In a world where financial landscapes are constantly shifting, the importance of regularly reassessing your financial goals cannot be overstated. Whether you’re navigating the complexities of a career change, experiencing a life transition, or simply reevaluating your aspirations, a strategic approach to your finances can make all the difference. This guide aims to empower you wiht the tools and insights needed to critically analyze your current financial standing, align your goals with your evolving life circumstances, and develop a robust action plan tailored to your unique vision for the future. Join us as we delve into the strategies that can help you refine your objectives,optimize your resources,and ultimately set the stage for lasting financial success. It’s time to take control of your financial journey and ensure your goals reflect not just where you have been, but where you aspire to go.

Table of Contents

- Understanding the importance of Regular Financial Assessments

- Identifying and Prioritizing Your Financial Objectives

- Creating a Flexible financial plan for Changing Circumstances

- Implementing Tracking and Accountability Mechanisms for Success

- The Way Forward

Understanding the Importance of Regular Financial Assessments

Committing to regular financial assessments is crucial for maintaining control over your economic future. By routinely evaluating your financial situation, you can identify trends, make informed decisions, and adjust your strategies to align with your evolving goals. Consider the following key benefits of conducting these assessments:

- Identifying Financial Trends: Regular reviews help you spot patterns in your spending and saving, allowing you to make proactive adjustments.

- Enhancing Accountability: Setting a schedule for assessments keeps you accountable, ensuring that you’re consistently working towards your financial objectives.

- Adapting to Changes: Life events such as a job change, marriage, or having children affect financial priorities, and assessments allow you to pivot when necessary.

moreover, these evaluations offer a bird’s-eye view of your financial landscape, empowering you to make strategic decisions. For example, you might discover that reallocating funds from underperforming investments to high-potential assets could significantly boost your portfolio. A simple evaluation table can assist in visualizing your financial health:

| Assessment Element | Current Status | Recommended Action |

|---|---|---|

| Budget Adherence | Over Budget | Reduce discretionary spending |

| Investment growth | 5% annual return | Consider diversifying portfolio |

| Emergency Fund | 3 months’ expenses | Increase to 6 months’ expenses |

Identifying and Prioritizing Your Financial Objectives

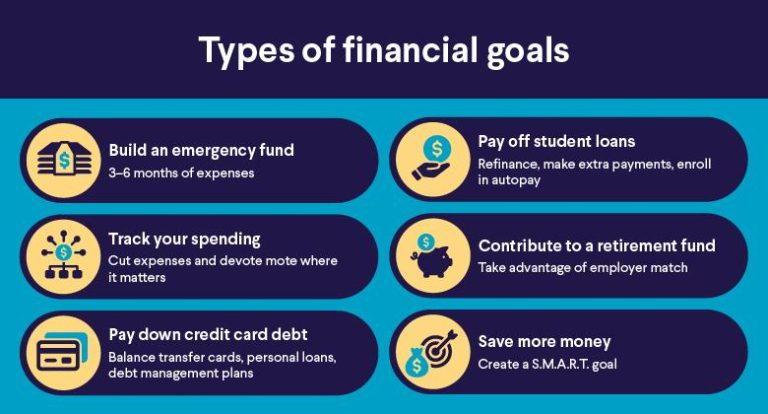

Understanding your financial objectives is crucial for crafting a roadmap that leads you to financial stability and success. Start by clearly defining what you want to achieve. consider the following key goals that could shape your financial landscape:

- Short-term Goals: Emergency fund, debt repayment, and savings for immediate needs.

- Medium-term Goals: Vacation savings, home purchase, or education funding.

- Long-term Goals: Retirement planning, investments, and estate planning.

Once you’ve identified these objectives, it’s vital to prioritize them based on urgency and importance. This involves evaluating timelines, resource availability, and potential impact on your overall financial health. A simple decision matrix can definitely help clarify your priorities:

| Goal | Timeframe | priority Level |

|---|---|---|

| Build Emergency Fund | 1 Year | High |

| Pay Off Credit Card Debt | 1-3 Years | High |

| save for Kids’ College | 5-10 Years | Medium |

| Retirement Savings | 20+ Years | Medium |

Creating a Flexible Financial Plan for Changing Circumstances

In today’s unpredictable financial landscape, the importance of adaptability in your financial plan cannot be overstated. A flexible financial plan is not just a safety net; it’s a proactive strategy that empowers you to navigate life’s inevitable changes. Start by identifying key aspects of your financial blueprint that may require regular reassessment,such as income stability,expenses,and savings goals. Consider incorporating the following elements into your plan:

- Emergency Fund: Ensure you have at least three to six months’ worth of living expenses set aside.

- Income Sources: Diversify your income streams to mitigate risks associated with job loss or reduced hours.

- Investment Adjustments: Be willing to reallocate investments based on market conditions and personal circumstances.

Monitoring these components regularly allows you to pivot when needed, ensuring your financial goals remain realistic and attainable. Additionally, consider establishing milestones to track your progress. One way to visualize this is by creating a simple table that outlines your goals and the timeline for achieving them:

| Financial Goal | Target Date | Status |

|---|---|---|

| Fully Fund Emergency Fund | Dec 2024 | In Progress |

| Raise Investment Contributions | June 2023 | Completed |

| Pay Off Credit Card Debt | Mar 2025 | Not Started |

By revisiting your financial goals and adjusting your strategies to account for changes in your circumstances, you solidify your financial foundation and enhance your ability to withstand challenges.

Implementing Tracking and Accountability Mechanisms for Success

Establishing effective tracking and accountability mechanisms is crucial for turning your financial goals into achievable outcomes. Regular reviews of your financial progress should be scheduled, allowing you to assess whether you’re on track or need to adjust your strategies. Consider using tools such as budgeting apps and financial dashboards to visualize your progress. By setting measurable milestones, you can clearly see how far you’ve come and maintain motivation. Additionally, creating a financial journal can help you keep a written record of your thoughts, setbacks, and achievements, offering valuable insights for future adjustments.

To foster accountability, enlist a financial accountability partner who shares similar goals or interests. This partnership can provide motivation and constructive feedback, as you both work towards your targets. Utilize a tracking sheet where each of you can log and share your progress regularly. Below is an illustrative example of a simple check-in framework:

| Check-In Date | Your Progress | Partner’s Progress | Next Steps |

|---|---|---|---|

| Week 1 | saved $200 | Saved $150 | Review budget for adjustments |

| Week 2 | Invested $100 | Invested $50 | Discuss investment options |

The Way Forward

reassessing your financial goals is not just a periodic necessity but a strategic imperative that can significantly enhance your financial well-being and future security. By taking the time to reflect on your current situation, align your goals with your evolving aspirations, and develop a clear action plan, you empower yourself to navigate life’s uncertainties with confidence.

Consider this an ongoing journey—one that requires adaptability and awareness as your circumstances change. Whether it’s planning for retirement, saving for a new home, or investing in your education, regularly revisiting your financial objectives can provide you with clarity and motivation.

As you embark on this strategic reassessment, remember that the tools and resources available to you are plentiful. Utilize budgeting apps, consult with financial advisors, and engage in community discussions to enrich your understanding and expand your options. The more informed you are, the more adept you’ll become at steering your financial future towards success.

Thank you for joining us in exploring this essential topic.Here’s to your financial clarity, growth, and the achievement of your goals. Don’t hesitate to share your thoughts or experiences in the comments below; we’d love to hear about your journey!