Navigating the world of personal finance can frequently enough feel overwhelming,especially when unexpected charges,such as overdraft fees,come into play.These pesky fees not only disrupt your budgeting efforts but can also accumulate quickly, draining your hard-earned savings. In today’s article, we’re here to equip you with practical and actionable tips to help you dodge those unwanted overdraft fees and take control of your financial well-being. Whether you’re looking to establish better banking habits, enhance your budgeting skills, or simply gain a clearer understanding of your finances, our insights will empower you to maintain a healthy balance and avoid unnecessary penalties. Join us as we explore effective strategies to keep your finances in check and set you on a path toward financial mastery.

Table of Contents

- Understanding Overdraft Fees and Their Impact on your Finances

- Effective Budgeting Techniques to Keep Your Account in the Green

- Practical Strategies for Monitoring Your Bank Account Activity

- Choosing the Right Banking Options to Minimize Overdraft Risks

- in Summary

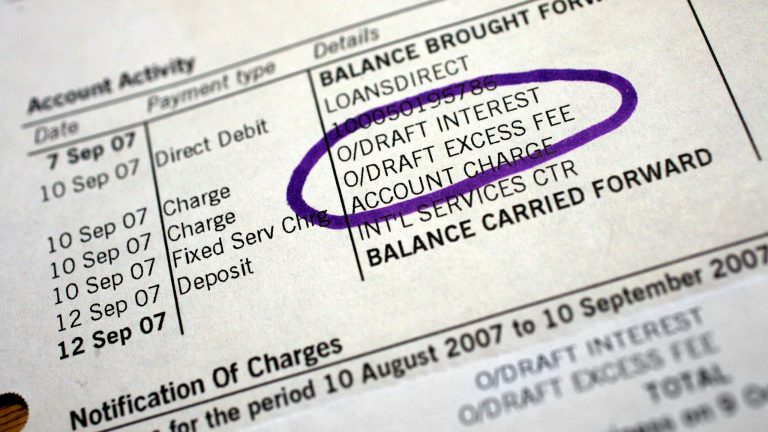

understanding Overdraft Fees and Their Impact on Your Finances

Overdraft fees can significantly derail your financial plans and create unnecessary stress.These fees occur when you withdraw more money than you have in your account, leading to additional charges by your bank. Understanding how these fees work is essential for effectively managing your finances. Typically, banks charge an overdraft fee for each transaction that exceeds your balance, which can quickly add up. Here are some important points to consider about overdraft fees:

- Frequency and Amount: Banks often charge multiple overdraft fees within a single day, often exceeding $30 per transaction.

- Impact on Savings: Regular overdraft events can substantially diminish your savings, as fees siphon off a portion of your income that could have been allocated for future goals.

- Financial Reputation: Persistent overdraft occurrences might affect your credit score, as some banks report account mismanagement to credit agencies.

To mitigate the negative impact of overdraft fees, it is indeed crucial to implement effective strategies.As a notable example, consider using budgeting tools to monitor your spending habits closely or set up low-balance alerts to notify you when your account dips below a certain threshold. Additionally, keep track of your regular expenses to maintain an accurate picture of your financial situation. Here’s a rapid overview to help you stay in control of your finances:

| Strategy | Benefits |

|---|---|

| Set Up Alerts | Receive notifications before overdraft occurs |

| Create a Budget | Track your expenses and plan accordingly |

| Link Savings Accounts | Cover overdrafts with linked accounts without additional fees |

Effective Budgeting Techniques to Keep Your Account in the Green

One of the most efficient ways to maintain a healthy bank balance is to adopt a realistic budgeting approach. Start by tracking your income and expenses meticulously. Use budgeting apps or spreadsheets to categorize your spending into fixed and variable expenses.This method not only clarifies where your money goes but also helps you identify areas where you can cut back. Here are some strategies to enhance your budgeting process:

- Set clear financial goals: Determine short-term and long-term goals, and allocate funds accordingly.

- Use the 50/30/20 rule: allocate 50% of your income to needs, 30% to wants, and 20% to savings or debt repayment.

