planning for the future can often feel overwhelming,but when it comes to estate and legacy planning,a well-structured approach can provide peace of mind for you and your loved ones. Whether you’re just starting to think about your assets, or you’re ready to refine an existing plan, understanding the key components of effective estate planning is vital. This essential guide will walk you through the fundamental principles of creating a extensive estate plan that not only reflects your wishes but also preserves your legacy for generations to come. We’ll explore vital topics such as wills,trusts,tax implications,and the role of professional advisors,empowering you to make informed decisions.Let’s unravel the complexities of estate planning together, paving the way for a secure and thoughtful legacy.

Table of Contents

- Understanding the Fundamentals of Estate Planning

- Key Documents You Need for Legacy Protection

- strategies for Minimizing Taxes and Maximizing Inheritance

- Communicating Your Plans: Engaging Family in Estate Discussions

- Wrapping Up

Understanding the Fundamentals of Estate Planning

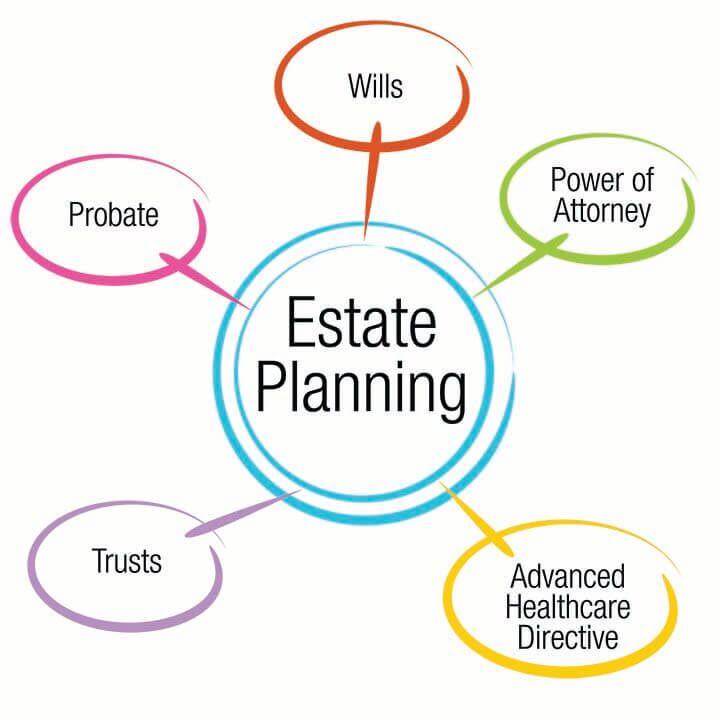

When embarking on the journey of estate planning, it’s crucial to grasp the critical components that comprise a robust plan.Estate planning encompasses a broad array of documents and strategies aimed at managing your assets, ensuring they are distributed according to your wishes after your passing. Key elements include:

- Wills and Trusts: Fundamental documents that outline how your assets will be allocated. Wills detail your wishes regarding asset distribution, while trusts can provide more flexibility and reduce estate taxes.

- Power of Attorney: This legal document appoints someone to make decisions on your behalf in case of incapacity, ensuring your affairs are managed by a trusted individual.

- Healthcare Directives: Also known as living wills, thes outline your preferences regarding medical treatment should you be unable to communicate your wishes.

Understanding these components not only empowers you to make informed decisions but also streamlines the process for your beneficiaries. To visualize how different elements fit together in effective estate planning, consider the summary table below:

| Document Type | Purpose | Key Benefit |

|---|---|---|

| Will | Distributes assets posthumously | Clear directives to prevent disputes |

| Trust | Manages assets during and after life | Reduces taxes and avoids probate |

| power of Attorney | Appoints decision-maker in incapacity | Ensures wishes are honored and affairs managed |

| Healthcare Directive | Specifies medical treatment preferences | Gives voice to healthcare choices when incapacitated |

Key Documents You Need for Legacy Protection

To secure your legacy and ensure your wishes are honored, creating and organizing certain legal documents is paramount. The cornerstone of effective estate planning typically includes a Last Will and Testament, which dictates how your assets will be distributed after your passing. Alongside this, a Revocable Living Trust can definitely help manage your assets during your lifetime and simplify the transfer process, possibly avoiding probate. Additionally,don’t overlook the importance of Advance Healthcare Directives,which detail your medical treatment preferences if you’re unable to communicate those choices.

