In today’s fast-paced financial landscape,credit cards have transformed from mere convenience tools into powerful financial instruments that can help savvy consumers save money and build wealth. Though, the key to maximizing their benefits lies in understanding credit card utilization—how you leverage your available credit to enhance your financial health without falling into the traps of debt. In this article, we will explore smart strategies that empower you to effectively manage your credit card usage, reduce interest payments, and ultimately save money. Whether you’re a seasoned credit card user or just starting your financial journey, these insights will equip you with the knowledge to navigate credit responsibly and make every purchase count toward your savings goals. Let’s dive into the world of credit card utilization and discover the strategies that can work for you!

Table of Contents

- Understanding Credit Utilization Ratios for Financial Health

- Maximizing Rewards Programs: Tips for Savvy Spending

- Avoiding Common Pitfalls: Mistakes to Sidestep with Credit Cards

- Creating a Budget-Friendly Credit Card Strategy for Long-Term Savings

- The Conclusion

Understanding Credit Utilization Ratios for Financial Health

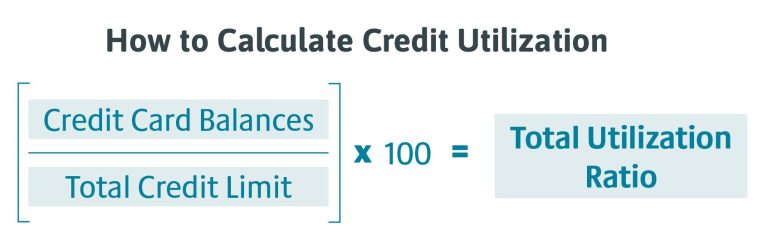

To maintain a healthy credit score, it’s essential to grasp the concept of credit utilization ratios. This metric represents the percentage of your total available credit that you are currently using. A lower ratio indicates a more responsible use of credit, which is favorable in the eyes of lenders.Experts typically recommend keeping your utilization below 30% of your total credit limit, as this threshold can significantly impact your credit score. Managing this ratio effectively can not only enhance your creditworthiness but also ensure you have access to better financing options.

Adjusting your credit utilization can be as simple as implementing a few smart strategies. Here are some effective tactics to consider:

- Pay Down Balances: Regularly pay off your credit card balances to lower your utilization ratio.

- Increase Credit Limits: Requesting higher limits can reduce your utilization percentage without changing your spending habits.

- Spread Your Charges: Distributing your expenses across multiple cards can help keep each card’s utilization low.

Consider the following table as a guideline to understand how different utilization levels can affect your finances:

| Credit Limit | Current Balance | Utilization Ratio |

|---|---|---|

| $1,000 | $300 | 30% |

| $2,500 | $500 | 20% |

| $5,000 | $1,000 | 20% |

| $10,000 | $3,500 | 35% |

By actively managing your credit utilization, you not only safeguard your financial health but also position yourself for future borrowing opportunities. Even small adjustments can lead to significant improvements in your credit score,making it essential to keep an eye on how much credit you’re using compared to what you have available.

Maximizing Rewards Programs: Tips for Savvy Spending

To truly make the most of your rewards programs, understanding how to align your spending with your rewards categories is essential. Start by identifying which categories offer the highest return on your purchases. For example, many credit cards provide elevated rewards for grocery shopping, gas, or online purchases. Here’s how to optimize your spending strategy:

- Review your monthly expenses: Take a close look at where your money goes each month and see how you can categorize those purchases to benefit from higher rewards.

- Utilize category-based promotions: Many credit cards have rotating categories that offer extra points; be sure to activate these offers when they are available.

- Combine rewards programs: some retailers allow you to stack rewards with credit card points, maximizing the benefits on every purchase.

Additionally, consider keeping track of your points and knowing the redemption options available to you. Each rewards program has its unique perks, and redeeming points at the right time can dramatically enhance their value. For clarity, here’s a simple overview of popular credit card reward structures:

| Reward type | Typical Earn Rate | Best Use |

|---|---|---|

| Cash Back | 1% to 5% | Everyday purchases |

| Travel Points | 1 to 3 points per dollar | Flights and hotels |

| Retail Points | 1 to 5 points per dollar | Store-specific discounts |

Avoiding Common Pitfalls: Mistakes to Sidestep with Credit Cards

When it comes to credit card use, avoiding common errors can significantly enhance your financial health.One of the biggest pitfalls is overspending. It’s easy to lose track of how much you’re charging to your card, especially with the convenience offered. To sidestep this mistake, consider the following:

- Set a strict monthly budget and keep track of all expenses.

- Always keep your credit utilization below 30% of your total credit limit.

- Review your statements regularly to monitor spending habits.

Another frequent misstep is neglecting to pay off your balance in full each month. Carrying a balance can lead to accrued interest, which diminishes any rewards or benefits you may earn. To avoid this, implement a few smart strategies:

- Set up automatic payments to ensure you never miss a due date.

- Utilize credit card alerts to remind you of upcoming payments.

- Consider having an emergency fund to avoid relying solely on credit for unexpected expenses.

| Mistake | Consequence | Solution |

|---|---|---|

| Overspending | Debt accumulation | Establish a budget |

| Missing payments | Late fees & interest | Set up automation |

| Not using rewards wisely | Lost benefits | Research best rewards |

Creating a Budget-Friendly Credit card Strategy for Long-Term Savings

Establishing a credit card strategy that aligns with your long-term savings goals is essential for enhancing your financial health. Start by evaluating your spending habits to determine which categories you consistently allocate the most funds. This will enable you to select credit cards that offer rewards or cashback tailored to your spending patterns. Additionally, always aim to pay off the balance in full each month to evade interest charges, which can quickly erode any benefits you might gain from rewards. By doing so, you not only maintain a healthy credit score but also maximize your savings over time.

Another crucial component of a savvy credit card strategy is leveraging promotional offers without falling into the debt trap.Consider the following tactics to make the most of your credit cards:

- Utilize sign-up bonuses: Choose cards that provide considerable rewards for meeting initial spending requirements.

- Monitor promotional interest rates: Take advantage of 0% APR offers for balance transfers or new purchases to save on interest.

- Set up automatic alerts: Receive notifications for payment due dates to avoid late fees and maintain your credit health.

By adopting these approaches, you’ll not only cultivate a resilient credit profile but also enhance your savings potential over the long haul.

The Conclusion

mastering credit card utilization is not just about managing debt; it’s a strategic approach to enhancing your financial health. By understanding and implementing smart strategies, you can leverage your credit cards to save money while building a solid credit profile. From keeping your utilization ratio in check to maximizing rewards and benefits,every small adjustment can lead to significant savings over time.

Remember, responsible credit card use is a valuable tool in your financial toolkit—one that, when wielded wisely, can unlock opportunities for savings and rewards. So, take a moment to review your current credit habits and consider how you can apply these strategies to achieve your financial goals. With a proactive mindset and a little discipline,you’ll find that not only can you save money,but you can also pave the way for a brighter financial future.

Thank you for reading! Stay tuned for more tips and insights to help you navigate the world of personal finance with confidence.