In today’s competitive financial landscape, understanding your credit history is more crucial than ever. Your credit report serves as a comprehensive snapshot of your financial behavior,influencing not just your ability to secure loans but also the terms and rates that lenders offer you.But have you ever wondered how banks precisely interpret your credit data to curate personalized offers? From interest rates to credit limits, these tailored financial products are designed with your unique credit profile in mind. In this article, we’ll delve into the mechanics behind credit history assessment and demystify how banks leverage this data to craft offers that cater specifically to your financial needs. whether you’re looking to improve your credit score or simply want to make sense of the various offers in your inbox, this guide will equip you with the insights necessary to navigate the world of credit with confidence.

Table of Contents

- Understanding the Basics of Your Credit History and Its Importance

- How Banks Analyze Your Credit Profile to Create Personalized offers

- Key Factors That Influence Your Credit Scores and Financial opportunities

- Strategies for Improving Your Credit History and Maximizing Bank Offers

- In Summary

Understanding the Basics of Your Credit History and Its Importance

your credit history is a comprehensive record of your borrowing behavior and repayment patterns. It typically includes details such as your credit accounts, payment history, credit inquiries, and any public records like bankruptcies. Understanding these elements is crucial because they form the basis of your credit score—a three-digit number that lenders use to gauge your financial reliability. A solid credit history can open the door to favorable loan terms, lower interest rates, and can even impact job applications in certain industries. Therefore, maintaining a healthy credit report is essential for securing financial products on your terms.

Banks and financial institutions analyze your credit history to create tailored offers that align with your financial profile.For instance, if your credit report demonstrates timely payments and a diverse mix of credit, you might receive premium offers with lower rates. Conversely, a history of late payments could led to comparatively high-interest rates or even denied applications. Here’s a swift look at how your credit behavior influences banking offers:

| Credit Behavior | Possible Bank Offer |

|---|---|

| Timely Payments | Lower Interest Rates |

| High Credit Utilization | Limited Credit Access |

| diverse Credit Accounts | Premium Credit Cards |

| Recent Late Payments | Higher Rates or Denial |

How Banks Analyze Your Credit Profile to Create Personalized Offers

Understanding your credit profile is like peering into a mirror that reflects your financial behaviors. Banks meticulously analyze various elements of your credit record, including your payment history, credit utilization, and the length of your credit accounts. They look for patterns and trends that indicate how reliably you manage credit. For instance, a history of timely payments may lead a bank to extend premium offers, while inconsistent behavior might trigger higher interest rates or fewer benefits. This evaluation helps banks categorize you, allowing them to craft personalized offers that align with your creditworthiness.

To better illustrate this process, consider how banks employ different metrics to customize their offers. Here are some of the key factors they might assess:

- Credit Score: A numerical representation of your credit risk.

- Credit Mix: The variety of credit accounts you hold, such as credit cards, loans, etc.

- Debt-to-Income Ratio: Your monthly debt payments compared to your income.

- Recent Inquiries: How many times you’ve sought new credit in a short timeframe.

Through these analyses,banks are not just evaluating numbers; they are gauging your financial health to develop offers that you are more likely to accept and benefit from.the outcome is a tailored product that meets your unique needs, whether it’s a low-interest credit card, a home loan, or special account benefits. Below is a simplified view of how a bank might structure offers based on your credit profile.

