In today’s financial landscape, a strong credit score is more than just a number; it’s a gateway to better interest rates, improved loan options, and greater financial versatility. For many, credit cards serve as both a valuable tool and a potential pitfall when it comes to managing debt and building credit. If you’ve ever wondered how to navigate the complexities of credit card usage to elevate your credit score,you’re not alone. In this article,we’ll delve into smart strategies that not only help you maximize the benefits of your credit cards but also ensure your credit score rises steadily over time. Whether you’re new to credit cards or looking to enhance your existing practices, thes actionable tips will empower you to take control of your financial future with confidence. Let’s embark on the journey to a healthier credit score together!

Table of Contents

- Understanding Credit Scores and Their Impact on Financial Health

- Maximizing Credit Utilization for Optimal Score Improvement

- Timely Payments: The Key to a Strong Credit history

- Strategically Managing Credit Inquiries and new Accounts

- To Conclude

Understanding Credit Scores and Their Impact on Financial Health

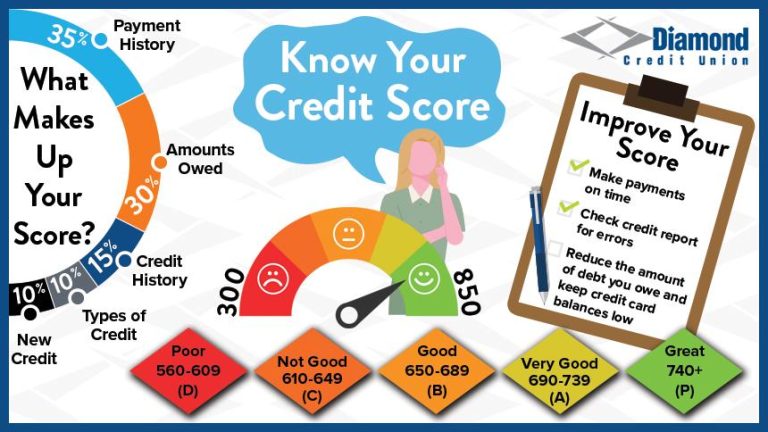

Your credit score is more than just a number; it’s a crucial indicator of your financial health that can influence many aspects of your life. When your credit score is high, you may qualify for lower interest rates on loans or enjoy better terms on credit cards, which saves you money over time. Conversely, a low credit score can lead to higher borrowing costs and may even prevent you from securing loans or renting a home. understanding how credit scores work and what affects them is essential to take control of your financial future. Factors impacting your score include:

- Payment History: Consistently making payments on time boosts your score.

- Credit Utilization: Keeping your credit card balances low relative to your limits is favorable.

- Length of Credit History: A longer history can positively affect your score.

- Types of Credit: A mix of credit accounts, such as credit cards and loans, can enhance your score.

- New Credit Inquiries: Too many inquiries in a short time can signal risk.

By implementing smart credit card strategies, you can improve your credit score significantly. One effective approach is to automate your payments to ensure they are never missed.Another tip is to use your cards lightly and pay off the balance in full each month,as this demonstrates responsible credit use. Additionally, reviewing your credit reports regularly allows you to catch errors that could negatively affect your score. Below is a fast reference table summarizing effective practices for maintaining a healthy credit score:

| Practice | Description |

|---|---|

| Automate payments | Avoid late payments by setting up auto-pay. |

| Pay Balances in Full | Reduce credit utilization and avoid interest charges. |

| Review Credit Reports | Check for and dispute any inaccuracies. |

| Limit New Credit Applications | Minimize hard inquiries to maintain a stable score. |

Maximizing Credit Utilization for Optimal Score Improvement

To enhance your credit score effectively, understanding and managing your credit utilization ratio is vital. This ratio represents the percentage of your available credit that you’re using, and it should ideally be kept below 30%. By doing so, you not only showcase responsible credit management to creditors but also reduce your risk of overwhelming debt. Here are some strategies to help you maximize this critically important factor:

- Pay off balances in full: Make it a habit to pay your credit card balances in full each month.