- Review and adjust: Revisit your budget monthly to track progress and make necessary adjustments.

In addition, consider implementing the envelope system to manage your cash flow effectively. This technique involves dividing your cash into envelopes designated for specific spending categories. Once the money in an envelope is gone, you cannot spend in that category until the next budgeting period. This approach promotes disciplined spending and discourages impulse purchases. To illustrate the balance between income and key expenditures, here’s a simple budget comparison table:

| Category | Monthly Budget | Actual Spending |

|---|---|---|

| Rent | $1,200 | $1,200 |

| Groceries | $400 | $350 |

| Utilities | $150 | $160 |

| Entertainment | $200 | $180 |

| Savings | $400 | $500 |

Practical Strategies for Monitoring Your Bank Account Activity

keeping a close eye on your bank account activity is essential to avoiding overdraft fees. Start by setting up account alerts. Most banks offer customizable alerts that inform you of important account activity, such as low balances, deposits, and significant transactions. You can tailor these notifications to suit your needs, ensuring that you receive timely updates to help you stay within your budget. Additionally, consider linking your checking account to a savings account; this can provide a safety net for overdrafts by automatically transferring funds when your checking balance dips below a certain threshold.

Adopting a regular review process can further enhance your financial awareness. Aim to check your bank account on a weekly basis to monitor spending patterns and ensure that all transactions are accurate. Use an online budgeting tool or a simple spreadsheet to track your income and expenses. You can set up a table like the one below to categorize your monthly transactions, which can definitely help you identify any trends or areas where you can cut back:

| Category | Amount Spent | notes |

|---|---|---|

| Groceries | $200 | Weekly shopping |

| Utilities | $150 | Electricity and water |

| Dining Out | $100 | Restaurants and takeout |

Choosing the Right Banking Options to minimize Overdraft Risks

When it comes to managing your finances and minimizing the risks associated with overdraft fees, the type of banking options you choose plays a crucial role. First and foremost, consider selecting a bank that offers overdraft protection services tailored to your needs. Many banks provide different types of protection, such as linking your checking account to a savings account or a line of credit, which can automatically cover your overdrafts. this way, you can avoid the hefty fees associated with bounced checks or declined transactions while maintaining peace of mind about your financial transactions.

Additionally, it’s wise to explore accounts that feature no overdraft fees or those with lower fees compared to traditional options. Here are a few factors to keep in mind while selecting the right banking options:

- Account Fees: Look for accounts with minimal monthly maintenance fees.

- Understanding Policies: Make sure to read the fine print on overdraft policies.

- Technology Utilization: Choose banks that offer alerts and mobile banking features to track your balance seamlessly.

To further illustrate the different banking options and their associated overdraft fees, here’s a simple comparison:

| Bank Type | Overdraft Fee | Overdraft Protection Options |

|---|---|---|

| Traditional Bank | $35 per transaction | Linked Savings, Line of Credit |

| Online Bank | $0 – $10 per transaction | No Overdraft |

| Credit Union | $25 per transaction | Linked Savings |

In Summary

Conclusion: Take Control of Your Finances Today

Navigating the complexities of personal finance can be challenging, but mastering your accounts and avoiding pesky overdraft fees is entirely within your grasp. By implementing the tips and strategies outlined in this article, you can cultivate better spending habits, stay informed about your account balances, and ultimately take control of your financial destiny.

Remember, every small step you take towards better financial management not only helps you avoid unnecessary fees but also empowers you to make more informed decisions about your money. Start by creating a budget, setting up alerts for low balances, and exploring alternatives like linked savings accounts or overdraft protection plans.

As you embark on this journey toward financial literacy and security, know that being proactive today can lead to a more stable and prosperous tomorrow. Your financial well-being is worth the effort—so take charge, make informed choices, and watch your confidence grow as you Master Your Finances!

Thank you for joining us on this path to financial empowerment. If you found these tips helpful, be sure to share this article with friends and family, and don’t hesitate to explore more resources on our blog for further insights and strategies.Here’s to your financial success!