As you transition into retirement, the excitement of newfound freedom and leisure is often accompanied by an importent question: How will you sustain your lifestyle for the years to come? Crafting a smart retirement withdrawal plan is a crucial step in ensuring financial security during this life stage. With careful planning, you can maximize your savings, minimize taxes, and maintain your purchasing power, all while enjoying the retirement you’ve earned. in this article, we will explore the essential elements of an effective withdrawal strategy, highlighting key considerations and practical tips to help you navigate the complexities of managing your retirement funds. Whether you’re just beginning to think about retirement or are already enjoying the benefits, understanding the intricacies of withdrawal planning can make all the difference in achieving your long-term financial goals. Let’s delve into the strategies that will empower you to master your finances and enjoy a fulfilling retirement.

Table of Contents

- Understanding the Importance of a Strategic Withdrawal Plan

- Essential Factors to consider for retirement Income Planning

- Diversifying Income Sources: Maximizing Your Financial Stability

- Practical Steps to Create and Adjust Your Withdrawal Strategy

- Concluding Remarks

Understanding the Importance of a Strategic Withdrawal Plan

Having a strategic withdrawal plan is crucial for maintaining financial stability throughout retirement. It allows retirees to navigate their unique financial landscape, ensuring that their income lasts as long as they need it. The absence of a clear withdrawal strategy can lead to several pitfalls, such as withdrawing too much too soon, which risks depleting savings prematurely. A well-structured plan takes into account various factors, including life expectancy, expected expenses, and market fluctuations. By carefully planning their withdrawals,retirees can enjoy their golden years without the constant worry of financial insecurity.

The benefits of a strategic withdrawal plan extend beyond mere financial peace of mind.It empowers individuals to maximize their retirement savings and minimize tax liabilities. Consider the following key elements that should be woven into any sound withdrawal strategy:

- Tax Efficiency: Understanding how diffrent accounts are taxed can dramatically affect your overall retirement income.

- market Conditions: A good plan adapts to market volatility, ensuring that withdrawals do not come from accounts that are temporarily down.

- Spending Needs: Adjusting withdrawals based on annual spending can prevent unnecessary depletion of funds.

By addressing these crucial areas, retirees can create a resilient withdrawal plan that provides both financial security and versatility throughout their retirement years.

Essential Factors to Consider for Retirement Income Planning

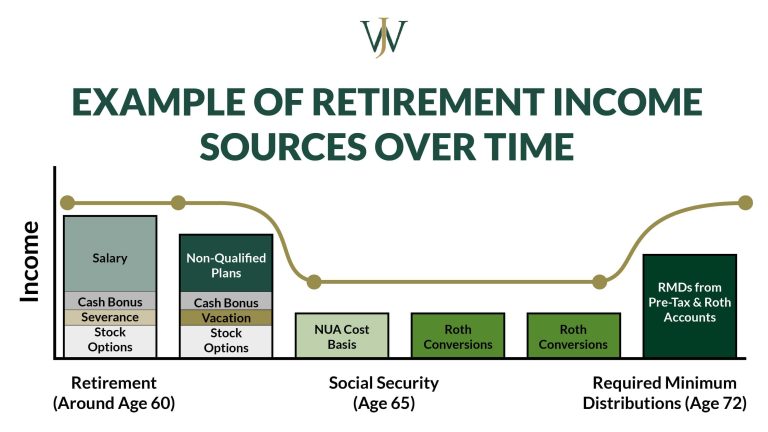

When planning for retirement income, it’s crucial to assess your diversity of income sources. This includes not just your savings and investments, but also considerations like Social Security, pensions, and any potential part-time work. Each source has its own considerations regarding taxes and withdrawal strategies, which influence how long your funds will last.To maximize your income, evaluate how each element can work together in harmony, ensuring a balance that reflects your lifestyle needs and goals. The more robust your income plan, the less you’ll need to rely solely on one source, reducing risk and enhancing financial security.

