In today’s dynamic financial landscape, the search for a reliable investment vehicle often leads to a wealth of options. Yet,one avenue stands out for its unique blend of accessibility,potential returns,and intrinsic diversification: Real Estate Investment Trusts (REITs). Designed for both seasoned investors and novices alike, reits offer a gateway to the real estate market without the burdensome responsibilities of property management. As we embark on this exploration of REITs, we will delve into their myriad advantages, highlighting how they can serve as a powerful tool for building wealth. Whether you’re looking to enhance your portfolio or simply curious about this fascinating investment strategy,understanding the benefits of REITs can unlock new opportunities for financial growth and stability. Join us as we uncover the compelling reasons to consider investing in REITs and how they can pave the way to a prosperous future.

Table of Contents

- Exploring the Fundamentals of Real Estate Investment Trusts

- Maximizing Returns: The Financial Benefits of Investing in REITs

- Diversification and Stability: How REITs Enhance your Investment Portfolio

- Strategic Considerations for Selecting the Right REITs for Your Needs

- Final Thoughts

Exploring the Fundamentals of Real Estate Investment Trusts

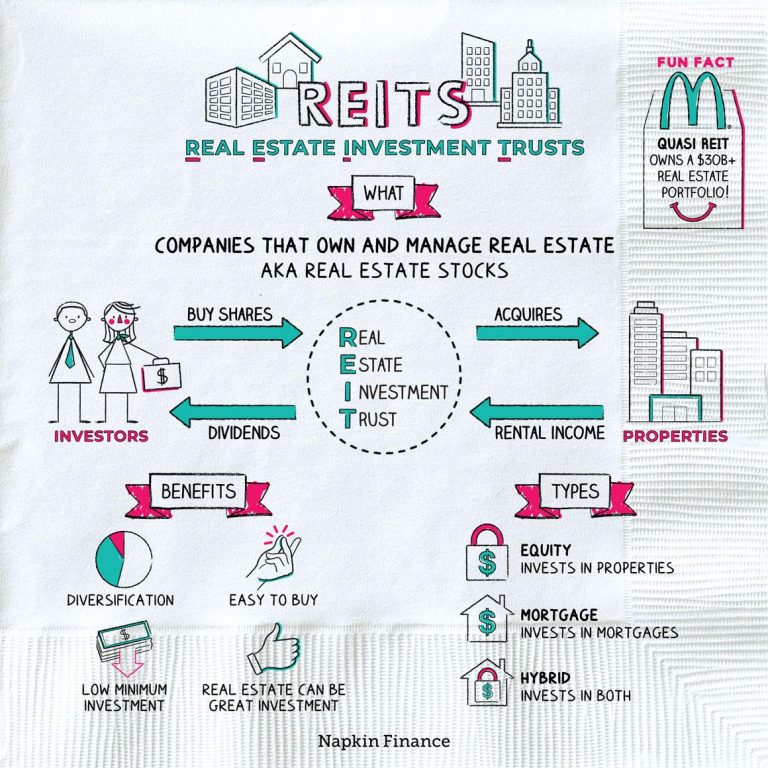

Real Estate Investment Trusts (REITs) are a unique way to invest in real estate without the need to directly buy,manage,or finance properties. Investors purchase shares in these publicly traded companies, which pool capital to acquire, manage, and develop income-generating real estate. One of the significant benefits of investing in REITs is the liquidity they offer. unlike customary real estate investments that can take years to yield returns, REITs can be bought and sold on stock exchanges, providing an efficient exit strategy.Additionally, moast REITs are required by law to distribute at least 90% of their taxable income as dividends, leading to potentially high yields for investors looking for regular income from their investments.

Another advantage is the increased diversification that REITs provide. by investing in a REIT, you gain exposure to a wide range of properties, whether they are retail complexes, office buildings, residential apartments, or healthcare facilities. This diversification helps mitigate risks as poor performance in one sector can be balanced by strong returns in another. Moreover, REITs frequently enough have professionals managing their portfolios, which means investors benefit from expert insights and strategic management that would typically be unavailable to individual property owners. Here’s a simple comparison of the key attributes of REITs versus direct real estate investment:

| Attribute | REITs | Direct Real Estate |

|---|---|---|

| Liquidity | High – Can be traded on stock exchanges | Low – Requires buyer/seller negotiation |

| Investment Minimum | Varied, often lower | Typically high, depending on property |

| Management | Professional management | Owner-managed or hired management |

| Income Distribution | Regular dividends | Variable, based on property income |

Maximizing Returns: The Financial Benefits of Investing in REITs

Investing in Real Estate Investment Trusts (REITs) offers a plethora of financial advantages that appeal to both seasoned investors and novices alike. One of the primary benefits is the potential for high dividend yields, often greater than traditional stocks. This consistent income stream stems from the legal requirement that REITs must distribute at least 90% of their taxable income to shareholders in the form of dividends. Consequently, investors can enjoy regular payouts while also benefiting from possible capital gratitude as the real estate market fluctuates. Moreover, REITs allow investors to diversify their portfolios without the complexities and responsibilities of property ownership, making them a hassle-free way to enter the real estate market.

