In the often volatile terrain of investing,where market fluctuations can trigger anxiety and uncertainty,finding a strategy that mitigates risk without sacrificing potential returns is essential for both novice and seasoned investors. Enter dollar-cost averaging (DCA)—a disciplined, methodical investment approach that enables individuals to navigate through market ups and downs with greater confidence. By consistently investing a fixed amount at regular intervals, DCA transforms the emotional rollercoaster of investing into a more stable journey. In this guide, we will delve into the principles behind dollar-cost averaging, explore its numerous benefits, and provide practical tips on how to effectively implement this strategy in your own investment portfolio. Whether you’re looking to build wealth for retirement or save for a major life goal, mastering DCA can be the key to reducing risk and fostering long-term financial success. Join us as we unpack the fundamentals of this powerful investment technique.

Table of Contents

- Understanding Dollar-Cost Averaging and Its Benefits for Investors

- Strategies for Implementing Dollar-Cost Averaging in Your Investment Plan

- Common Mistakes to Avoid When Using Dollar-cost Averaging

- Evaluating Your Progress: how to Measure the Effectiveness of Dollar-Cost Averaging

- the way Forward

Understanding Dollar-Cost Averaging and Its Benefits for Investors

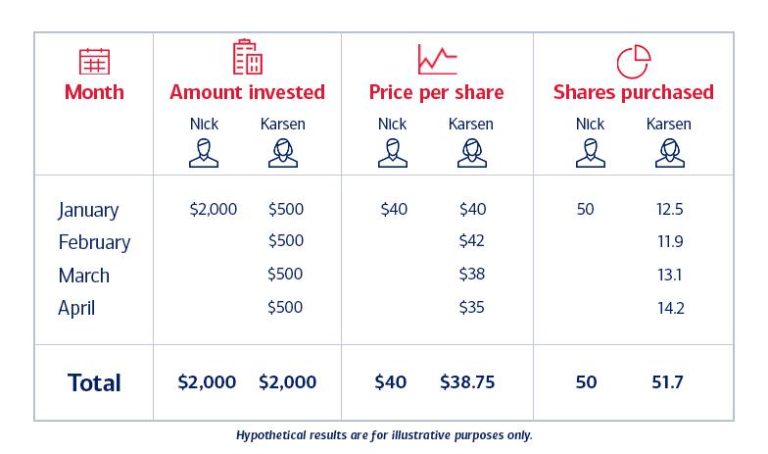

Dollar-cost averaging (DCA) is a systematic investment strategy that involves regularly investing a fixed amount of money into a particular asset, irrespective of its price. This approach can significantly mitigate the impact of market volatility on an investor’s portfolio. By spreading investments over time, investors can take advantage of price fluctuations, possibly lowering their average cost per share. instead of trying to time the market, which can lead to missed opportunities or costly mistakes, DCA encourages a consistent investment habit that can pave the way for long-term financial growth.

One of the primary benefits of dollar-cost averaging is its ability to promote disciplined investing. This strategy helps prevent emotional decision-making, which can often lead to buying high in a market frenzy or selling low in a panic.Additionally, it reduces the risk of investing a large sum of money at an inopportune time. here are some key advantages:

- Lower Average Cost: Regular investments can lead to purchasing more shares when prices are low and fewer shares when prices are high.

- Reduced stress: Knowing that you’re investing consistently allows you to focus on your long-term goals rather than short-term market fluctuations.

- Flexible Strategy: DCA can be applied to a wide range of investment vehicles, from stocks and mutual funds to cryptocurrencies.

Strategies for Implementing Dollar-Cost Averaging in Your Investment Plan

To effectively implement dollar-cost averaging in your investment strategy, start by defining a specific investment schedule.This means committing to invest a fixed amount of money at regular intervals, regardless of market conditions. You can set this up by:

- Selecting a frequency: Choose to invest weekly, bi-weekly, or monthly based on your budget and financial goals.

- Identifying target assets: Decide which stocks, mutual funds, or ETFs you want to invest in consistently.

- Automating contributions: Set up automatic transfers from your bank account to your investment account to reinforce discipline.

Next, regularly review your investment performance and make adjustments as necessary. While dollar-cost averaging is a sound strategy,it’s crucial to ensure your asset allocation aligns with your financial objectives. Consider the following tips for ongoing evaluation:

- Analyzing market trends: Stay informed about economic indicators and market shifts that could affect your chosen investments.

- Rebalancing portfolios: At least annually, reassess your portfolio to maintain the desired asset allocation according to changes in risk tolerance or life circumstances.

- Tracking contributions: Maintain records of your investments to compare average costs and performance over time.

Common mistakes to Avoid When Using Dollar-Cost Averaging

When implementing a dollar-cost averaging strategy, one of the most prevalent pitfalls is allowing emotional responses to dictate investment decisions. Investors might be tempted to stop contributions during market downturns, fearing further losses, or can become overly enthusiastic during market highs, significantly increasing their investment amounts. this behavior not only contradicts the principles of dollar-cost averaging but can also lead to poor long-term results. Staying disciplined and adhering to a consistent investment schedule is key to harnessing the strategy’s full potential.

Another common mistake is neglecting to review and adjust the investment plan based on changes in financial goals and market conditions. Many investors fall into a routine of automatic contributions without evaluating whether the assets they are buying still align with their long-term objectives. Regular assessments of the investment portfolio can provide insights into performance and help identify the need for diversifying assets or reallocating funds. Furthermore, overlooking transaction fees or tax implications can erode the benefits of dollar-cost averaging, making it essential to account for these factors during investment planning.

Evaluating Your Progress: How to Measure the Effectiveness of Dollar-Cost Averaging

To effectively assess the impact of your dollar-cost averaging strategy, it’s essential to establish clear metrics that reflect both performance and personal goals.Begin by tracking the average purchase price of your investments over time, which can be calculated by dividing the total amount invested by the total number of shares acquired. This will offer insight into whether your average cost is lower than the current market price, showcasing potential gains. Regularly reviewing your investment portfolio against benchmark indices can also provide context, indicating whether your dollar-cost averaging is yielding favorable results in comparison to broader market trends.

In addition to numerical analysis, consider qualitative factors such as your comfort level with the market’s fluctuations and how well your strategy fits within your long-term financial objectives. Keep an eye on the emotional aspects of your investing behavior; understanding how dollar-cost averaging impacts your decision-making during market volatility can be just as crucial as tracking financial returns. To visualize your progress in relation to your goals, you might also choose to create a simple table that outlines your investment milestones alongside relevant market events, helping you draw comparisons and adjust your strategy if necessary.

| Milestone | Investment Amount | Market Event | Average purchase Price |

|---|---|---|---|

| Initial Investment | $1,000 | Market Dip | $50 |

| After 6 Months | $2,000 | Market Recovery | $48 |

| 1 Year Mark | $5,000 | Market Peak | $55 |

The way Forward

mastering dollar-cost averaging can be a game-changer in your investment strategy, allowing you to mitigate risk while steadily building your portfolio over time. By committing to a consistent investment schedule and resisting the urge to time the market, you position yourself to benefit from market fluctuations rather than fear them. Remember, investing is a marathon, not a sprint. the disciplined approach of dollar-cost averaging not only helps insulate you from the emotional rollercoaster of market volatility but also empowers you to focus on your long-term financial goals.As you embark on your investment journey, keep these principles in mind, and let the power of dollar-cost averaging work for you. Happy investing!