Introduction:

Planning for the future is a essential aspect of ensuring yoru wishes are honored and your loved ones are cared for, even when you’re no longer here. An estate plan goes beyond merely distributing your assets; it encompasses key decisions about your healthcare preferences, guardianship for dependents, and strategies to minimize tax burdens. Yet, the idea of creating a comprehensive estate plan may seem daunting. Where do you start? What documents do you need? In this article, we’ll outline the essential steps to developing a solid estate plan that reflects your values and protects your legacy. Whether you’re just beginning to think about estate planning or seeking to update your existing documents, this guide will equip you with the knowledge needed to navigate this vital process with confidence and clarity.

table of Contents

- Understanding the Importance of Estate Planning for financial Security

- Key components of an Effective Estate Plan: Trusts, Wills, and Beyond

- Navigating Legal Requirements: Ensuring Compliance and Validity

- Regular Review and Updates: Adapting Your Estate Plan to Life Changes

- in Retrospect

Understanding the Importance of Estate Planning for financial Security

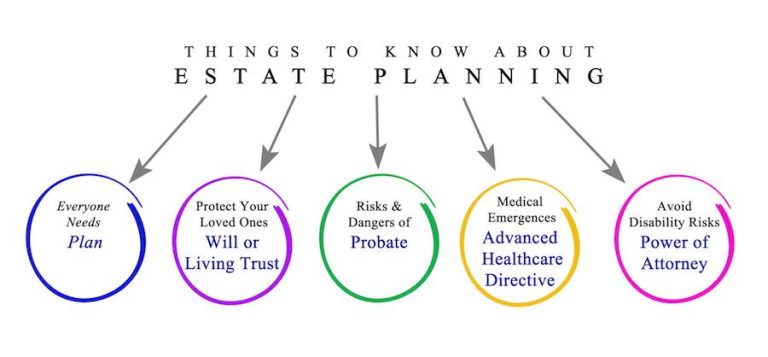

Estate planning is a crucial component of financial security, serving not just the wealthy but everyone who wishes to ensure their wishes are honored and their loved ones are cared for after their passing. By taking the time to establish a comprehensive estate plan, individuals can protect their assets, minimize stress for their family members, and ensure that their legacy is preserved according to their desires. Key elements of an effective estate plan include the creation of a will, establishing trusts, and designating beneficiaries. Each of these components plays a vital role in directing how assets should be allocated and handled, preventing potential disputes among heirs.

A well-structured estate plan can also provide meaningful tax benefits and facilitate a smoother transition of assets. To achieve this, it is essential to work with legal and financial professionals to create a tailored approach. Consider including the following in your estate planning checklist:

- Draft a Will – Outline how your assets should be distributed.

- Establish Trusts – Protect your assets and possibly reduce tax liabilities.

- Designate Powers of Attorney – Ensure decisions can be made in your best interest if you’re unable to make them yourself.

- Review Beneficiary Designations – Ensure that your financial accounts reflect your current wishes.

Key Components of an Effective Estate Plan: Trusts, Wills, and Beyond

Creating a robust estate plan involves understanding the various components that can protect your assets and ensure your wishes are honored.Trusts are pivotal tools that allow you to control how your assets are distributed while potentially providing tax benefits and avoiding probate. They come in different forms, including revocable and irrevocable trusts, each designed for specific needs. Wills, on the other hand, serve as legal documents that articulate your final wishes regarding asset distribution, guardianship for dependents, and funeral arrangements. It’s essential to ensure that your will is regularly updated to reflect any changes in your life circumstances or relationships.

Along with trusts and wills, there are other vital elements to consider in your estate plan. These include powers of attorney, which grant someone the authority to make decisions on your behalf in case of incapacity, and healthcare proxies that designate the individual responsible for making medical decisions. You may also want to look into living wills, specifying your healthcare preferences in the event of a terminal illness. To aid your understanding, here’s a simple comparison of these documents:

| Document Type | Purpose | Key Feature |

|---|---|---|

| Trust | Manage asset distribution | Can avoid probate |

| Will | Specify final wishes | Goes through probate |

| Power of Attorney | Delegate decision-making | Financial matters |

| Healthcare proxy | Medical decision-making | Healthcare choices |

| Living Will | End-of-life decisions | Specific medical preferences |

Navigating legal Requirements: Ensuring Compliance and Validity

Understanding the legal landscape surrounding estate planning is crucial to creating a valid and enforceable plan. Start by consulting with a qualified estate planning attorney who can guide you through specific state requirements.Each jurisdiction has its own rules governing wills, trusts, and powers of attorney.To ensure that your estate plan respects these laws,consider the following essential steps:

- Research State Laws: Familiarize yourself with the estate laws in your state,as they can affect how your estate is managed and distributed.

- Utilize Valid Forms: Make sure to use the correct legal documents required in your jurisdiction, such as wills or trusts.

- Witness Requirements: Ensure that your documents are executed in the presence of the necessary number of witnesses as mandated by state law.

Once you have a foundational understanding, it’s also vital to periodically review and update your estate plan to reflect any changes in family dynamics, assets, or laws. Create a system for regular check-ins, and involve trusted family members in discussions about your plans. This proactive approach can definitely help you avoid potential pitfalls:

| Aspect | Frequency of Review |

|---|---|

| Life Events (marriage, divorce, birth) | After any significant life change |

| Asset Changes (buying or selling property) | Annually |

| Legal Updates (changes in estate laws) | Bi-annually or as needed |

Regular Review and Updates: Adapting Your Estate Plan to Life Changes

Life is a series of changes, and in this very way, your estate plan should evolve alongside you.Regularly reviewing your estate plan ensures that it reflects your current wishes and circumstances. Key life events such as marriage, divorce, the birth of a child, or the death of a loved one can significantly impact your plans. It’s essential to take stock of any new assets you may acquire, changes in your personal relationships, and shifts in your financial situation. A thoughtful estate planning process encapsulates these transitions, making it imperative to revisit your documents periodically.

Consider scheduling annual reviews with your estate planning attorney to go over your documents. During these sessions, focus on the following critical areas:

- Beneficiary Designations: Ensure that they align with your current wishes.

- Asset Ownership: Verify that all assets are titled correctly.

- Guardianship Provisions: Update guardianship plans for minor children as needed.

- Tax Implications: Review potential estate tax changes that may impact your estate.

A simple table can definitely help organize the changes you may need to consider in each review:

| Life Change | Considerations |

|---|---|

| Marriage | Update beneficiaries, revise wills and trusts. |

| divorce | Modify asset distribution, change beneficiaries. |

| Birth of a Child | Include child in will,set up guardianship. |

| Relocation | Review state laws impact; update documents as necessary. |

In Retrospect

As we conclude our exploration of the essential steps to create a comprehensive estate plan, it’s crucial to remember that each individual’s journey is unique.While the process may seem daunting at first, taking these deliberate steps will provide you with peace of mind and security for your loved ones.

By outlining your wishes, organizing your assets, and engaging with professionals when necessary, you’re not just making plans for the future; you’re creating a legacy that reflects your values and priorities.Whether it’s drafting a will, setting up trusts, or designating power of attorney, every decision you make today can have a significant impact down the road.

We encourage you to take the first step in this vital process and ensure that your estate plan is tailored to your specific needs and goals. Remember, estate planning is not a one-time task but an evolving process that requires periodic review and adjustments as your life circumstances change.

Thank you for joining us on this journey toward secure and thoughtful estate planning. If you have any questions or need further assistance, don’t hesitate to reach out. Your future—and the future of your loved ones—deserves careful planning and consideration.