In the world of investing, one principle stands out as a beacon of wisdom amidst the frequently enough turbulent seas of market volatility: dollar-cost averaging (DCA). as an investment strategy that involves consistently investing a fixed amount of money over regular intervals, regardless of market conditions, DCA offers a systematic approach to building wealth while minimizing the risks associated with unpredictable price fluctuations. For both seasoned investors and newcomers alike, understanding the intricacies of dollar-cost averaging can empower you to navigate the complexities of the financial landscape with greater confidence. In this article, we will explore the mechanics of dollar-cost averaging, its advantages in reducing the impact of market volatility, and practical tips for implementing this strategy effectively in your investment journey. Whether you’re saving for retirement, a major purchase, or simply hoping to grow your wealth over time, mastering DCA could be the key to achieving your financial goals.

Table of Contents

- Understanding Dollar-Cost Averaging and Its Importance in Investment Strategies

- Key benefits of Dollar-Cost Averaging for Long-Term Wealth Accumulation

- Practical Steps to Implement a Successful Dollar-Cost Averaging Approach

- Common Misconceptions and Pitfalls to Avoid When Using Dollar-Cost Averaging

- The Way Forward

Understanding Dollar-Cost Averaging and Its Importance in Investment Strategies

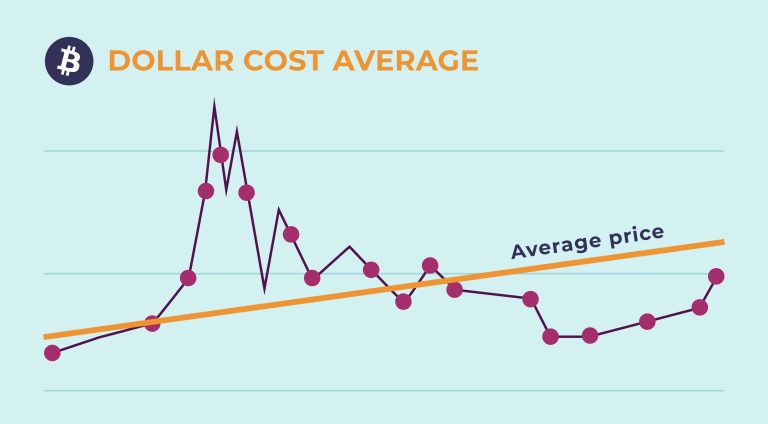

Dollar-cost averaging (DCA) is a powerful investment strategy that allows individuals to invest a fixed amount of money repeatedly over time, regardless of asset prices. This method enables investors to mitigate risk associated with market volatility by spreading the investment over various price points. One of the key benefits of DCA is that it helps to avoid the pitfalls of timing the market, which can frequently enough lead to poor investment decisions. By regularly committing a set amount, investors can take advantage of market dips while avoiding large investments at perhaps inflated prices. Here are some advantages of adopting dollar-cost averaging:

- Reduces emotional decision-making: Helps eliminate the fear and anxiety associated with market fluctuations.

- Encourages disciplined investing: Promotes saving and consistent investment habits over time.

- Builds wealth gradually: Takes advantage of compounding interest, potentially leading to significant returns.

In practice, implementing dollar-cost averaging can be as simple as setting up automatic contributions to your investment accounts. This ensures that you remain committed to your financial goals while also cushioning the blow against sudden market downturns. To illustrate the concept further, consider the following example of investing $100 each month over six months:

| Month | Investment Amount ($) | Price per Share ($) | Shares Purchased |

|---|---|---|---|

| 1 | 100 | 10 | 10 |

| 2 | 100 | 8 | 12.5 |

| 3 | 100 | 12 | 8.33 |

| 4 | 100 | 9 | 11.11 |

| 5 | 100 | 11 | 9.09 |

| 6 | 100 | 7 | 14.29 |

In this example, the investor has purchased shares at different prices. By the end of the six months, the average cost per share would be lower than in a lump-sum investment approach, demonstrating the efficacy of dollar-cost averaging in creating a balanced investment portfolio over time.

