgeting guide aims to empower families of all shapes and sizes to take control of their finances, ensuring that money works for them rather than the other way around. Whether you’re a seasoned budgeter or just beginning to navigate the world of personal finance, this comprehensive resource will provide practical tips, tools, and insights to help you create a sustainable financial plan. Join us as we explore the essential elements of budgeting, making informed financial decisions, and cultivating a stress-free money management routine that supports your family’s unique needs and aspirations.

Table of Contents

- Understanding Family Financial Goals and priorities

- Creating a Comprehensive Family Budget: Steps and Tips

- Monitoring and Adjusting Your Family Budget for Success

- Tools and Resources for Effective Family Financial Management

- To Conclude

Understanding Family Financial Goals and Priorities

When navigating the complex landscape of family finances, it’s crucial to define clear financial goals and establish priorities that resonate with all family members. These goals can range from short-term objectives such as saving for a family vacation to long-term plans like funding education or preparing for retirement. Engaging in open discussions about financial aspirations fosters a sense of teamwork and understanding among family members, ensuring that each individual’s voice is heard. This collective effort not only clarifies priorities but also creates a supportive environment were everyone feels invested in achieving financial success.

To facilitate this process, consider creating a visual depiction of the family’s financial goals. A simple table can definitely help streamline and clarify your objectives, enabling you to track progress effectively. Here’s an example layout:

| Financial Goal | Target Date | Current Status |

|---|---|---|

| Emergency Fund | End of 2024 | 70% Funded |

| Family Vacation | Summer 2023 | Planning Stage |

| College Savings | Fall 2026 | 30% Funded |

By regularly reviewing these priorities as a family, you can ensure that everyone remains aligned and motivated toward common financial achievements. This transparency not only improves accountability but also inspires creative ideas for budget optimization, fostering a culture of financial literacy and collaboration within the home.

Creating a comprehensive Family Budget: Steps and Tips

Establishing a comprehensive family budget is crucial for achieving financial stability and planning for the future. Start by gathering all your financial facts, which includes income from salaries, bonuses, and any side jobs. Next, list all your monthly expenses, categorizing them into fixed (like rent or mortgage, utilities, and insurance) and variable (like groceries, childcare, and entertainment) costs. This visibility will help you understand where your money goes each month and identify areas where you can cut back. consider using budgeting tools or apps to streamline this process, making it easier to track your spending in real-time.

once you’ve got a clear picture of your income and expenses, it’s time to implement some budgeting strategies. One effective method is the 50/30/20 rule, where 50% of your income goes towards needs, 30% towards wants, and 20% towards savings and debt repayment.To make things even clearer, you can create a simple budget table that shows each category and its respective allocation:

| Category | Percentage | Monthly Amount (Based on $5000 Income) |

|---|---|---|

| Needs | 50% | $2500 |

| Wants | 30% | $1500 |

| savings/Debt Repayment | 20% | $1000 |

Regularly review and adjust your budget as circumstances change, such as a new job, changes in income, or major expenses like a new home or car. Engaging the entire family in the budgeting process fosters a sense of teamwork and accountability. Encourage each member to share their thoughts on financial priorities and spending habits, and consider setting up monthly family finance meetings to discuss the budget, celebrate achievements, and strategize for upcoming financial goals. By working together, your family can cultivate a healthier relationship with money and pave the way for lasting financial security.

Monitoring and Adjusting Your Family Budget for Success

To truly achieve financial success as a family, it’s essential to exercise vigilance in monitoring your budgeting progress. Keep your financial health in check by regularly reviewing your expenses, income, and savings. Schedule monthly budget meetings where each family member can contribute insights and updates on their spending habits. Consider these strategies for effective monitoring:

- Track spending: use apps or spreadsheets to categorize and record all expenses.

- Set financial goals: Establish short-term and long-term goals and assess your progress regularly.

- Review recurring expenses: Identify subscriptions or bills that can be trimmed or eliminated.

Adjusting your budget is just as crucial as monitoring it. Life can throw unexpected challenges your way,from car repairs to medical bills,and a flexible budget can empower you to respond effectively. Here’s how to adapt your budget for changing circumstances:

- Emergency Fund: always prioritize allocating funds for emergencies,thereby reducing reliance on credit.

- Evaluate lifestyle changes: If income fluctuates, adjust discretionary spending accordingly.

