In today’s fast-paced financial landscape, where inflation often outpaces traditional savings methods, many investors and savers find themselves seeking better options for their hard-earned money. Enter high-yield savings accounts (HYSAs)—an increasingly popular choice for those looking to maximize their savings while maintaining a level of liquidity. These accounts promise higher interest rates compared to standard savings accounts, but the question remains: Are they worth your investment? In this article, we will delve into the mechanics of high-yield savings accounts, explore their advantages and potential drawbacks, and help you determine if they align with your financial goals. Whether you’re building an emergency fund, saving for a big purchase, or simply looking to earn more on your existing savings, understanding the true value of HYSAs coudl be the key to making smarter financial decisions. Let’s take a closer look at how these accounts work and whether they deserve a place in your financial strategy.

Table of Contents

- Understanding high-Yield Savings Accounts and Their Benefits

- Comparing High-Yield Savings Accounts with Traditional Savings Options

- Key factors to Consider when Choosing a High-yield Savings Account

- Maximizing Your Earnings: Tips for Utilizing high-Yield Savings Accounts

- key Takeaways

Understanding High-Yield Savings accounts and Their Benefits

High-yield savings accounts (HYSAs) are a popular choice for individuals looking to earn more on their deposits compared to traditional savings accounts. These accounts typically offer interest rates significantly higher than the national average, allowing your savings to grow at a quicker pace. Here are some key features that make HYSAs appealing:

- Higher interest rates: HYSAs often yield rates that can be several times higher than standard savings accounts.

- Liquidity: Unlike many investment options, HYSAs maintain easy access to your funds, allowing for withdrawals without penalties.

- Minimal fees: Many high-yield accounts come with no monthly maintenance fees, helping you retain more of your earnings.

- FDIC insured: Moast high-yield savings accounts are insured up to $250,000, providing security for your funds.

Investing in a high-yield savings account can serve as an effective strategy for building an emergency fund or saving for short-term goals. The benefits of compounding interest mean that even small deposits can accumulate into substantial savings over time. However, it’s essential to compare different options to ensure you’re maximizing your returns. Below is a simple comparison of some notable HYSAs:

| Bank Name | APY (%) | Minimum Deposit | Monthly Fees |

|---|---|---|---|

| Bank A | 0.75% | $0 | $0 |

| Bank B | 0.85% | $1,000 | $5 |

| Bank C | 1.00% | $5,000 | $0 |

Comparing High-Yield Savings Accounts with Traditional Savings Options

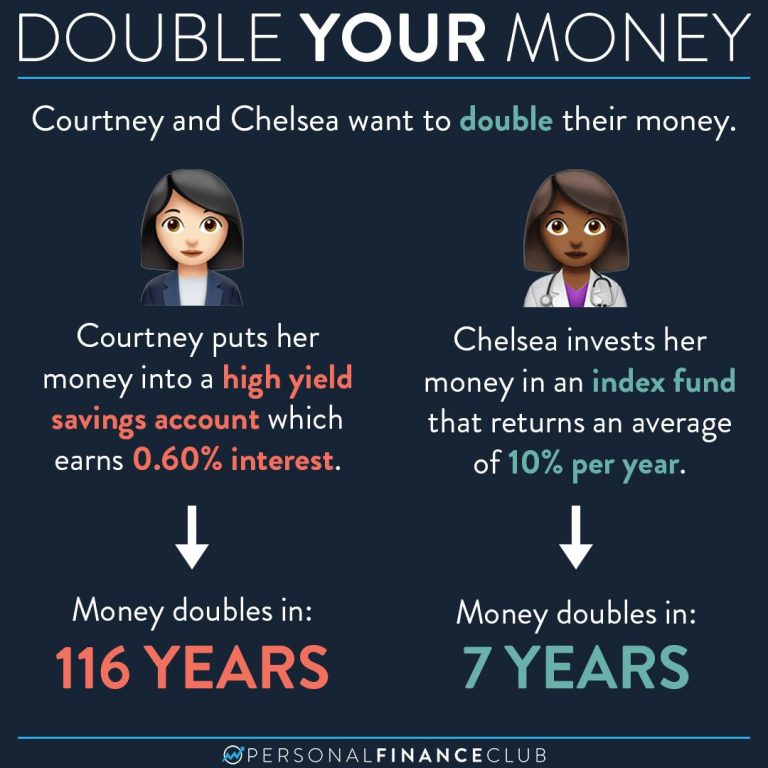

High-yield savings accounts have garnered attention for offering significantly higher interest rates compared to traditional savings options.While conventional savings accounts typically offer annual percentage yields (APYs) around 0.01% to 0.10%, high-yield accounts can reach rates of 0.50% to 2.00% or more, depending on market conditions and financial institutions. this difference can lead to considerable growth in your savings over time, making them particularly appealing for individuals looking to maximize their savings potential.However, it’s important to consider factors such as maintenance fees, withdrawal restrictions, and minimum balance requirements that may apply to high-yield accounts, which can affect overall returns.

