In an increasingly digital age, the role of conventional bank branches may seem overshadowed by the convenience of online banking and mobile apps. However, thes physical locations continue to play a crucial role in the financial ecosystem. From personalized customer service to complex transactions that require human interaction, bank branches offer a range of services that cannot be replicated by digital platforms alone.In this article, we will delve into the various services provided by bank branches, explore their significance in fostering customer relationships, and highlight how they adapt to contemporary banking needs. Join us as we uncover the multifaceted importance of bank branch services and their enduring relevance in a rapidly evolving financial landscape.

Table of Contents

- Understanding the Essential Functions of Bank Branch services

- The Impact of Customer Relationship Management in Branch Operations

- Maximizing Efficiency: Enhancing Services Through Technology and Automation

- Building Community Trust: The Vital Role of Bank Branches in Local Economies

- Wrapping Up

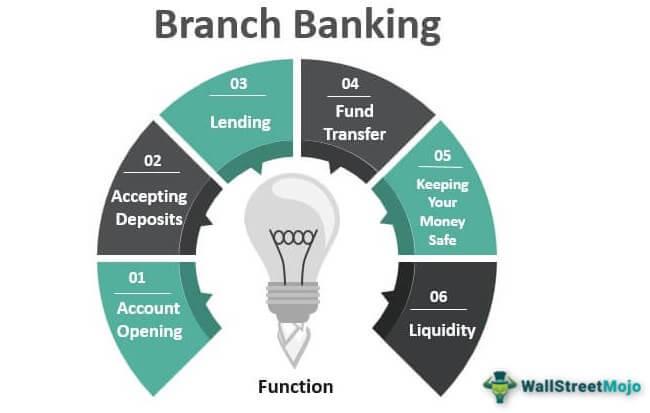

Understanding the Essential Functions of Bank Branch Services

Bank branches serve as the frontline of banking operations, providing a range of essential services to customers while fostering significant relationships within the community. personal banking services, including checking and savings accounts, personal loans, and mortgages, remain integral to branch offerings. Branch staff not only assist customers with transactions but also guide them through the selection of products that best suit their financial needs. Customers who visit bank branches can enjoy personalized service from knowledgeable staff, ensuring they receive tailored advice and support.Furthermore, branches play a vital role in building trust and rapport, as community members often prefer in-person interactions over digital alternatives.

In addition to personal services, bank branches facilitate business banking operations. They provide small and medium-sized enterprises (SMEs) access to crucial services such as business loans, merchant accounts, and investment advice. The face-to-face consultation at branches helps businesses navigate banking requirements and fosters a stronger connection with financial institutions. Here’s a brief comparison of key functions offered at bank branches:

| Function | Personal Banking | Business Banking |

|---|---|---|

| Account Services | Savings & Checking Accounts | Merchant Accounts |

| Loan Services | Personal & Home Loans | Business Loans |

| Investment Advice | Retirement Accounts | Business Investments |

The Impact of Customer Relationship Management in Branch Operations

effective customer relationship management (CRM) significantly enhances branch operations by fostering a more personalized banking experience. By utilizing advanced CRM systems, banks can gather, analyze, and leverage customer data to tailor services that meet individual needs. This strategic approach not only improves customer satisfaction but also builds stronger client loyalty. Branch staff equipped with comprehensive customer insights can proactively address concerns,offer relevant products,and streamline service processes,resulting in a more efficient and engaging branch environment. As a result, customers feel valued and understood, wich enhances their overall banking experience.

Furthermore, the integration of CRM tools in branch operations aids in identifying key performance indicators (KPIs) that reflect customer engagement and satisfaction levels. Branch managers can monitor metrics such as customer retention rates, the effectiveness of promotional campaigns, and response times to inquiries. This data-driven methodology empowers banks to make informed decisions that enhance service delivery and operational efficiency. The implementation of tailored training programs for branch employees based on these insights also plays a crucial role in delivering exceptional customer service, ensuring that every interaction at the branch is optimized for a positive customer experience.

| CRM Benefits | Impact on Branch Operations |

|---|---|

| Enhanced Customer Insights | Customized services and stronger relationships |

| Improved Communication | Faster issue resolution and support |

| Data Analysis | Informed decision-making and strategy advancement |

| Staff Training | Higher service quality and customer satisfaction |

Maximizing Efficiency: Enhancing services Through Technology and Automation

In the fast-paced world of banking, technology and automation are not just optional enhancements; they are essential for maximizing efficiency and streamlining services. By implementing advanced digital solutions, bank branches can improve customer experiences significantly. For instance, automated teller machines (ATMs) have evolved from cash withdrawal points to multifunctional service kiosks that can handle deposits, transfers, and even loan applications. This not only reduces waiting times but also allows staff to focus on more complex customer needs, increasing the overall productivity of the branch. Furthermore, mobile banking applications offer clients the freedom to conduct transactions anytime, enhancing convenience and satisfaction.

Additionally, the integration of data analytics and customer relationship management (CRM) systems has transformed how banks understand their clientele.By analyzing customer behavior and preferences,banks can tailor services to better meet individual needs,leading to higher engagement and loyalty. Automated messaging systems can provide timely alerts about new offerings, account updates, and potential fraud, encouraging proactive communication. A recent survey indicated that 70% of customers prefer receiving service notifications via automated channels rather than traditional methods, showcasing the shift towards a tech-driven approach in enhancing branch services. The following table illustrates some key tech-driven enhancements:

| Service Enhancement | Description | Benefits |

|---|---|---|

| Automated Teller Machines (ATMs) | Multi-function kiosks that handle various transactions. | Reduced waiting times, increased customer satisfaction. |

| mobile Banking apps | 24/7 access to banking services. | Convenience,real-time transaction tracking. |

| Data Analytics | Insight into customer behavior and preferences. | personalized services, improved client retention. |

| Automated Notifications | Timely alerts about account and service updates. | Proactive communication,increased engagement. |

Building Community Trust: The vital Role of Bank Branches in Local Economies

In an increasingly digital world, bank branches continue to serve as essential touchpoints for fostering community trust and economic stability. They provide a sense of familiarity and security, reinforcing the importance of personal relationships in banking. The role of these branches extends beyond mere transactions; they actively engage with the community through a variety of services, including:

- Financial Education: Offering workshops and resources to enhance financial literacy among local residents.

- Personalized Services: Catering to individual customer needs through tailored financial solutions.

- Community Involvement: participating in local events and sponsoring community initiatives to strengthen ties.

This unique presence empowers banks to become integral parts of the neighborhoods they serve,allowing them to understand local needs and challenges more intimately. Additionally, their investment in the community enhances local economies by helping small businesses thrive. Below is a brief overview of how bank branches impact community vitality:

| Impact Area | description |

|---|---|

| Job Creation | Branches create job opportunities, stimulating local employment rates. |

| Small Business Support | providing loans and financial advice to entrepreneurs. |

| Local Investment | Reinvesting profits back into the community through various initiatives. |

Wrapping Up

the exploration of bank branch services highlights their enduring significance in today’s evolving financial landscape. While digital banking continues to gain traction, bank branches remain crucial pillars of customer support, fostering personal relationships and providing tailored financial advice. They serve not only as transactional hubs but also as educational resources that empower individuals to make informed financial decisions. As we continue to embrace technological advancements, it’s essential to recognize the value of these physical spaces, bridging the gap between innovation and personal service. Whether your looking for assistance with complex transactions or seeking expert guidance on your financial journey, bank branches will remain indispensable resources in navigating the world of finance. Thank you for joining us in this exploration—stay informed, stay engaged, and remember that your local branch is always there to support your financial goals.