- Involve everyone: Make budgeting a family affair to share responsibilities and reinforce accountability.

| Activity | Frequency |

|---|---|

| Monthly budget review | Once a month |

| Expense tracking | Weekly |

| Emergency fund assessment | Quarterly |

Tools and Resources for Effective Family Financial Management

to effectively manage family finances, leveraging the right tools and resources is crucial. Start by using budgeting apps that resonate with your family’s financial habits. Some recommended options include:

- You Need a Budget (YNAB): Focuses on proactive budgeting and helps you allocate your income effectively.

- Mint: offers a free platform to track income, expenses, and financial goals in one place.

- GoodBudget: A virtual envelope system that allows for easy expense tracking and savings goals.

In addition to apps, several financial resources can further enrich your understanding and capability in family finance management. Consider attending workshops hosted by local community centers or financial institutions. Additionally,useful literature,such as budgeting ebooks or blogs focusing on family finance,can provide strategies tailored to your specific circumstances. Here are some resources to explore:

- Financial Peace University: Offers courses on managing debt and budgeting for families.

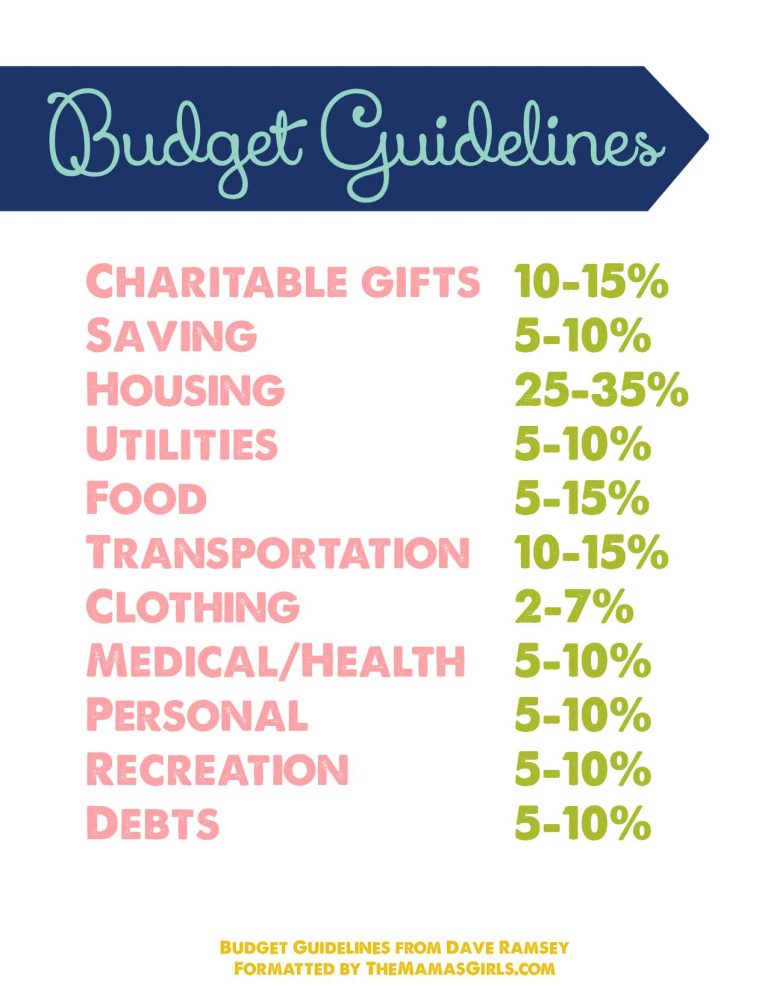

- Books by Dave ramsey: A comprehensive guide to financial health for families.

- Online communities: Engage with forums,such as Reddit’s personal finance group,for shared experiences and advice.

To Conclude

As we wrap up our comprehensive guide on mastering family finances, it’s essential to remember that budgeting is not just a one-time task, but a continuous journey toward financial stability and prosperity. By implementing the strategies discussed, you can cultivate a financial environment that not only meets your family’s needs but also promotes growth and security for your future.

Take the insights from this guide and adapt them to fit your unique family dynamics and goals. Involve every family member in the budgeting process to foster accountability and teach valuable financial skills. Remember, the earlier you start practicing positive financial habits, the better prepared your family will be for life’s unexpected challenges.

We hope this journey toward mastering family finance inspires you to take charge of your financial life.Here’s to a future built on smart budgeting, open conversations about money, and the resources you need to thrive. Embrace the challenges, celebrate the wins, and keep striving for a financially healthy family. Happy budgeting!