In an ever-evolving financial landscape, where market fluctuations can occur at a moment’s notice, the importance of a well-diversified investment portfolio cannot be overstated. Diversification is not just a buzzword—its a strategic approach that can mitigate risk and enhance potential returns, allowing investors to navigate volatility with greater confidence. In this article, we will delve into the principles of diversification and explore how to craft a balanced portfolio tailored to your financial goals, risk tolerance, and time horizon. Whether you’re a seasoned investor or just starting your financial journey, understanding and mastering diversification will empower you to make informed decisions that align with your long-term objectives. Join us as we unpack the essential elements of diversification and guide you step-by-step in building your ideal investment portfolio.

Table of Contents

- Understanding the importance of Diversification in Investment Strategies

- Asset Allocation: Balancing Risk and Reward for Optimal Returns

- Evaluating Investment Options: A Comprehensive Guide to Asset Classes

- Monitoring and Rebalancing Your Portfolio for Long-Term Success

- In Retrospect

Understanding the Importance of Diversification in Investment strategies

In the realm of investment, diversification is not merely a strategy; it is a crucial principle that can substantially influence the performance of your portfolio. By spreading investments across various asset classes, such as stocks, bonds, real estate, and commodities, investors can mitigate risks associated with market volatility. This means that when one asset class experiences a downturn, others can potentially offset the losses, creating a buffer for your overall investment. A well-diversified portfolio is designed to enhance returns while minimizing risks,allowing you to enjoy the benefits of growth without exposing yourself to undue financial stress.

To effectively implement diversification, consider the following key elements:

- Asset allocation: Determine the optimal mix of different asset classes based on your risk tolerance and investment goals.

- Geographic diversity: Look beyond local markets by investing in international assets,reducing dependency on a single economy.

- Sector variety: Invest across various industries,ensuring that fluctuations in one sector don’t drastically impact your overall performance.

- Regular rebalancing: Maintain your desired level of diversification by regularly adjusting your portfolio in response to market changes.

To illustrate how diversification works in practice,here’s a simple comparison of different asset classes and their ancient performance characteristics:

| Asset Class | Average Annual return (%) | Risk Level (1-5) |

|---|---|---|

| Stocks | 10 | 4 |

| Bonds | 5 | 2 |

| Real Estate | 7 | 3 |

| Commodities | 6 | 5 |

This table illustrates that while stocks typically offer higher returns,they come with increased risks. Bonds, conversely, offer stability but lower returns. By diversifying your portfolio to include a mix of thes asset classes, you can strategically balance potential returns against risk, aligning your investments with your financial objectives and risk appetite.

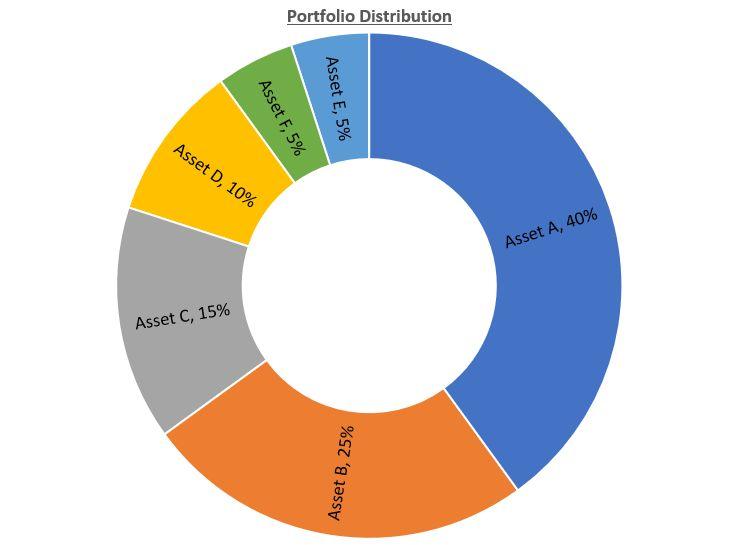

Asset allocation: Balancing risk and Reward for Optimal Returns

When constructing an investment portfolio, striking the right balance between risk and reward is essential for maximizing returns. A well-thought-out asset allocation strategy incorporates various asset classes, allowing investors to harness the potential of each while mitigating risk. Key components of a diversified portfolio include:

- Equities: These can offer high growth potential, albeit with increased volatility.