Key Benefits of Dollar-Cost Averaging for Long-Term Wealth Accumulation

Dollar-cost averaging (DCA) is a time-tested investment strategy that offers several key benefits for building long-term wealth. By regularly investing a fixed amount of money at predetermined intervals,investors can take advantage of market fluctuations,thereby reducing the impact of volatility. This method ensures that more shares are purchased when prices are low and fewer shares when prices are high, promoting a disciplined approach that can lead to lower average costs over time. The consistent investment also helps to alleviate emotional decision-making, encouraging investors to remain committed to their financial goals regardless of market conditions.

Furthermore, dollar-cost averaging fosters a sense of financial security that can empower investors to stay the course during turbulent times. This strategy allows individuals, regardless of their financial acumen, to participate in the market without needing to time their investments strategically. Key advantages include:

- Reduced Emotional Stress: Investors are less likely to panic during downturns, as they adhere to a systematic approach.

- Simplified Investment Process: DCA eliminates the need for constant monitoring of market trends, making it accessible to novices.

- Long-term Growth potential: The compounding effect of regular investments can significantly enhance wealth over time.

Practical Steps to Implement a Successful Dollar-Cost Averaging Approach

To effectively implement a dollar-cost averaging strategy, start by establishing a dedicated investment schedule.Determine how much you can invest regularly, whether it’s weekly, bi-weekly, or monthly, and stick to this commitment, regardless of market conditions. This disciplined approach not only helps in mitigating the emotional responses to market fluctuations but also creates a habit of consistent investing. You can consider using automated investment platforms that allow you to set up recurring purchases of your chosen assets, ensuring you won’t miss out on market opportunities.

Next, ensure the selection of a diverse range of assets to further reduce risk. While dollar-cost averaging is effective, diversifying your investment portfolio can enhance the benefits of the strategy. A couple of key points to keep in mind include:

- research Asset Classes: Include a mix of stocks,bonds,and exchange-traded funds (ETFs) based on your risk tolerance.

- Regular Assessment: Periodically review your portfolio to ensure alignment with your long-term financial goals.

By committing to a structured investment plan and periodically reassessing your portfolio’s diversity, you can position yourself for greater financial stability and potential long-term growth.

Common Misconceptions and Pitfalls to Avoid When Using Dollar-Cost Averaging

When employing dollar-cost averaging as a regular investment strategy, several misconceptions can lead investors astray. One common belief is that this approach guarantees profits regardless of market conditions. However, the reality is that dollar-cost averaging does not eliminate the risk of loss; instead, it spreads out investments, which can cushion against market volatility. Additionally,some investors mistakenly assume that they should always invest the same amount at the same frequency. This rigid structure may ignore significant market trends and opportunities for higher returns.

Investors often fall into the trap of overestimating their current financial situation when implementing dollar-cost averaging. Many believe that becuase they are investing regularly, they can ignore budgeting or spending habits. This can be detrimental and may lead to inadequate savings for emergencies or other investment opportunities. It’s essential to balance dollar-cost averaging with a broader financial strategy, ensuring that investments do not consume funds needed for daily living or unexpected expenses.

The Way Forward

Conclusion: Embrace the Power of Dollar-cost Averaging

In a world where market volatility can make even the most seasoned investors uneasy, mastering dollar-cost averaging stands out as a time-tested strategy to mitigate risk and enhance your investment approach. By committing to regular investments, regardless of market conditions, you not only build a disciplined investing habit but also take advantage of price fluctuations, potentially lowering your average purchase cost over time.

As you contemplate your own investment journey, remember that patience and consistency are key. This strategy can definitely help you weather the ups and downs of the market, allowing you to stay focused on your long-term financial goals. By incorporating dollar-cost averaging into your investment repertoire, you are not only investing wisely but also fostering a mindset that values stability over speculation.

So,as you move forward in your financial planning,consider how dollar-cost averaging can fit into your broader strategy. Whether you’re a novice investor or a seasoned pro, this effective approach can provide peace of mind and contribute to a solid foundation for financial success. Happy investing!