In an evolving financial landscape marked by fluctuations in conventional markets, savvy investors are increasingly looking beyond the conventional avenues of stocks and bonds. Alternative investments—spanning private equity, real estate, hedge funds, and commodities—offer a compelling way to enhance portfolio diversification while perhaps mitigating risk. As interest rates rise and market volatilities become more pronounced, understanding how to effectively integrate these assets into your investment strategy is more crucial than ever.In this article, we’ll delve into the fundamentals of alternative investments, explore the benefits they can bring to your overall portfolio, and provide practical guidance on how to master this dynamic asset class for a more resilient financial future. Whether you’re a seasoned investor or just starting out, this exploration will arm you with the insights needed to navigate the world of alternative investments confidently.

Table of Contents

- Understanding Alternative Investments and Their Role in Diversification

- Key Types of Alternative Investments: A Detailed Exploration

- Strategic Allocation: How to Integrate Alternatives into Your Portfolio

- Risk Management and Due Diligence in Alternative Investment Choices

- Future Outlook

Understanding Alternative Investments and Their Role in diversification

Alternative investments have gained traction as vital components in the modern investor’s toolkit, providing avenues beyond traditional stocks and bonds. Their unique characteristics often lead to low correlation with conventional asset classes, thus enhancing portfolio resilience during market volatility.By incorporating alternative assets, investors can potentially achieve superior returns and improved risk-adjusted performance. Some key types of alternative investments include:

- Real Estate: Properties can serve as a hedge against inflation and provide potential income through rentals.

- Hedge Funds: These pooled investment funds employ diverse strategies to maximize returns, often unencumbered by the stricter regulations of mutual funds.

- Commodities: Investments in physical goods such as gold, oil, and agricultural products can be a safeguard during economic downturns.

- Private equity: Investments in privately-held companies offer a chance to capitalize on growth before businesses go public.

Understanding the role of these investments in diversification is essential for all investors. As alternative assets frequently enough exhibit different return profiles and risk parameters, they can smooth out the overall performance of an investment portfolio. As an example, during periods of economic stress when stocks may be declining, real estate or commodities like gold often perform better, thereby buffering losses. To illustrate how these investments interact with traditional assets, consider the following table:

| Asset Class | Typical Return | Risk Level | Correlation with Stocks |

|---|---|---|---|

| Stocks | 6-9% | High | 1.0 |

| Bonds | 3-5% | Medium | 0.2 |

| Real Estate | 8-12% | Medium | 0.5 |

| commodities | 4-10% | High | -0.2 |

Key Types of Alternative Investments: A Detailed Exploration

Alternative investments encompass a broad array of asset classes that provide distinct opportunities for diversification beyond traditional stocks and bonds. Among the most sought-after types are real estate, hedge funds, and private equity. Investing in real estate can take various forms, including residential, commercial, or industrial properties, each offering potential for capital gratitude and rental income. Hedge funds employ diverse strategies, such as long/short equity, global macro, or event-driven tactics, enabling investors to thrive in fluctuating market conditions. Meanwhile, private equity involves capital invested directly in private companies, fostering growth and innovation while providing potentially high returns.

Other notable alternative investments include commodities, cryptocurrencies, and collectibles. Commodities, such as gold, oil, and agricultural products, serve as a hedge against inflation and currency fluctuations. The surge of cryptocurrencies has created an entirely new investment landscape, appealing to tech-savvy investors looking for speculative opportunities. Lastly, collectibles—ranging from art and antiques to vintage cars and rare wines—can also hold significant value and appeal to investors seeking unique assets that can appreciate over time. Below is a brief comparison of these investment types:

| type of Investment | Key Characteristics | Potential risks |

|---|---|---|

| Real Estate | Income-generating, tangible asset | Market volatility, liquidity issues |

| Hedge Funds | Diverse strategies, active management | High fees, complex structures |

| Private Equity | Long-term investment, high returns | illiquidity, management risks |

| Commodities | Hedge against inflation | Price volatility, geopolitical risks |

| Cryptocurrencies | Digital assets, high growth potential | Regulatory changes, extreme volatility |

| Collectibles | Unique, potential for appreciation | Market demand, authenticity verification |

Strategic Allocation: how to Integrate Alternatives into your portfolio

Integrating alternative investments into your portfolio requires a strategic approach that not only acknowledges the unique characteristics of these assets but also harmonizes them with your overall investment goals. To successfully implement alternatives, begin by conducting a thorough assessment of your current portfolio’s asset allocation. Consider factors such as your risk tolerance, investment horizon, and liquidity needs. Diversifying with alternatives can include a variety of asset classes, each contributing differently to your strategy:

- Hedge Funds: Frequently enough employ complex strategies to achieve absolute returns.