| Credit Tier | offer Type | Interest Rate | Additional Benefits |

|---|---|---|---|

| Excellent | Premium Credit Card | 12% | Cashback & Rewards |

| Good | Standard loan | 15% | Flexible Repayment |

| Fair | Basic Credit Card | 20% | No Annual Fee |

| Poor | Secured Card | 25% | Building Credit |

Key Factors That Influence Your Credit Scores and Financial Opportunities

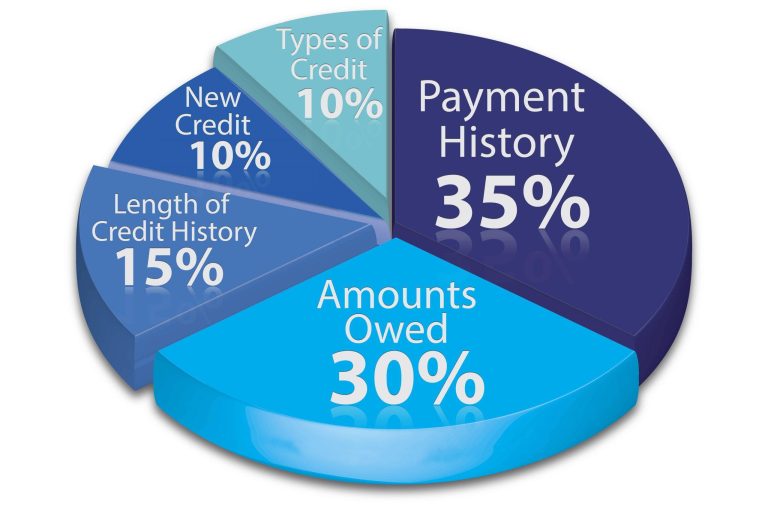

Your credit score is a reflection of your financial behavior and plays a crucial role in determining the credit offers you receive. several factors actively shape your score, including:

- Payment History: Timely payments on debts such as loans and credit cards significantly boost your score.

- Credit Utilization: Keeping your credit card balances low relative to your credit limits indicates responsible credit usage.

- Length of Credit History: A longer credit history often contributes positively, showcasing your experience as a borrower.

- types of Credit: Having a mix of installment loans and revolving credit can reflect positively on your score.

- New Credit Inquiries: Frequent credit inquiries can suggest risk to lenders, potentially lowering your score.

Each of these elements intertwines, forming a composite portrait that financial institutions scrutinize to tailor offers specifically for you. Understanding how these aspects interrelate can empower you to make informed financial decisions. For a clearer perspective, consider the following table illustrating how common credit behaviors can influence your score:

| Behavior | Impact on Score |

|---|---|

| On-time Payments | Positive |

| High Credit Utilization | Negative |

| Short credit History | Negative |

| Diversified Credit Types | Positive |

Strategies for Improving Your Credit History and Maximizing Bank Offers

Improving your credit history is not an overnight endeavor, but implementing strategic measures can significantly enhance your financial standing. Start by frequently checking your credit report for errors; disputing inaccuracies can elevate your score. Additionally,maintain a low credit utilization ratio by keeping balances below 30% of your total credit limit. This demonstrates responsible credit use and reassures banks of your financial reliability. Consider diversifying your credit mix; having a combination of installment loans and revolving credit can positively influence your score. paying your bills on time is paramount, as your payment history is a significant factor in credit scoring models.

To maximize bank offers, leverage your improved credit history by positioning yourself as a low-risk candidate for lenders. Research banks that tailor their products to individuals with your credit profile and take advantage of pre-approval options when available. Building a positive relationship with your bank can also yield fruitful benefits; engaging with them through regular communications can alert you to exclusive offers as they arise. Keep track of your progress with a simple table highlighting improvements in your credit score over time:

| Month | Credit Score | Actions Taken |

|---|---|---|

| January | 650 | Disputed errors & paid bills on time |

| February | 670 | Lowered credit utilization |

| March | 700 | diversified credit mix |

In Summary

understanding your credit history is more than just knowing your credit score; it’s about recognizing how it influences the financial opportunities available to you. As banks and lenders utilize complex algorithms and data analytics to tailor their offers, being proactive about your credit can empower you to take charge of your financial journey.

By regularly monitoring your credit report, addressing discrepancies, and building a positive credit history, you position yourself favorably in the eyes of banks, unlocking access to better rates and terms. Remember, your credit profile is a reflection of your financial behavior, and with the right strategies, you can ensure it works in your favor.

We hope this article has shed light on the intricate relationship between your credit history and the offers you receive. Stay informed, stay proactive, and embrace the opportunity to enhance your financial well-being.For more insights and tips on managing your finances effectively, be sure to check back regularly on our blog. Your journey to financial empowerment starts with knowledge!