Traveling offers a wealth of experiences, from breathtaking sights to cultural encounters, but maintaining control over your finances while on the road can frequently enough be daunting. As wanderlust takes hold, it’s easy to lose track of expenses, but a well-thought-out financial plan can enhance your journey and provide peace of mind. In this article, we will explore practical tips and smart strategies for managing your money while traveling. Whether you’re a seasoned globetrotter or embarking on your first adventure, these insights will help you budget effectively, avoid common pitfalls, and make the most of your travel funds, ensuring that your journey is as memorable financially as it is indeed culturally enriching.Join us as we dive into the essentials of financial wellness on the go!

Table of Contents

- Essential Pre-Travel Financial Planning for a Stress-Free Journey

- Maximizing Your Budget: Tips for Saving While Abroad

- Navigating Currency Exchange: Best Practices for Travelers

- Staying Secure: Protecting Your Money and Personal Information on the Road

- The Conclusion

Essential Pre-Travel Financial Planning for a Stress-Free Journey

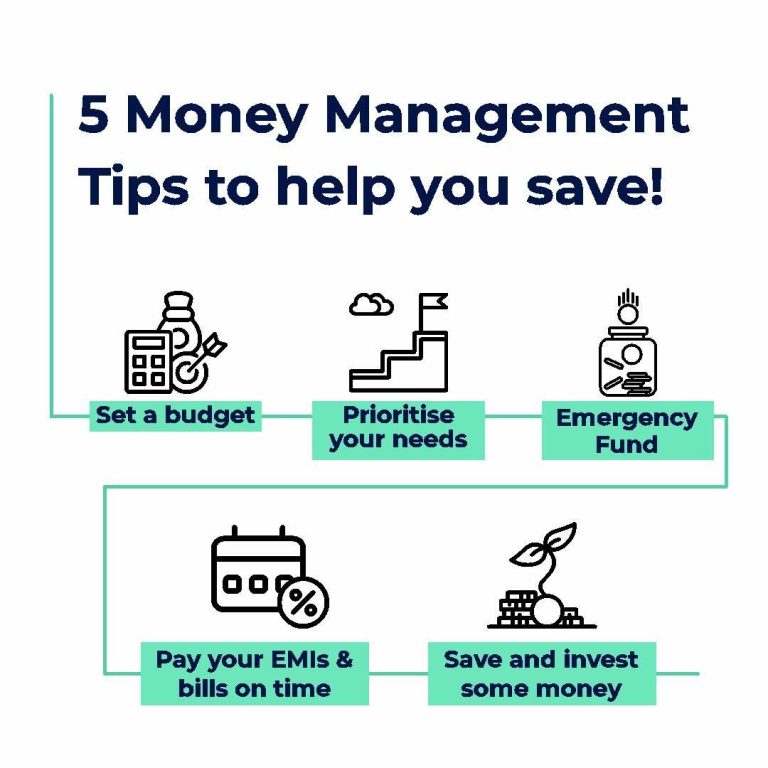

Before embarking on any journey, it’s crucial to ensure your finances are in order to avoid potential pitfalls. Start by establishing a clear budget that considers all aspects of your trip, including accommodations, transportation, food, activities, and emergency funds. Use budgeting apps to track your spending in real-time, ensuring that you remain within your limits. Consider creating a dedicated travel fund that you can contribute to regularly, allowing you to save for future adventures without impacting your day-to-day finances.

It’s also wise to familiarize yourself with the currency and exchange rates of your destination.Understanding these elements can prevent you from falling victim to unfavorable exchange rates and hidden fees. To make transactions easier, utilize travel-pleasant financial tools such as multi-currency accounts or prepaid travel cards. These often come with lower fees and better rates than using standard bank cards overseas. additionally, keep an accessible list of your vital financial contacts, including bank representatives and credit card issuers, ensuring you can quickly resolve any issues that may arise during your travels.

Maximizing Your Budget: Tips for Saving While Abroad

When it comes to traveling, every cent counts. To make the most of your funds while abroad, consider utilizing public transportation instead of taxis. Buses, trams, and local trains often provide an authentic experience, allowing you to explore like a local. Additionally, look for discount passes that offer unlimited travel for a set number of days, saving you both time and money. Don’t forget to download public transport apps that can help you navigate unfamiliar routes without stress.

Eating like a local is another way to stretch your budget. Seek out street food stalls and neighborhood cafés where you can enjoy authentic dishes at a fraction of the cost of tourist traps. Use local markets to stock up on fresh snacks like fruits and nuts, which can keep you energized while sightseeing. For a unique dining experience, consider cooking your own meals occasionally; many hostels and vacation rentals come equipped with kitchen facilities that allow you to whip up something delicious using local ingredients.

navigating currency Exchange: Best Practices for Travelers

When traveling abroad, one of the most crucial aspects to consider is how you manage your currency exchange. Researching exchange rates before your trip can help you identify the best times to convert your money. Using local ATMs can also be a more favorable option, as they typically offer better rates compared to currency exchange kiosks. However, be mindful of potential fees—both from your home bank and the ATM provider. Carry a mixture of cash and cards for versatility; some places may not accept cards,particularly in rural areas.

Another important strategy is to keep an eye on the fees associated with your currency activities.Here are a few best practices to help you minimize costs and maximize your efficiency while exchanging currency:

- Use credit cards that avoid foreign transaction fees.

- Don’t exchange money at airports unless absolutely necessary.

- Compare multiple sources for currency exchange rates.

- Avoid dynamic currency conversion, which can be costlier.

| Exchange Method | Pros | Cons |

|---|---|---|

| ATM withdrawal | Better exchange rates | Possible fees charged |

| Currency exchange office | Convenient locations | Higher exchange rates |

| Credit card purchases | Safe and easy | Can incur foreign transaction fees |

Staying Secure: Protecting Your Money and Personal Information on the Road

When you’re navigating new cities and cultures, it’s essential to prioritize the safety of your finances and personal information. Start by limiting the amount of cash you carry; rather, rely on secure digital payment options such as mobile wallets or credit cards with no foreign transaction fees. Consider using a money belt or hidden pouch to store essential items like your passport and extra cash. It’s also a good idea to keep copies of important documents on your phone or in your email for swift access in case of loss or theft.

Additionally, staying connected while traveling can pose security risks. Use a virtual private network (VPN) when accessing public Wi-Fi networks, as these connections can be vulnerable to hackers. Be cautious about sharing personal information online and avoid logging into sensitive accounts in unfamiliar locations. Here are some tips to enhance your security:

- Monitor your accounts: Regularly check for unauthorized transactions.

- Use strong passwords: Ensure all your accounts have unique, strong passwords.

- Enable two-factor authentication: Add an extra layer of protection to your online accounts.

- Notify your bank: Inform them of your travel plans to prevent unusual activity flags.

The conclusion

managing your finances while traveling doesn’t have to be a daunting task. By employing these smart strategies, you can ensure that you make the most of your adventures without the stress of overspending or financial mishaps. From planning and budgeting to taking advantage of local currency options and mobile apps, being proactive about your money will allow you to focus on what truly matters: enjoying your journey.

remember, traveling is an investment in your experiences, and with the right financial strategies in place, you can savor every moment without the weight of monetary concerns. So pack your bags, keep these tips in mind, and embark on a journey filled with exploration and discovery, secure in the knowledge that your finances are well-managed. happy travels!