When choosing the right savings option, evaluating your financial goals is crucial. High-yield savings accounts are frequently enough provided by online banks, allowing for reduced overhead costs and thus higher interest rates. Here are some key points to consider when making your comparison:

- Accessibility: High-yield accounts may offer limited access to branches,whereas traditional banks provide more in-person services.

- Security: Both types of accounts are typically insured by the FDIC, ensuring the safety of your deposits up to specified limits.

- Interest Rates: Assess whether the higher rates of a high-yield account outweigh the potential constraints on your funds.

| Feature | High-Yield Savings | Traditional Savings |

|---|---|---|

| Typical APY | 0.50% – 2.00% | 0.01% – 0.10% |

| Bank Type | Online Banks | Brick-and-Mortar Banks |

| Fees | May vary (often low) | Higher fees common |

Key Factors to Consider When Choosing a High-Yield Savings Account

When selecting a high-yield savings account, it’s crucial to evaluate the interest rates offered by various institutions. While some banks may boast attractive introductory rates, it’s important to consider the annual percentage yield (APY) over the long term. A competitive APY can significantly affect your savings growth, so look for accounts that can provide consistent rates without frequent fluctuations. Additionally, check for any minimum balance requirements that could hinder your ability to access higher yields if your balance falls below a certain threshold.

Another essential aspect is the fees associated with the account. Some high-yield savings accounts come with monthly maintenance fees, transaction limits, or penalties for early withdrawals, which can erode your savings. Look for accounts that offer no monthly fees or easy ways to waive them. Moreover, consider the level of customer service your bank provides. A responsive and supportive banking experience can make a significant difference, particularly when you have questions about your account or need assistance with online banking features. always weigh interest rates, fees, and customer experience before deciding which high-yield savings account best suits your financial goals.

Maximizing Your Earnings: Tips for Utilizing high-Yield Savings Accounts

To truly make the most of a high-yield savings account, it’s essential to shop around and compare interest rates from various financial institutions. Shopping for the best rates can lead you to accounts that offer significantly higher APYs (Annual Percentage Yields) than traditional savings accounts. Many online banks, in particular, tend to provide more competitive rates due to lower overhead costs. Look for accounts that have no monthly maintenance fees, as these can quickly chip away at your earnings. Consider the following when comparing options:

- Interest rate: Seek out accounts with the highest APYs.

- fees: Avoid accounts with hidden fees that can diminish your savings.

- Accessibility: Check how easy it is to transfer funds when you need them.

In addition to selecting the right account, strategically depositing funds can amplify your returns. Aim to set up automatic transfers from your checking account to your high-yield savings account, reinforcing a regular saving habit and helping you build your balance consistently. You might also consider setting aside any unexpected windfalls, like tax refunds or bonuses, into this account to maximize your growth potential. Here’s a brief table to illustrate how incremental deposits can impact savings over one year:

| Deposit Type | Amount | Total After 1 Year (Assuming 2% APY) |

|---|---|---|

| Monthly Contribution | $100 | $1,225 |

| One-time Deposit | $1,200 | $1,224 |

Key Takeaways

high-yield savings accounts present a compelling option for those looking to maximize their savings while maintaining liquidity. With interest rates significantly higher than traditional savings accounts, they can serve as a powerful tool for your financial strategy, whether you’re saving for an emergency fund, a major purchase, or long-term goals.However, it’s essential to scrutinize the details: compare interest rates, fees, and the institution’s reliability before committing your funds.While they may not replace higher-risk investment avenues, high-yield savings accounts offer a safe haven for your money, particularly in our unpredictable financial landscape. Remember to evaluate your personal financial situation and goals, and consider diversifying your investment strategy to include other options alongside this secure and accessible savings solution.

Ultimately, the decision to invest in a high-yield savings account should align with your broader financial objectives. As you weigh the benefits and potential drawbacks, keep in mind that every step you take towards better financial health is a step in the right direction. Happy saving!