In addition to steady income, REITs often provide liquidity and accessibility that direct real estate investments lack. As publicly traded REITs can be bought and sold on stock exchanges, investors can quickly adjust their holdings, offering adaptability in investment strategies. Moreover, reits encompass a variety of sectors, such as commercial, residential, and industrial real estate, enabling investors to gain exposure to multiple asset classes. Here’s a brief comparison of traditional real estate investments versus REITs:

| Aspect | Traditional Real Estate | REITs |

|---|---|---|

| Investment Minimum | High (cost of property) | Low (shares available for purchase) |

| Liquidity | Low (property sales can take time) | High (traded like stocks) |

| Income distribution | Variable (depends on property performance) | Consistent (dividend payouts) |

| Diversification Options | Limited (often single property) | Extensive (various sectors) |

Diversification and Stability: How REITs Enhance Your Investment Portfolio

Investing in Real Estate Investment Trusts (REITs) offers a unique opportunity to diversify your portfolio and enhance its overall stability. By allocating a portion of your investments to REITs, you gain exposure to the real estate market without the need to directly purchase properties. This not onyl allows for potential appreciation in asset value but also provides consistent income through dividends. The inherent structure of REITs means they are mandated to distribute at least 90% of their taxable income to shareholders, resulting in attractive yields. In addition,the variety of REIT sectors—such as residential,commercial,and industrial—means you can spread risk across multiple types of properties. This level of diversification can safeguard your portfolio against the volatility often seen in stocks and bonds.

Along with risk mitigation, REITs contribute to portfolio stability through their low correlation with traditional investments. The performance of real estate can often be independent of stock market fluctuations, creating a buffer during periods of economic uncertainty. By including reits in your investment strategy,you can benefit from the appreciation of underlying real assets,along with the potential for regular income. Here are a few key points on the stability REITs can bring:

- Regular Dividend Payments: Steady cash flow that can act as a safety net in turbulent times.

- Inflation Hedge: Real estate frequently enough appreciates in value with inflation, protecting your purchasing power.

- Liquidity: Publicly traded REITs offer the ability to buy and sell shares easily, providing flexibility and access to capital.

Strategic Considerations for Selecting the Right reits for Your Needs

Selecting the right Real Estate Investment Trusts (REITs) requires a careful evaluation of various factors tailored to your personal financial goals and risk tolerance. Start by assessing the type of REIT that aligns with your investment strategy. Different REITs focus on diverse sectors, such as residential, commercial, industrial, or healthcare properties. By understanding the nuances of each category,you can position your investment to benefit from trends that resonate with your financial aspirations. Additionally, consider the geographical focus, as REITs operating in growing or stable markets may present different levels of growth potential and risk exposure.

Another key consideration is the financial health of the REIT. Pay close attention to metrics such as funds from operations (FFO), dividend yield, and debt levels. A REIT with a consistent and lasting dividend payout may indicate solid management and robust cash flows, essential factors for long-term investors. Implementing a thorough analysis may involve reviewing the portfolio diversification of the REIT,which can mitigate risks associated with market downturns. Below is a simple table that summarizes these critical factors:

| Factor | Importance |

|---|---|

| Type of REIT | Align investment with sector trends |

| Geographical Focus | Assess regional market stability |

| Financial Health | Ensure sustainable dividends |

| Portfolio Diversification | Reduce risk exposure |

final Thoughts

As we conclude our exploration of the compelling world of Real Estate Investment Trusts (reits), it’s clear that these investment vehicles present a unique opportunity for both seasoned investors and newcomers alike. From their potential for passive income to the benefits of diversification and liquidity, REITs offer a pathway to wealth that is both accessible and advantageous.

By understanding the nuances and advantages of investing in REITs, you position yourself to capitalize on the potential of the real estate market without the complexities of directly owning property. Whether you’re looking to build a retirement nest egg or enhance your portfolio, incorporating REITs could be a strategic move towards unlocking your financial goals.

Remember, as with any investment, due diligence is paramount. Stay informed, evaluate your options, and consider consulting with a financial advisor to tailor your investment strategy to your personal goals. With the right approach, investing in REITs can indeed be a powerful tool in your wealth-building journey.

Thank you for joining us on this exploration of REITs. Here’s to making informed investment choices that lead to prosperous futures!