In an ever-changing financial landscape,where uncertainties can emerge unexpectedly,understanding the intricacies of your insurance coverage is more crucial than ever. Whether you’re a young professional just starting out,a growing family planning for the future,or an established individual looking to safeguard your assets,regularly reviewing your insurance needs is a vital step toward achieving long-term financial success. This essential guide will walk you through the pivotal aspects of assessing your insurance policies, identifying potential gaps in coverage, and making informed decisions that not only protect your investments but also empower you to navigate life’s unpredictable twists and turns. Join us as we delve into the key considerations and actionable steps you can take to optimize your insurance portfolio and secure peace of mind for years to come.

Table of Contents

- Understanding Different Types of Insurance Coverage for Comprehensive Protection

- Assessing Your personal and Business Risks for Tailored Insurance Solutions

- Evaluating Policy Terms and Premiums to Maximize Value and Minimize Costs

- Conducting Annual Reviews of Your Insurance Portfolio for Ongoing Financial Security

- In Summary

Understanding Different Types of Insurance Coverage for Comprehensive Protection

Insurance coverage isn’t a one-size-fits-all solution. Understanding the various types of insurance can empower you to choose the policies that best fit your circumstances. The following are crucial types of coverage to consider:

- Health Insurance: Covers medical expenses and can include preventive care, hospital visits, and prescriptions.

- Auto Insurance: Protects against financial loss in the event of an accident, theft, or damage to your vehicle.

- Homeowners or Renters Insurance: Safeguards your property and belongings against events like theft, fire, and natural disasters.

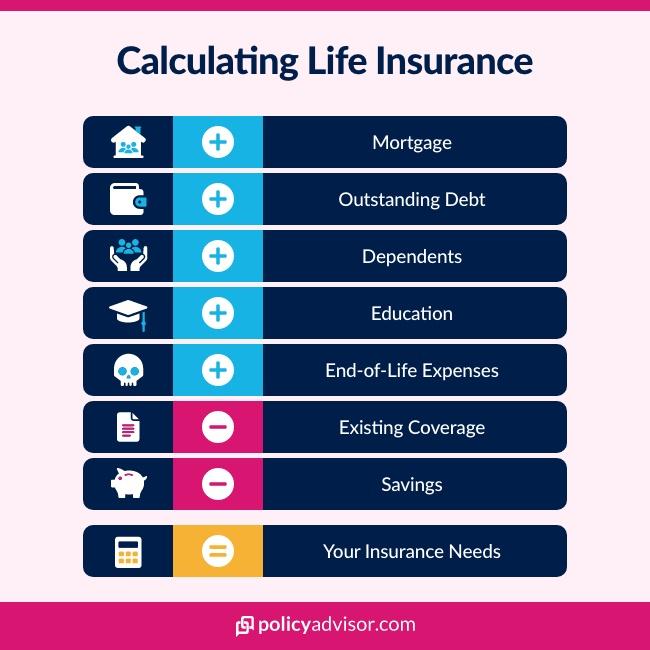

- life Insurance: Provides financial support to beneficiaries upon the policyholder’s death, ensuring dependents are taken care of.

- disability Insurance: Offers income replacement if you are unable to work due to illness or injury.

When evaluating your specific insurance needs, its beneficial to conduct a thorough review of your assets, liabilities, and potential risks. A practical approach to understanding your insurance requirements includes:

| Type of Insurance | Key Benefits |

|---|---|

| Health insurance | Access to medical services without financial strain |

| Auto insurance | Liability coverage and protection for your vehicle |

| Homeowners Insurance | Protection of your home and personal property |

| Life Insurance | Financial security for your loved ones |

| disability Insurance | Income protection during periods of incapacitation |

Assessing Your Personal and Business Risks for tailored Insurance Solutions

Understanding and evaluating your unique risks is crucial for establishing a solid foundation for tailored insurance solutions. Begin by identifying the potential threats that could impact both your personal life and your business operations.Common personal risks to consider include:

- Health-related issues: Illnesses or injuries that may lead to increased medical expenses

- Property damage: Risks associated with natural disasters, theft, or accidents in the home

- Liability risks: Potential lawsuits from accidents or injuries that may occur on your property

For businesses, the landscape is frequently enough more complex, requiring a thorough assessment of potential risks to minimize disruptions. Key business risks to analyze are:

- Cybersecurity threats: Data breaches or hacking incidents that could compromise customer details

