In todayS financial landscape, consumers are presented with a multitude of options when it comes to managing their money. Among the most common choices are credit unions and banks, both of which offer essential financial services. However, despite their similarities, these two types of institutions operate on fundamentally different principles, which can considerably impact your banking experience. Understanding the key differences between credit unions and banks is crucial for making informed financial decisions tailored to your personal needs. In this article, we will explore the core distinctions between credit unions and banks, including their structures, services, fees, and member benefits. Whether you’re considering switching your current financial institution or simply seeking to broaden your financial literacy, this thorough guide will equip you with the insights needed to navigate the world of banking and choose the right fit for your needs.

Table of Contents

- Understanding the Fundamental Structure of Credit Unions and Banks

- Comparative Analysis of Services Offered by Credit Unions and Banks

- Evaluating Financial Benefits and Fees: What You Need to Know

- Choosing the Right Financial Institution for your needs

- Closing Remarks

Understanding the Fundamental Structure of Credit Unions and Banks

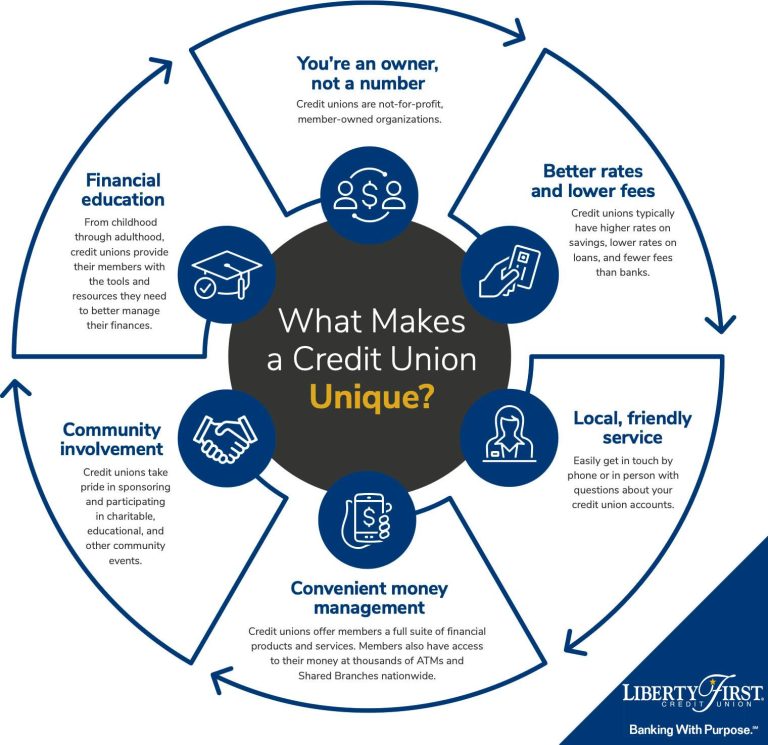

Credit unions and banks operate under distinct structural frameworks that fundamentally influence their services, member interactions, and profitability. Credit unions are member-owned cooperatives, meaning that each member has a stake in the institution and a voice in decisions made. Their primary purpose is to serve their members rather than to maximize profits, resulting in potentially lower fees and better interest rates on loans and savings accounts. In contrast, banks are typically for-profit institutions owned by shareholders. While they may offer a broader range of services, their emphasis on profit can often lead to higher fees and less favorable interest rates for consumers.

Both entities provide essential financial services,but their operational models differ significantly. Here are some key aspects to consider:

- Ownership: Members own credit unions; shareholders own banks.

- Profit Motivation: Credit unions aim for member benefit; banks prioritize profit generation.