- Increase your credit limits: Consider requesting a credit limit increase on existing cards, which can lower your utilization ratio.

- Use multiple cards: Spread your purchases across different credit cards to keep individual utilization rates low.

- Monitor your spending: Regularly check your transactions to ensure you remain within your desired utilization percentage.

For a clearer viewpoint on the impact of credit utilization, you can use the following table:

| Available Credit | Current Balance | Credit Utilization Ratio |

|---|---|---|

| $1,000 | $250 | 25% |

| $2,000 | $900 | 45% |

| $5,000 | $300 | 6% |

By analyzing your utilization ratio regularly and adopting these best practices, you can work towards achieving a stronger credit score, paving the way for better financial opportunities in the future.

Timely Payments: The Key to a Strong Credit History

Maintaining a strong credit history is primarily about demonstrating reliability in your financial commitments, and timely payments are the cornerstone of this process. When you consistently pay your bills, especially credit card payments, by the due date, you signal to lenders that you are responsible and can be trusted with credit. This behaviour not only boosts your credit score but also enhances your credibility in future borrowing situations. An ideal payment history can lead to lower interest rates and better credit card offers, further multiplying your financial opportunities.

To ensure that you never miss a payment, consider these strategies:

- Set up automatic payments for at least the minimum amount due each month to avoid late fees.

- Utilize reminders via calendar apps or alerts on your phone to stay ahead of due dates.

- Budget effectively to allocate funds for credit card payments, ensuring that you always have sufficient resources available.

By implementing these tactics, you can safeguard your credit score and build a solid foundation for your financial future. Remember, establishing a habit of timeliness in payments not only reflects well on your credit history but also paves the way for meaningful savings and credit opportunities in the long run.

strategically Managing Credit Inquiries and New Accounts

To maintain a healthy credit score, it’s essential to be strategic about when and how you apply for new credit accounts. every time you request a new credit card, a hard inquiry is recorded on your credit report. While a single hard inquiry may only have a minimal impact, multiple inquiries within a short time frame can signal to lenders that you are a credit risk. To mitigate this, consider the following tips:

- Space Out Your Applications: Aim to apply for credit accounts only when necessary. Spacing out your applications can definitely help you avoid multiple inquiries that can hurt your score.

- research First: Use pre-qualification tools offered by financial institutions to gauge your chances of approval without triggering a hard inquiry.

- Limit New Accounts: Be cautious about how many new accounts you open within a given time. aim for no more than one or two new accounts per year.

In addition to managing credit inquiries, being strategic with new accounts is also crucial. Opening a new credit card can be beneficial if used wisely, as it can improve your credit utilization ratio and add to your credit history. though, it’s vital to consider the following:

| Factor | Impact on Credit Score |

|---|---|

| Credit Utilization Ratio | Lower utilization positively affects your score; aim for below 30%. |

| Average Account Age | Opening new accounts can lower the average age, potentially impacting your score negatively. |

| Diversity of Credit Types | Having a mix (credit card, installment loans) can benefit your score. |

By strategically managing inquiries and being selective with new accounts, you can create a balanced approach to building your credit health. This not only supports a better credit score but also positions you favorably for future credit needs.Remember, quality over quantity is key when it comes to credit management.

To Conclude

improving your credit score doesn’t have to be a daunting task. By implementing these smart tips for credit card use, you can take control of your financial health and pave the way for future opportunities. Remember, responsible credit management is a journey, not a sprint. Focus on timely payments,maintaining a low credit utilization rate,and regularly reviewing your credit report for any inaccuracies. With consistent effort and mindful habits, you can boost your credit score and open doors to better financing options, lower interest rates, and enhanced purchasing power.

So, embrace these strategies, stay informed about your credit, and watch as your financial future becomes brighter. If you have any experiences or tips of your own to share, feel free to leave a comment below. Let’s continue the conversation on building stronger financial foundations together!