When it comes to securing financing for a new home, a vehicle, or any significant purchase, understanding teh associated costs is crucial. Among these costs, loan origination fees often raise questions for borrowers. What exactly are thay? How are they calculated? and why do they matter? In this article, we’ll demystify loan origination fees, providing you with essential insights to help you navigate the lending landscape with confidence. Weather you’re a first-time borrower or a seasoned investor, understanding these fees can not only save you money but also empower you to make informed decisions when selecting the best loan options for your needs. Let’s dive into the details and empower your financial journey.

table of Contents

- Understanding Loan Origination Fees and Their Role in borrowing Costs

- Common Components of Loan Origination Fees Explained

- How to Negotiate Loan Origination Fees for Better Terms

- Evaluating the Impact of Loan Origination Fees on Your Overall Financial Strategy

- Future Outlook

Understanding loan Origination Fees and Their Role in Borrowing Costs

Loan origination fees are a key component of the upfront costs associated with borrowing money, significantly influencing the total expense of a loan. these fees, typically expressed as a percentage of the total loan amount, cover the lender’s costs to process the loan, including underwriting, readiness, and administrative expenses.Understanding these fees is crucial, as they can vary widely between lenders and loan types, making it essential for borrowers to do their research and compare offers. On average, origination fees may range from 0.5% to 1% of the loan amount, but some lenders may charge higher rates, especially for loans perceived as higher risk.

When assessing the impact of origination fees on your overall borrowing costs, it’s important to factor in several elements:

- Loan Amount: Higher loans will naturally incur larger fees.

- interest Rates: A loan with a lower interest rate may offset a high origination fee.

- Comparison Shopping: Always compare origination fees among different lenders to find the best deal.

To illustrate, here’s a simple comparison of the impact that different origination fees can have on a hypothetical loan of $200,000:

| Origination Fee (%) | Cost |

|---|---|

| 0.5% | $1,000 |

| 1.0% | $2,000 |

| 2.0% | $4,000 |

This clear breakdown helps potential borrowers grasp how origination fees can add to the cost of borrowing and why it’s prudent to seek the most favorable terms available.

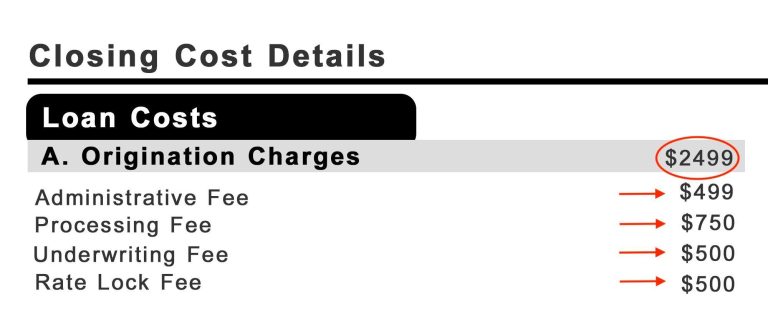

Common Components of Loan Origination Fees Explained

Understanding the components of loan origination fees is crucial for borrowers seeking transparency in their financing options. These fees can vary significantly depending on the lender, the type of loan, and your credit profile. Common components include:

- Request Fee: The initial fee charged to cover the lender’s costs in processing your loan application.

- underwriting Fee: This fee compensates the lender for evaluating your financial information and assessing your risk as a borrower.

- Processing fee: A charge for the administrative work required to prepare your loan for closing.

- Credit Report Fee: A fee that covers the cost of obtaining your credit history to evaluate your creditworthiness.

Some lenders may bundle these fees into the overall loan origination fee, while others itemize them, making it easier for borrowers to see where their money is going.To illustrate the typical makeup of a loan origination fee, the table below provides a simple breakdown of how fees can add up:

| Fee Type | typical Amount |

|---|---|

| Application Fee | $300 |

| Underwriting Fee | $400 |

| Processing Fee | $500 |

| Credit Report Fee | $50 |

| Total Origination Fees | $1,300 |

How to Negotiate Loan Origination Fees for Better Terms

Negotiating loan origination fees can significantly impact the overall cost of your loan. Start by doing thorough research on standard fee ranges in your area, as this knowledge will empower you during discussions. When engaging with lenders, consider the following strategies to advocate for better terms:

- know Your Credit Score: A higher score could position you favorably for lower fees.

- Shop Around: Don’t settle for the first offer; approach multiple lenders for comparisons.

- Leverage Competing Offers: Use quotes from different lenders as a bargaining tool.

- Ask for a Breakdown: Requesting a detailed fee sheet can help identify areas for negotiation.

When discussing fees with your lender, be mindful of other components in your loan that may affect your negotiation stance. Here’s a simple table outline to help you track potential costs and benefits:

| Lender | Origination Fee | Interest Rate | Potential Savings |

|---|---|---|---|

| Lender A | $2,000 | 3.5% | $5,000 |

| Lender B | $1,500 | 3.75% | $3,500 |

| Lender C | $1,800 | 3.6% | $4,000 |

By assessing various offers in terms of their origination fees and potential savings, you can better position yourself when negotiating with your preferred lender. A solid understanding of these elements can ultimately lead to more favorable loan terms, putting you in a stronger financial position.

Evaluating the Impact of Loan Origination Fees on Your Overall Financial Strategy

When assessing your financial landscape, loan origination fees can play a pivotal role in determining the overall cost of borrowing. While these fees are often a small percentage of the loan amount, their cumulative effect on your financial strategy can be significant. By factoring in these expenses from the outset, you can gain a clearer picture of your total loan costs and make informed decisions about whether to proceed with a particular lender or loan product. To evaluate their impact effectively, consider the following:

- Comparison Shopping: Look at different lenders and their origination fees to find the best deal.

- loan Duration: Longer loans may allow you to spread out origination fees, influencing monthly payments.

- Budgeting: Integrate these fees into your overall budget to ensure you remain financially stable.

It’s also beneficial to quantify how origination fees affect your long-term financial goals. Creating a simple table to visualize these costs alongside your projected loan payments can help clarify their significance. For example, evaluating how these fees stack up against your potential savings from a lower interest rate can guide you in determining the best loan choice for your specific needs.

| Loan Amount | Origination Fee (%) | Total Fee | Monthly Payment Impact |

|---|---|---|---|

| $100,000 | 1% | $1,000 | $5.00 |

| $200,000 | 1.5% | $3,000 | $15.00 |

| $150,000 | 2% | $3,000 | $15.00 |

Understanding these details allows you to see beyond the initial sticker price of a loan.By appraising how these fees fit into your broader financial picture, you can strategize more effectively, ensuring that every dollar spent is an investment in your future financial health.

Future Outlook

understanding loan origination fees is crucial for anyone navigating the lending landscape. By breaking down these costs, you empower yourself to make informed financial decisions that can save you money and prevent any unpleasant surprises down the line. Always remember to scrutinize the fee structures presented to you and don’t hesitate to ask lenders for clarification or negotiate terms that better suit your needs. With this knowledge in hand,you’re one step closer to securing the best loan for your financial goals. We hope this guide has provided you with valuable insights, and we encourage you to keep exploring your options in the world of finance. Your future self will thank you!