- Eligibility: Credit unions often have membership criteria; banks are generally open to everyone.

| Feature | Credit Unions | Banks |

|---|---|---|

| Ownership | Member-owned | Shareholder-owned |

| Profit Motivation | Not-for-profit | For-profit |

| Product Offerings | Limited, focused on member needs | Comprehensive, aim for market reach |

| Interest Rates | Typically lower | Variable, often higher |

Comparative Analysis of Services Offered by Credit Unions and Banks

When it comes to services offered, both credit unions and banks provide a range of essential financial products, but with distinct differences that cater to their unique customer bases. Credit unions tend to focus on personal relationships and member needs, frequently enough offering services like:

- Lower interest rates on loans

- Higher interest rates on savings accounts

- Limited fees for account maintenance

- Member-focused service, including financial education

Conversely, banks typically offer a broader array of services, which may appeal to a wider audience. Their service offerings can include:

- Extensive ATM and branch networks for customer convenience

- More advanced online and mobile banking features

- Specialized investment products and services

- Business accounts and corporate loans

| Feature | Credit Unions | banks |

|---|---|---|

| Interest Rates | Generally lower | Often higher |

| Fees | lower fees | Higher fees |

| Customer Service | Member-focused | Varies by institution |

| Product Range | Basic services | Comprehensive services |

Evaluating Financial Benefits and Fees: What You Need to Know

When choosing between credit unions and banks, understanding the financial benefits and fees associated with each is crucial for making an informed decision. Credit unions frequently enough offer lower fees, higher interest rates on savings, and more favorable loan terms due to their non-profit status. This structure allows them to pass on savings directly to their members,which distinguishes them from traditional banks that generally prioritize profit maximization. Some of the typical advantages you may find with credit unions include:

- Reduced Fees: Lower service fees for accounts and transactions.

- Higher Savings Rates: Competitive interest on savings accounts.

- Better Loan Rates: More favorable terms on personal loans and mortgages.

On the other hand, banks frequently offer a broader range of services and may have more advanced technology options, like online banking and mobile apps. Though, their fee structures can be heavier, including monthly service fees, ATM fees, and overdraft charges, which can add up over time. When evaluating the costs,it’s beneficial to compare the following:

| Feature | Credit Union | Bank |

|---|---|---|

| Membership Fees | Frequently enough minimal or waived | Varies by institution |

| Monthly Maintenance Fees | Usually low or none | Can be high |

| ATM Access | Local networks,fewer fees | Widespread access,often with fees |

Choosing the Right Financial Institution for Your Needs

When selecting a financial institution,it’s crucial to evaluate how each option aligns with your personal financial goals and lifestyle. Credit unions often stand out for their member-centric approach, typically offering lower fees and interest rates on loans compared to traditional banks. While banks are usually more established with greater access to diverse products and services, credit unions may offer a more personalized banking experience with community involvement. Consider these factors before making a choice:

- Membership requirements: Credit unions frequently enough require you to be part of a specific community or organization.

- Fee structures: Credit unions generally have fewer and lower fees.

- Interest rates: Credit unions tend to offer better rates on savings and loans.

- Access to branches and ATMs: Banks may provide wider access to physical locations and services.

- Technology and online banking: Evaluate the ease of digital access and tools offered by each option.

Another critically important aspect to consider is the range of services available. While credit unions focus on providing essential services such as savings accounts, checking accounts, and personal loans, banks typically offer a broader array of financial products, including mortgages, investment services, and wealth management. To illustrate this, here’s a swift comparison of typical offerings:

| Feature | Credit Unions | Banks |

|---|---|---|

| Membership Fees | Low or none | Varies by bank |

| Loan Rates | Competitive, frequently enough lower | Market rate |

| Investment Services | Limited | Extensive |

| Customer Service | Personalized | Standardized |

Closing Remarks

choosing between a credit union and a bank ultimately comes down to your personal financial needs and preferences. While both types of institutions offer a variety of services, they differ significantly in terms of ownership structure, service philosophy, and fee structures.Credit unions excel in community-oriented services and member satisfaction, often providing lower fees and competitive rates. On the other hand, banks offer a wider range of products and greater accessibility with their extensive branch networks.

As you weigh your options, consider what matters most to you—whether it’s personalized service, lower costs, or a diverse array of financial products. Educating yourself on the key differences outlined in this article will empower you to make an informed decision that aligns with your financial goals. Whichever path you choose, remember that both credit unions and banks have unique strengths that can support your financial journey.Happy banking!