In today’s fast-paced world, mastering financial management is more crucial than ever. Whether you’re striving to pay off debt, save for a dream vacation, or simply build a more secure financial future, understanding the art of budgeting and saving is your first step toward success. For many, navigating the complexities of personal finance can feel overwhelming—where to start, what to track, and how to stick to your goals.In this article, we’ll break down essential budgeting and saving tips that can empower you to take control of your finances. With practical strategies and proven techniques, you’ll learn how to create a budget that works for you, set realistic savings targets, and establish habits that promote long-term financial wellness. Embrace this journey towards financial success and unlock the potential to achieve your monetary aspirations. let’s dive in!

Table of Contents

- Understanding Your Financial Landscape

- Crafting a Realistic Budget Plan

- Effective Saving Strategies for Long-Term Goals

- Identifying and Managing Unnecessary Expenses

- To Conclude

Understanding Your Financial Landscape

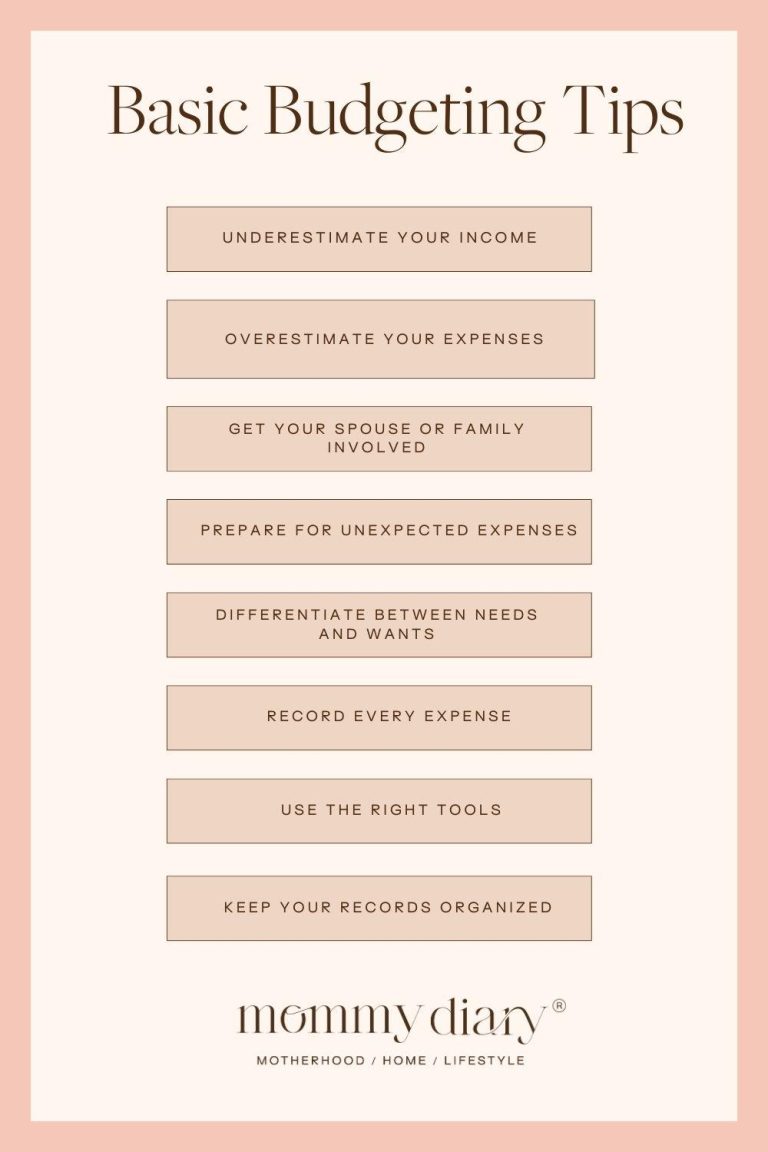

Gaining clarity on your financial situation is crucial for making informed decisions. Start by evaluating your income and expenses. create a detailed list of all sources of income, including salary, freelance work, and any passive income. Next, categorize your expenses into fixed and variable. Understanding these components will enable you to identify patterns,pinpoint areas of overspending,and find opportunities for savings.

As you analyze your finances, consider using tools such as budgeting apps and spreadsheets to keep track of your spending habits. Regular monitoring will help you to maintain discipline and stay on course with your financial goals. Here are some effective strategies:

- establish a monthly budget: Allocate funds for essentials, savings, and discretionary spending.

- Prioritize your needs: Separate wants from needs to manage your resources effectively.

- Set saving goals: Aim for specific amounts to save each month, gradually building your emergency fund.

