In today’s competitive financial landscape, introductory credit card offers can feel like a siren’s call—enticing and full of promise. Whether you’re a seasoned credit card user or a first-time applicant,navigating these offers requires a discerning eye and a solid understanding of the terms and conditions that accompany them. From tantalizing bonus rewards and zero percent interest rates to the fine print that ofen hides crucial details, the array of options can be overwhelming. In this comprehensive guide, we will break down the various components of introductory credit card offers, helping you decode the jargon and make informed decisions that align with your financial goals.By the end of this article, you’ll be equipped not only to identify the best offers available but also to avoid potential pitfalls that could impact your financial health in the long run. Let’s dive in and uncover the secrets behind these alluring promotions.

Table of Contents

- Understanding the Basics of Introductory Credit Card Offers

- Evaluating the Fine Print: Key Terms and Conditions to Consider

- Maximizing Benefits: Strategies for Making the Most of Your Intro Offer

- Common pitfalls to Avoid When Signing Up for Credit Card Promotions

- The Conclusion

Understanding the Basics of Introductory Credit Card Offers

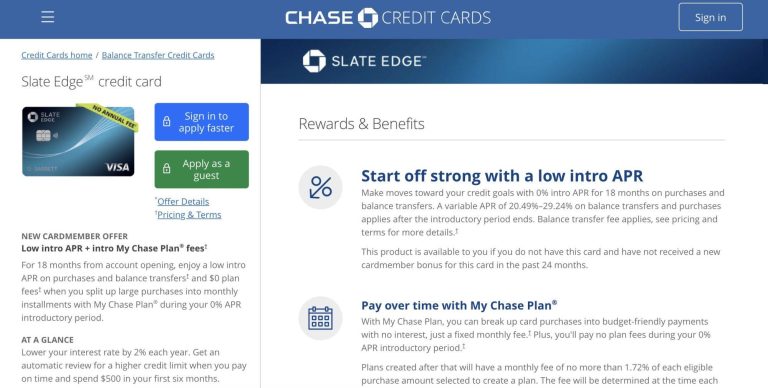

Introductory credit card offers are designed to attract new customers, providing them with enticing benefits to consider a specific card. These offers frequently enough include perks such as 0% APR for an introductory period, cashback rewards, or bonus points upon meeting certain spending thresholds. Understanding the terms associated with these offers is crucial. Here are some key elements to watch for:

- Duration of the introductory period: Typically lasts from 6 to 18 months.

- Post-Introductory APR: Be aware of the potential interest rate hike after the introductory phase.

- Fees: Look for annual fees or other hidden charges that may apply.

When evaluating which card to apply for, consider creating a comparison table to outline diffrent offers and see how they stack up against each other. This can help clarify which card provides the most value over time. Here’s an example table using common features you might find:

| Card Name | Intro APR | Bonus Offer | Annual Fee |

|---|---|---|---|

| Card A | 0% for 12 months | $200 cashback after $1,000 spend | $0 |

| Card B | 0% for 15 months | 60,000 points after $500 spend | $95 |

| Card C | 0% for 18 months | $100 cashback after $750 spend | $0 |

Evaluating the Fine Print: Key Terms and Conditions to Consider

When navigating the landscape of introductory credit card offers, it’s essential to scrutinize the terms and conditions to uncover what lies beneath the surface of enticing promotions.First and foremost, understand the APR (Annual percentage Rate) and how it applies after the introductory period expires. While a low introductory APR can be attractive, always check how high it could rise post-promotion, as this directly impacts your financial obligations. Additionally, look out for annual fees, which can sometiems negate the benefits of the promotional offer, especially if you’re planning to keep the card long-term.

Be vigilant about additional fees associated with the card. Consider the following elements to ensure you’re fully informed:

- Foreign Transaction Fees: Essential for travelers.

- balance Transfer Fees: Often applied to transferred balances.

- Late Payment Fees: understand the penalties for missed payments.

| Fee Type | Typical Amount |

|---|---|

| Annual Fee | $0 – $95 |

| Foreign Transaction Fee | 0% – 3% |

| Late Payment Fee | $15 – $40 |

Lastly, keep an eye out for rewards and cashback structures that may have intricate redemption requirements, often found in the fine print. Understanding the full context of these benefits will help you maximize your card’s offerings and avoid pitfalls.Reading between the lines can often led to clarity and empower you to choose the card that best fits your financial lifestyle.

Maximizing Benefits: Strategies for Making the Most of Your Intro Offer

To unlock the full potential of your introductory offer, it’s essential to be strategic in your approach. Start by understanding the terms of your offer, including the duration of the promotional period and the spending requirements to qualify for rewards. This knowledge will allow you to plan your purchases effectively, ensuring you can meet the necessary criteria without overspending. As an example, consider timing your larger purchases—like home appliances or travel expenses—to coincide with the introductory offer window, maximizing your rewards without straining your budget.

Moreover, keep track of your spending habits to ensure you’re making the most of the offer. Using a budgeting app or spreadsheet can help you monitor your progress toward meeting the spending threshold. Additionally, focus on categorizing your purchases into essential and discretionary spending. The goal should be to shift some of your regular expenses, such as groceries or gas, onto the new credit card to reach the spending target. By doing this intentionally, you’ll not only reap the benefits of the intro offer but also potentially earn additional rewards on your usual expenditures.

common Pitfalls to Avoid When Signing Up for Credit Card Promotions

When considering credit card promotions, many consumers fall into traps that could lead to financial regret.One major pitfall is overlooking the interest rates associated with promotional offers. It’s easy to get swept up in the allure of a bonus or cash back, but if the card has a high APR, you could end up paying more in interest charges than you earn in rewards. Be sure to read the fine print related to promotional interest rates—many cards revert to standard rates after an introductory period, which can considerably impact your finances if you carry a balance.

Another common mistake is failing to track spending limits and promotional timelines. Sometimes, promotional offers are linked to minimum spending requirements that can be hard to meet without overspending. Additionally, watch out for deadlines associated with reward claims; missing a cut-off date can mean you lose your hard-earned bonuses. Here’s a swift checklist to help you avoid these pitfalls:

- Read the Terms: Understand the APR, fees, and terms before signing up.

- Track Promotions: Keep a record of promotional timelines and spending limits.

- Evaluate Spending Habits: Assess if you can realistically meet the spending requirements without unnecessary debt.

The Conclusion

As we conclude our comprehensive guide on decoding introductory credit card offers, it’s clear that navigating the landscape of credit cards can be both exciting and overwhelming. From enticing sign-up bonuses to promotional interest rates,understanding the fine print is essential to making an informed decision that aligns with your financial goals.

Remember, an introductory offer is just the beginning. Assessing your spending habits, payment capacity, and long-term financial strategy will help you leverage these offers to your advantage. Whether you’re looking to build your credit history, earn rewards, or save on interest, taking the time to evaluate your options can lead to smarter financial choices.

We hope this guide has equipped you with the knowledge to sift through the promotional jargon and make savvy decisions. Don’t forget to revisit this article as you explore new offers down the line, and may your journey into the world of credit cards be both rewarding and enlightening. Happy spending wisely!