moreover, it’s vital to establish a Durable Power of Attorney to designate someone to make financial decisions on your behalf when you cannot.This document works hand-in-hand with your estate plan, ensuring that your affairs are managed according to your wishes. It may also be useful to create a Beneficiary Designation Document, particularly for assets that pass outside of your will, such as life insurance policies and retirement accounts. To assist in organizing these essential documents, consider using a simple table format:

| Document Type | Purpose |

|---|---|

| Last will and Testament | Outlines asset distribution |

| Revocable Living Trust | Manages assets and avoids probate |

| Advance Healthcare Directive | Specifies medical treatment preferences |

| Durable Power of Attorney | Authorizes someone to make decisions |

| Beneficiary Designation Document | Determines asset transfer outside the will |

Strategies for Minimizing Taxes and Maximizing Inheritance

To effectively manage your estate and reduce tax liabilities, it’s imperative to explore various tax-saving strategies. Utilizing tax-advantaged accounts can be a game-changer; for instance, contributing to a Health Savings Account (HSA) or a 401(k) can help you defer taxes. Gifting assets to heirs during your lifetime not only reduces your taxable estate but can also leverage current tax exemptions. Setting up trusts—especially irrevocable ones—can further shield your wealth from estate taxes while ensuring your beneficiaries receive their inheritance according to your wishes. Additionally, consider investing in tax-efficient funds and assets, which can provide better after-tax returns mounted against high tax obligations.

In conjunction with these strategies, it’s vital to regularly review and adjust your estate plan as your financial situation changes.engaging a financial advisor can definitely help navigate the complexities of your estate and advise on the best approaches to minimize tax burdens. Documenting your wishes clearly can prevent disputes and ensure a smoother transition of wealth. A well-structured inheritance plan can be laid out effectively in tables that illustrate specific bequests and their tax implications, ensuring clarity and clarity for all parties involved. Below is an example of how your plan might look:

| Asset | Beneficiary | Tax Implications |

|---|---|---|

| Family Home | Spouse | Step-Up Basis |

| Investment Account | Child | Capital gains Tax |

| life Insurance Policy | Designated Beneficiary | Usually tax-Free |

Communicating Your Plans: Engaging Family in Estate Discussions

Engaging your family in discussions about estate planning can feel daunting, but it’s essential for ensuring that your wishes are understood and respected. Start by creating a welcoming habitat where everyone feels comfortable expressing their thoughts and concerns. Consider organizing a family meeting specifically for this purpose. some effective strategies include:

- Setting a positive tone: Frame the discussion around love and care,emphasizing the importance of shared values.

- Being obvious: Share your goals and intentions clearly, allowing your family members to ask questions and seek clarification.

- Encouraging participation: Invite family members to share their perspectives, which can foster a sense of inclusion and respect.

To aid in these discussions, it might help to have a visual representation of your estate plans. A simple table can clarify how your assets will be distributed and the roles each family member might play. Consider laying out information in the following format:

| Asset Type | Designated Beneficiary | Notes |

|---|---|---|

| Family Home | Jane Doe | To remain in the family |

| Investment account | John Doe | To help with education expenses |

| Personal Items | Samantha doe | Sentimental value |

This table can act as a reference point during discussions, helping everyone understand their roles and responsibilities while minimizing misunderstandings. By simplifying the information presented, you create a foundation for productive conversations that can led to a more harmonious future for your family.

Wrapping Up

effective estate and legacy planning is not just a financial necessity; it’s a profound expression of your values and intentions for the future. By taking the time to thoughtfully organize your affairs, you ensure that your wishes are honored and that your loved ones are supported, even after you’re no longer there to guide them. Remember, this process is ongoing and requires regular review and adjustment to reflect any changes in your life circumstances or goals.

As you embark on this journey, consider seeking the advice of financial advisors or estate planning professionals who can provide customized guidance tailored to your unique situation. The peace of mind gained from knowing you’ve planned effectively cannot be overstated.

We hope this essential guide serves as a valuable resource to help you navigate the intricacies of estate and legacy planning. Achieving your legacy goals is within reach,so take the first step today. After all, a well-executed plan not only protects your assets but also defines the narrative you wish to leave behind. thank you for joining us on this important discussion, and here’s to building a future that reflects your legacy.