Crafting a Realistic Budget Plan

Creating a budget is more than just a financial exercise—its a roadmap that guides your spending choices and savings goals. To craft a realistic budget plan, start by identifying your monthly income and categorizing your essential expenses. Here are some common categories you might consider:

- Housing: Rent or mortgage payments, utilities

- Transportation: Fuel, public transit, maintenance

- Food: Groceries, dining out

- Insurance: Health, car, property

- Entertainment: Subscriptions, hobbies

Once you have your categories and estimate costs, ensure you account for periodic expenses by incorporating them into your monthly budget. This means setting aside savings for expenses that occur annually or bi-annually, such as car registration or insurance premiums. To visualize your budget comprehensively, you may choose to organize it in a simple table:

| Category | Estimated Monthly Cost |

|---|---|

| Housing | $1,200 |

| Transportation | $300 |

| Food | $500 |

| Insurance | $200 |

| Entertainment | $150 |

| Total | $2,600 |

By regularly reviewing and adjusting your budget as your financial situation changes, you can stay on track towards your savings goals. Remember to build in some versatility for unexpected expenses, ensuring that your budget is realistic and sustainable in the long run.

Effective Saving Strategies for Long-Term Goals

Long-term financial goals require a strategic approach to saving, ensuring you not only reach your targets but also build a strong foundation for your future. Start by establishing a clear vision of what you want to achieve—be it retirement, a home purchase, or educational expenses. This clarity will guide your saving efforts. Set specific milestones within your larger goals, and make use of automated savings tools that transfer funds into dedicated accounts regularly. This can be facilitated through:

- High-yield savings accounts: They offer better interest rates compared to traditional accounts.

- Certificates of Deposit (CDs): Great for locking away funds for a fixed period while earning interest.

- Retirement accounts: Contributing to 401(k)s or IRAs can be tax-advantaged and helps build long-term wealth.

Implementing a budget is essential for recognizing where your money goes and identifying opportunities for savings.Evaluating your monthly expenses can definitely help isolate discretionary spending that can be reduced. Create a simple table to track your income and expenses, which will provide clarity on savings potential:

| Category | Estimated Monthly cost | Actual Monthly Cost | Difference |

|---|---|---|---|

| Housing | $1,200 | $1,200 | $0 |

| Utilities | $300 | $350 | -$50 |

| Groceries | $400 | $350 | +$50 |

| Entertainment | $150 | $200 | -$50 |

| Total | $2,300 | $2,300 | $0 |

By analyzing discrepancies between your estimated and actual spending, you can develop a more disciplined approach to budgeting that supports your long-term savings objectives. Ultimately, the goal is to create a robust saving habit that, coupled with smart investments, will lead you toward financial freedom.

Identifying and Managing Unnecessary Expenses

Keeping a tight rein on your finances frequently enough means scrutinizing your spending habits to uncover areas where you might be overspending. Start by reviewing your recent bank statements or using budgeting apps to track your expenses. Look for subscriptions, dining out, or impulse purchases that don’t align with your priorities. Here are some common unnecessary expenses to consider:

- Unused Subscriptions: Evaluate monthly charges for platforms or services you no longer use.

- Dining Out: Compare the cost of restaurant meals to home-cooked alternatives.

- Upgraded Services: Assess whether you genuinely need premium features from your providers.

Once you’ve identified unnecessary expenses,it’s time to take action. Begin by creating a prioritized list of your expenditures and set a goal to reduce them by a specific percentage, such as 10%-20% each month.Consider using a simple table to track your progress:

| Expense Category | Current Spending | Target Spending | Savings Potential |

|---|---|---|---|

| Dining Out | $300 | $240 | $60 |

| Subscriptions | $100 | $80 | $20 |

| Entertainment | $150 | $120 | $30 |

By keeping this table updated, you can visualize your savings over time and stay motivated to maintain financial discipline. Ultimately, what you learn from managing unnecessary expenses will empower you not only to save money but also to invest in what truly matters to you.

To Conclude

As we conclude our exploration of essential budgeting and saving tips for financial success, it’s meaningful to remember that achieving your financial goals is a journey that requires patience, commitment, and continuous learning. By implementing the strategies discussed, from creating a realistic budget to setting aside savings for emergencies and future investments, you can cultivate a more secure financial future.Don’t forget that every small step towards better budgeting and saving can lead to significant progress over time. Whether you’re just starting out or looking to refine your existing practices, take the time to evaluate your financial situation and adjust your strategies as necessary.

Remember, financial success is not solely about how much you earn, but also how wisely you manage your resources. So, take control of your finances today, and watch as your dedicated efforts pay off in the long run. Here’s to your financial empowerment and a prosperous future ahead! If you have any questions or need further advice,feel free to reach out or leave a comment below. Happy budgeting!