in the complex world of finance, every detail matters—especially when it comes to your credit and loan reports. A single error can have notable repercussions, affecting your ability to secure loans, obtain favorable interest rates, or even purchase a home. Understanding how to identify and rectify inaccuracies on your loan report is essential for anyone looking to maintain their financial health and ensure their records accurately reflect their creditworthiness. In this article, we will delve into the common types of errors that can appear on loan reports, provide step-by-step guidance on how to dispute them effectively, and explain why taking action is crucial not only for your credit score but for your overall financial future. Weather you’re facing discrepancies from a previous bankruptcy, outstanding debts that have been paid off, or simply outdated information, mastering the art of disputing errors is a skill that can empower you in your financial journey.

Table of Contents

- understanding the Importance of Accurate Loan Reports

- Identifying Common Errors in Your Loan Report

- Steps to Effectively Dispute Inaccuracies

- Monitoring and Maintaining Your Loan Report Integrity

- Concluding Remarks

Understanding the Importance of Accurate Loan Reports

Accurate loan reports play a crucial role in determining your financial health and borrowing power.These reports, often referred to as credit reports, provide lenders with a snapshot of your creditworthiness, influencing their decision to grant loans and the interest rates associated with them. When inaccuracies exist, they can lead to unfavorable terms or, in severe cases, loan denials. Understanding the implications of these errors can save you significant time, money, and stress. To mitigate these risks, reviewing your loan report regularly is a best practice that should not be overlooked.

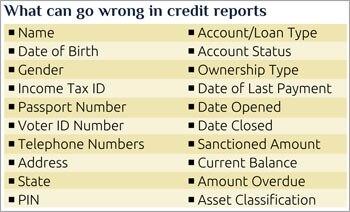

Correcting errors on your loan report is essential to maintaining your financial credibility.Common issues that may arise include incorrect personal information, duplicate accounts, and accounts that don’t belong to you. It’s vital to address these discrepancies promptly. Here are some steps to ensure your loan report reflects accurate data:

- Request a copy of your loan report annually to assess its accuracy.

- Identify discrepancies and gather pertinent documentation to support your claims.

- Contact the reporting agency to dispute errors, following their provided protocols.

Identifying Common Errors in Your Loan Report

When reviewing your loan report, it’s crucial to approach it with a keen eye for detail. Start by thoroughly checking for inaccurate personal information. This can include misspelled names, incorrect addresses, or wrong Social Security numbers. Additionally, take a close look at your payment history and be on the lookout for any discrepancies in your past due dates or reported payment amounts. An

inaccurate payment history can negatively impact your credit score, so it’s vital to correct any misreporting promptly.

Another common area where errors may lurk is in the credit inquiries section of your loan report. Know the difference between soft inquiries (which do not affect your score) and hard inquiries (which can impact your credit score temporarily). Make sure that you recognize all hard inquiries and that no unauthorized inquiries appear on your report. keep an eye out for any accounts listed that do not belong to you, as this could indicate cases of identity theft or reporting mistakes.Each error can have significant implications, so addressing them swiftly is paramount.

Steps to Effectively Dispute Inaccuracies

Disputing inaccuracies on your loan report is a critical step toward ensuring your financial wellbeing. To commence the process effectively, begin by gathering all relevant documentation. This may include your loan agreements, payment records, and any communication you’ve had with lenders or creditors. Once you have compiled this information, you can identify the specific errors. create a list of discrepancies to stay organized and provide clarity when disputing them.

Next, it’s important to contact the reporting agency that provided your loan report. Use the following steps to inform them of the inaccuracies:

- Draft a clear and concise dispute letter outlining the errors.

- attach copies of your supporting documents,ensuring you retain the originals for your records.

- Submit your dispute through certified mail if necessary,to ensure you have proof of your correspondence.

Once your dispute is submitted, you have the right to expect a timely inquiry. Typically, agencies have 30 days to resolve the claim. Be sure to monitor your credit report afterwards to confirm that corrections have been made.

Monitoring and Maintaining Your Loan Report Integrity

Ensuring the integrity of your loan report is crucial for maintaining a healthy financial footprint. Regularly monitoring your report helps detect discrepancies early on, which can save you time and stress later.Here are a few effective strategies to keep your loan report accurate:

- Schedule Regular Reviews: Set aside time each month to review your loan report for any inconsistencies.

- Utilize Alerts: Sign up for notifications from your lender to stay updated on changes to your loan status.

- Keep Extensive Records: Maintain documentation of your payments and agreements for reference during your reviews.

In case you find an error, it’s imperative to address it promptly. Failing to correct misinformation can lead to adverse effects on your credit score and future borrowing capabilities. Here’s a straightforward process to rectify inaccuracies:

| Step | Action |

|---|---|

| 1 | Identify the error clearly. |

| 2 | Contact your lender to dispute the error. |

| 3 | Provide supporting documents. |

| 4 | Follow up to ensure corrections are made. |

Concluding remarks

navigating the complexities of loan reporting can be a daunting task, but mastering disputes and correcting errors is pivotal for your financial health. By following the steps outlined in this article—reviewing your loan report meticulously,gathering supporting documentation,and communicating effectively with lenders—you can take charge of your financial narrative. Remember, proactive management of your loan report not only enhances your credit profile but also empowers you to secure better lending opportunities in the future.

As you embark on this journey towards financial clarity, don’t hesitate to seek professional advice if you encounter especially challenging disputes. Whether it’s understanding your rights or exploring more advanced dispute resolution methods, there’s a wealth of resources available to support you.

Empower yourself with knowledge, be diligent in your efforts, and watch as your financial landscape transforms for the better. Thank you for reading, and here’s to your success in mastering your loan report disputes!