- Private Equity: Invest directly in private companies or buyouts, focusing on long-term growth.

- Real Assets: Includes real estate and commodities wich can act as an inflation hedge.

- Cryptocurrencies: Digital assets offering high volatility but potentially high returns.

Once you have identified the suitable alternatives, carefully determine the right proportion of each asset class. A balanced allocation should aim not only for growth but also for risk mitigation. This is best visualized in a simple asset allocation table:

| Asset Class | Recommended Allocation (%) |

|---|---|

| Equities | 40 |

| Bonds | 30 |

| Alternatives | 20 |

| Cash & Cash Equivalents | 10 |

Incorporating alternative investments thoughtfully can optimize your portfolio’s performance while lowering overall risk. Regularly revisit your allocation strategy to adapt to market changes,ensuring that your investments align with your evolving financial objectives.

Risk Management and Due Diligence in Alternative Investment Choices

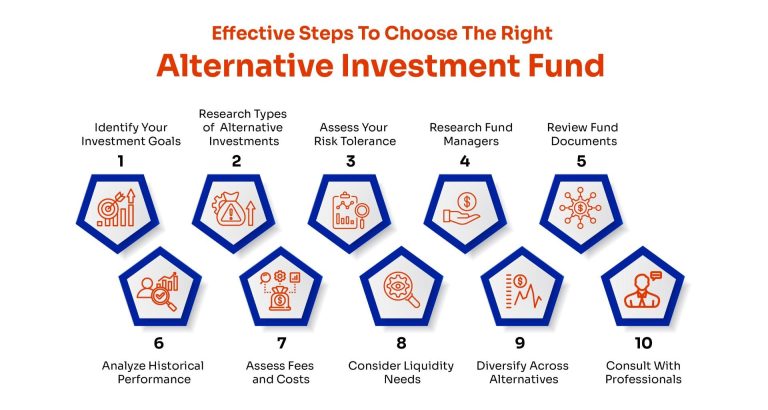

In the realm of alternative investments, effective risk management and meticulous due diligence are pivotal in safeguarding capital and optimizing returns. Investors must systematically evaluate potential risks associated with each asset class,identifying factors that could adversely impact performance. As part of this evaluation, consider the following aspects:

- Market Volatility: assess how fluctuations in the market may affect your investments.

- Liquidity Constraints: Analyze the potential difficulty of selling an asset quickly without a significant loss in value.

- Regulatory Factors: Stay informed about legal and regulatory changes that could impact your investment.

- manager Track Record: Review the experience and historical performance of fund managers if investing in pooled vehicles.

Incorporating comprehensive due diligence into your investment strategy not only helps in identifying opportunities but also in recognizing potential pitfalls. Creating a due diligence checklist can streamline this process. Below is a sample framework:

| Due Diligence Factors | Questions to Consider |

|---|---|

| Investment Thesis | What is the underlying rationale for this investment? |

| Financial Performance | How has the asset performed historically? |

| Operational Risks | What are the primary operational challenges? |

| Exit Strategy | What avenues exist for divesting from this investment? |

Future outlook

mastering alternative investments is not merely an option but a strategic necessity for today’s savvy investor. as traditional markets experience fluctuations and uncertainties, diversifying your portfolio with alternatives can provide stability, enhanced returns, and a hedge against economic downturns. From real estate to hedge funds and cryptocurrencies, the landscape of alternative assets is vast and varied, offering opportunities to align with your unique investment goals.

However,as with any investment strategy,due diligence and a clear understanding of the associated risks are imperative. By educating yourself and staying informed about market trends and performance metrics, you can position yourself to make informed decisions that align with your financial objectives.

Remember, prosperous investing is not about chasing trends; it’s about building a resilient portfolio that can weather various market conditions. Embrace the journey of exploring alternative investments, and you may find that the path to diversification unlocks new avenues for growth and prosperity.

Thank you for joining us in this exploration of alternative investments. Stay tuned for more insights and strategies to elevate your investment approach and achieve a well-rounded portfolio. Happy investing!