- Regulatory compliance: Risks of legal action from failing to adhere to laws and regulations

- business interruption: Factors such as natural disasters,supply chain disruptions,or workforce issues that might halt operations

By systematically evaluating these personal and business risks,you can create a customized insurance portfolio that meets your specific needs while providing peace of mind for the future. To facilitate your assessment,it may be beneficial to track your findings in a structured format:

| Risk Type | Description | Recommendation |

|---|---|---|

| Personal | Health-related issues | Consider health and life insurance options |

| Business | Cybersecurity threats | Invest in cyber liability insurance |

| Personal | Property damage | Explore home insurance policies |

| Business | Business interruption | Evaluate business interruption insurance |

Evaluating Policy Terms and Premiums to Maximize Value and Minimize Costs

When it comes to choosing insurance,not all policies are created equal.It’s crucial to conduct a thorough assessment of the terms and conditions of each policy you are considering. Look for key features such as coverage limits,exclusions,and any additional benefits that may be offered. Understanding these details can definitely help ensure you select a policy that provides adequate protection without needless enhancements that inflate premiums. A few essential factors to weigh include:

- Coverage Scope: Ensure it meets your specific needs.

- Deductibles: Choose a level that aligns with your financial comfort.

- exclusions: Familiarize yourself with what isn’t covered.

- customer Service: Investigate the insurer’s reputation for support.

Next, it’s essential to perform a cost-benefit analysis of the premiums in relation to the coverage provided. While finding the lowest premium might be tempting, it can lead to insufficient coverage and unforeseen expenses down the line. Utilizing a simple comparison table can highlight the vital differences among various insurance options:

| Policy Type | Monthly Premium | Coverage Amount | Deductible |

|---|---|---|---|

| Basic Coverage | $50 | $100,000 | $1,000 |

| Standard Coverage | $75 | $250,000 | $500 |

| Comprehensive Coverage | $120 | $500,000 | $300 |

Regularly reviewing these elements can help you make informed decisions that not only maximize the value of your insurance policies but also minimize costs.By strategically selecting the right plan, you can secure financial peace of mind while ensuring your insurance needs are effectively met.

Conducting Annual Reviews of Your Insurance Portfolio for Ongoing Financial Security

Conducting an annual review of your insurance portfolio is crucial for maintaining financial security and ensuring that your coverage aligns with your current needs. Over time, personal circumstances, financial situations, and market conditions may change, necessitating adjustments to your policies. When you sit down for this annual review, consider the following key factors:

- Life Changes: Major events such as marriage, the birth of a child, or a new job can considerably impact your insurance requirements.

- Coverage Gaps: Review your existing policies to identify any potential gaps in coverage that could leave you vulnerable.

- Policy adjustments: As your value of assets grows or diminishes, modify your coverage limits appropriately.

- Deductible Changes: Reassess your deductibles to find the right balance between lower premiums and manageable out-of-pocket expenses.

During your review, it’s also essential to evaluate the performance of your insurance providers and the types of policies you hold. Keep an eye on market trends and new products that may offer better benefits or lower rates. Consider compiling your findings in a simple comparison table to visualize your options:

| Insurance Type | Current Provider | Coverage Amount | Premium cost |

|---|---|---|---|

| Homeowners Insurance | Provider A | $300,000 | $1,200/year |

| Auto Insurance | Provider B | $25,000 | $800/year |

| Life Insurance | Provider C | $500,000 | $600/year |

In Summary

regularly reviewing your insurance needs is not just a prudent financial strategy; it’s a vital step toward achieving long-term financial success and security. By understanding the intricacies of your policies and assessing your current life circumstances, you position yourself to make informed decisions that can safeguard your assets and future. Remember, the landscape of insurance is ever-evolving, much like your personal and financial circumstances.Make it a habit to revisit your coverage—whether it’s health, property, or life insurance—at least once a year or whenever a notable life change occurs.

Taking the time to assess and adjust your insurance coverage can lead to peace of mind, knowing that you are well-protected against unpredictable events. If you find the process daunting,consider consulting with an insurance professional who can provide guidance tailored to your specific needs.

ultimately, being proactive about your insurance needs is an investment in your financial wellbeing and an essential component of a comprehensive financial plan. We hope this guide has equipped you with the knowledge and tools to take charge of your insurance needs. Here’s to making informed choices and securing a brighter financial future! Don’t forget to subscribe for more insights and tips that can help you achieve your financial goals.