Another key component to take into account is your spending strategy throughout retirement. As you age,your healthcare and living expenses can fluctuate significantly. it’s wise to project your expenses accurately by categorizing them into essential and discretionary spending. This distinction will help tailor your withdrawal plan to align with realities that may change over time. Consider utilizing a structured withdrawal strategy,such as the 4% rule or a bucket strategy,to create a systematic approach to accessing funds that accommodates your needs while maintaining sustainability.

| Income Source | notes |

|---|---|

| Social Security | Consider optimal claiming age. |

| Pensions | Evaluate options for lump-sum vs. annuity. |

| Investments | Focus on asset allocation and withdrawal timing. |

| Part-time work | Add flexibility to income and engagement. |

Diversifying Income Sources: maximizing Your Financial Stability

diversifying your income sources is a crucial strategy for enhancing your financial stability, especially as you approach retirement. Relying solely on one source of income can leave you vulnerable to unforeseen changes, such as market fluctuations or economic downturns. By exploring a range of income-generating options, you can build a more resilient financial future.consider integrating the following avenues into your retirement planning:

- Investing in Dividend Stocks: Regular payouts can supplement your retirement income.

- Real Estate Ventures: rental properties can provide consistent monthly cash flow.

- Peer-to-peer Lending: This option investment can yield higher returns compared to conventional savings.

- Starting a Side Business: Turn hobbies or passions into a profitable venture to boost income.

- Advanced Retirement Accounts: Utilize accounts that offer tax advantages and growth potential to secure your savings.

It’s critically important to analyze how each income source aligns with your risk tolerance and overall financial goals. Additionally,creating a comprehensive withdrawal strategy that considers the timing and taxation of funds can further optimize your income. Below is a simple overview of potential withdrawal timing and tax implications:

| withdrawal Source | Ideal Timing | Tax Implication |

|---|---|---|

| Traditional IRA | 65+ years old | Ordinary income tax |

| Roth IRA | Any time after 59.5 years | No tax if conditions met |

| Taxable Accounts | As needed | Capital gains tax on earnings |

Practical Steps to Create and Adjust Your Withdrawal Strategy

As you approach retirement, creating a sustainable withdrawal strategy is essential for maintaining your financial independence. Start by evaluating your expected expenses,lifestyle choices,and income sources. Establish a comprehensive budget that includes essential costs such as housing, healthcare, and living expenses, as well as discretionary spending. Identify the key accounts you will withdraw from, such as tax-deferred retirement accounts (like 401(k) plans), taxable brokerage accounts, and tax-free accounts (like Roth IRAs). This assessment will help you plan your withdrawals based on your tax situation and optimize your income streams.

Once your initial strategy is in place, it’s crucial to stay flexible and adjust as life circumstances change. Monitor your investment performance regularly, specifically focusing on your asset allocation and market conditions. Revisit your budget annually or whenever significant life changes occur (such as relocation, health issues, or the birth of a grandchild).here are some practical tips for adjustments:

- Rebalance your portfolio to ensure it aligns with your risk tolerance and withdrawal needs.

- Consider a flexible withdrawal rate that varies based on market performance, using a guideline like the 4% rule with room for adjustments.

- Evaluate tax implications of withdrawals annually to minimize tax burdens while maximizing your take-home income.

By remaining proactive and adaptive, you can effectively navigate the complexities of retirement withdrawals and secure your financial future.

Concluding Remarks

As we’ve explored throughout this article, crafting a smart retirement withdrawal plan is an essential step in ensuring your financial stability and peace of mind during your golden years. By understanding the interplay between your income sources,taxes,and longevity risks,you can tailor a strategy that not only sustains your lifestyle but also preserves your wealth for future generations.

Remember, retirement isn’t just a destination; it’s a journey that evolves as your needs and circumstances change. Regularly revisiting and adjusting your withdrawal strategy will keep you on track to meet your goals and adapt to any shifts in your financial landscape.

If you haven’t started planning yet, there’s no better time than now to take control of your financial future. Whether you choose to manage your finances yourself or seek assistance from a professional, being proactive and informed will empower you to make the best decisions for your retirement.

Thank you for joining us on this exploration of financial strategies.We hope you found the insights valuable and that you feel inspired to take charge of your retirement planning. Here’s to a secure and fulfilling retirement ahead!