In today’s fast-paced world,managing your finances often feels like navigating a complex maze with no clear path. with countless responsibilities—from paying bills and saving for retirement to planning that dream vacation—it’s easy to feel overwhelmed. However, mastering your finances doesn’t mean you need to have a degree in economics or an unyielding devotion to spreadsheets.Rather, it starts with setting actionable and achievable financial goals.In this article, we’ll explore the essential steps to effectively identify, articulate, and reach your financial aspirations.Whether you’re aiming to eliminate debt, build an emergency fund, or invest for the future, understanding the foundational principles of financial goal-setting can empower you to take control of your financial destiny. So, let’s dive in and unlock the strategies that will help you turn your financial dreams into reality.

Table of Contents

- Understanding the Importance of Financial Goals

- creating a Realistic Budget to Achieve Your Objectives

- Strategies for Tracking Progress and Staying Motivated

- Overcoming Common Obstacles in Financial Planning

- Concluding Remarks

Understanding the Importance of Financial Goals

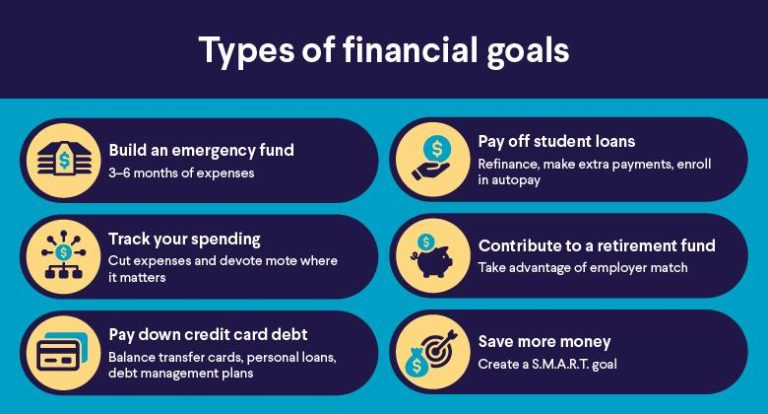

Establishing financial goals is crucial for guiding your financial journey and providing a roadmap for your economic future. These objectives serve as benchmarks that motivate and propel you toward your aspirations,whether they involve saving for a new home,funding your child’s education,or ensuring a comfortable retirement. by clearly articulating your financial goals, you incorporate a sense of purpose and accountability into your financial decisions.Prioritizing these goals can help you allocate resources more effectively and minimize impulsive spending.

To harness the full potential of your financial goals, consider categorizing them into short-term, medium-term, and long-term objectives. This structured approach can make daunting financial aspirations more manageable and attainable. Here are some examples of each category:

| Timeframe | Examples of Goals |

|---|---|

| Short-term (0-1 year) |

|

| Medium-term (1-5 years) |

|

| Long-term (5+ years) |

|

Creating a Realistic budget to Achieve Your Objectives

Establishing a realistic budget is crucial for anyone looking to reach their financial goals. A well-structured budget allows you to allocate your resources wisely and track your progress effectively.Start by identifying your income sources and the total amount you earn each month. Then, categorize your expenses into fixed (like rent or mortgage payments) and variable (like dining out or entertainment). This distinction helps you see where you can cut back if needed. Consider these steps:

- Calculate your total monthly income

- List all fixed and variable expenses

- Set savings and investment goals

- Allocate funds based on priorities

Once you have a clearer view of your financial landscape, it’s time to create a budget that reflects your goals and aspirations. A key aspect of a accomplished budget is flexibility; adjust it as your circumstances change, such as unexpected expenses or income increases. Keeping track of your spending can highlight areas for enhancement. Here’s a simple budgeting template to help you stay organized:

| Category | Budgeted Amount | Actual Amount | Difference |

|---|---|---|---|

| Income | $4,000 | $4,200 | $200 |

| Rent/Mortgage | $1,200 | $1,200 | $0 |

| utilities | $300 | $350 | -$50 |

| Groceries | $500 | $450 | $50 |

| Transportation | $250 | $300 | -$50 |

| Entertainment | $200 | $150 | $50 |

| Total Savings | $1,800 | $1,750 | $50 |

Strategies for Tracking Progress and Staying Motivated

Tracking your financial progress is essential to maintaining motivation and ensuring you stay on the right path to achieving your goals. Start by setting up a regular review schedule, whether it’s weekly or monthly, to assess where you stand financially. Utilize tools like budgeting apps or spreadsheets to visualize your expenditures and savings.Create a visual portrayal of your goals through charts or graphs to illustrate your progress over time. This helps remind you of your accomplishments and the journey ahead. Consider joining financial forums or communities where you can share updates and draw inspiration from others’ successes.

Staying motivated requires a mix of internal determination and external support. Set different tiers of rewards for reaching milestones, which can make the financial journey more enjoyable.As an example, you could create a simple table to track both your goals and the rewards associated with them:

| Milestone | Reward |

|---|---|

| Save $1,000 | Treat yourself to a nice dinner |

| Pay off a credit card | Buy a new book or hobby item |

| Reach 50% of your savings goal | Weekend getaway |

By making the pursuit of financial goals engaging and rewarding, you’ll enhance your commitment and sustain your enthusiasm over time. Sharing your goals with friends or family can also bolster your accountability, prompting you to stay focused and encourage mutual support in your financial journeys.

Overcoming Common Obstacles in financial Planning

Financial planning often encounters various hurdles that can deter individuals from reaching their desired financial objectives. One significant obstacle is the overwhelming amount of information available,which can lead to confusion and analysis paralysis. To combat this, it’s essential to simplify your approach. Break down your goals into smaller, manageable components, and prioritize them based on urgency and importance. Establish a clear timeline and create a checklist to ensure steady progress. Engaging with a financial advisor can also provide clarity and help tailor a plan suited to your unique circumstances.

Another common challenge is the tendency to fear the unknown, especially regarding investment decisions. A lack of confidence may lead to procrastination, preventing you from taking crucial steps toward financial security. Educating yourself about financial markets and investment strategies can empower you to make informed choices. Consider the following strategies:

- start Small: Invest smaller amounts to gauge your comfort level.

- Join a Community: Surround yourself with like-minded individuals who share their experiences.

- Conduct Research: Stay updated with financial news and trends to enhance your understanding and confidence.

Concluding remarks

As we wrap up our discussion on mastering your finances and effectively setting and achieving your financial goals, remember that the journey to financial wellness is a continuous one. By implementing the strategies outlined in this article, you can take substantial steps towards financial empowerment and security. Setting clear, measurable goals not only gives you direction but also motivates you to remain committed to your financial journey.

stay disciplined, revisit your goals regularly, and don’t hesitate to adjust them as your circumstances and aspirations evolve. Remember, every small step you take today adds up to significant progress tomorrow. Enlist the support of financial resources—be it tools, communities, or advisors—to guide you along the way.

In a world where financial literacy is more crucial than ever,investing the time and effort to educate yourself is one of the best decisions you can make. So, take charge of your finances, establish a robust action plan, and watch as you transform your financial dreams into reality. Here’s to your financial success and a future filled with opportunities!