- Bonds: Generally more stable, providing income while reducing overall portfolio risk.

- Real Estate: Adds a physical asset dimension, frequently enough appreciated during inflationary periods.

- Cash Equivalents: Maintaining liquidity for potential market opportunities without notable risk.

To fine-tune your asset allocation, consider your investment horizon and risk tolerance. A younger investor may lean more heavily towards equities for long-term growth, while someone closer to retirement might favor bonds to preserve capital and ensure steady income. Below is a sample allocation based on risk tolerance:

| Risk Profile | Equities (%) | Bonds (%) | Real Estate (%) | Cash Equivalents (%) |

|---|---|---|---|---|

| Conservative | 20 | 60 | 15 | 5 |

| Moderate | 40 | 40 | 15 | 5 |

| Aggressive | 70 | 20 | 5 | 5 |

Evaluating Investment Options: A Comprehensive Guide to asset Classes

When it comes to building an investment portfolio, understanding the various asset classes is crucial. Each class comes with its own risk-return profile, and selecting the right combination can significantly impact your overall financial health. Here’s a closer look at some of the major asset classes to consider, including:

- Equities: Stocks can offer high growth potential but come with increased volatility.

- Bonds: Generally more stable, they can provide fixed income streams.

- Real Estate: A tangible asset that can generate rental income and appreciate in value.

- Commodities: Raw materials like gold or oil that often serve as hedges against inflation.

- Cash Equivalents: Low-risk assets,such as money market funds,providing liquidity.

To effectively evaluate these options, consider the correlation between asset classes as well. A well-diversified portfolio typically includes assets that behave differently under various market conditions. Below is a simple illustration of typical risk levels associated with each asset class:

| Asset Class | Risk Level | Potential Return |

|---|---|---|

| Equities | High | 7-10% |

| Bonds | Moderate | 3-5% |

| Real Estate | Moderate | 5-8% |

| Commodities | High | Variable |

| Cash Equivalents | Low | 1-2% |

Monitoring and Rebalancing Your Portfolio for Long-Term Success

To achieve long-term success in your investment journey, it’s crucial to continuously monitor your portfolio’s performance. Market conditions and economic indicators are always in flux, which can significantly impact your asset allocation. Tracking these changes allows you to identify when your portfolio may no longer align with your original investment goals. Consider establishing a regular review schedule—perhaps quarterly or bi-annually—to assess your investments.During these reviews, you should evaluate the following:

- Asset Performance: Analyze how each asset class is performing in relation to your expectations.

- Market Trends: Stay informed on global and national economic trends that could impact your investments.

- Risk tolerance: Reassess your risk tolerance, especially if life circumstances or financial goals change.

Rebalancing your portfolio is the next vital step. Over time, certain investments may grow at a faster rate than others, leading to a shift in your desired asset allocation. Rebalancing allows you to restore your original investment strategy by buying or selling assets as needed. You can employ a systematic approach by adhering to a set percentage allocation; for instance, if your stocks have risen to 70% of your portfolio when your target was 60%, you would sell some of the stock and buy other assets to restore balance. Consider documenting your rebalancing strategy through a table for clarity:

| Asset Class | Target Allocation (%) | Current Allocation (%) | Action |

|---|---|---|---|

| Stocks | 60 | 70 | Sell 10% |

| Bonds | 30 | 25 | Buy 5% |

| Cash | 10 | 5 | Buy 5% |

In Retrospect

mastering diversification is not just a strategy; it’s the cornerstone of a resilient and flourishing investment portfolio. By thoughtfully spreading your investments across various asset classes, industries, and geographies, you can significantly mitigate risks while positioning yourself for significant growth. Remember, the goal is not merely to avoid losses but to enhance potential returns, adapting to market shifts and personal financial objectives.

As you embark on or refine your investment journey, take the time to evaluate your individual risk tolerance and financial goals. Stay informed and consider seeking advice from financial professionals when necessary. Building your ideal investment portfolio is an ongoing process that requires patience, discipline, and a willingness to adapt. the world of finance is ever-changing,and remaining agile will serve you well in both the short and long term.

Thank you for joining us on this exploration of diversification. we hope you feel empowered to take control of your investments and build a portfolio that aligns with your aspirations. Happy investing!