Investing can seem like a daunting undertaking, especially for beginners who are navigating the complex world of finance for the first time. Among the myriad options available, mutual funds stand out as a popular choice for individuals looking to grow their wealth while benefiting from professional management. But what exactly are mutual funds, adn how can you effectively get started? In this comprehensive guide, we’ll break down the essentials of mutual funds—exploring their structure, types, and advantages—while providing you with actionable steps to make informed investment decisions. Whether you’re saving for retirement,a future home,or simply looking to build your savings,this guide will equip you with the foundational knowlege you need to embark on your mutual fund journey with confidence. Let’s dive in!

Table of Contents

- Understanding mutual Funds: basics Every beginner Should Know

- Types of Mutual Funds: Choosing the Right Fit for Your Investment Goals

- How to Evaluate Mutual Funds: Key Metrics and Factors to Consider

- Steps to Invest in Mutual Funds: A Practical Guide for New Investors

- To Wrap It Up

Understanding Mutual Funds: Basics Every Beginner Should Know

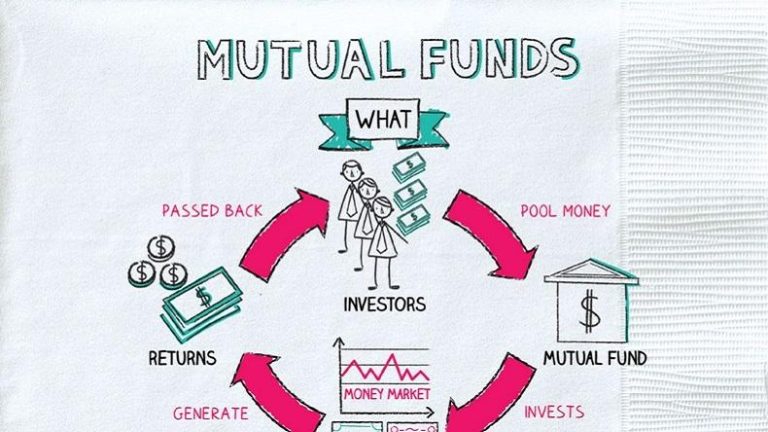

Before diving into the world of mutual funds, it’s essential to grasp some core concepts that will help you make informed investment decisions. A mutual fund pools money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. This collective investment allows individuals to access a broader array of assets, which can lead to reduced risks compared to investing in a single stock or bond.Here are some key features to consider:

- Types of Mutual Funds: Equity, Debt, Hybrid, and Money Market funds, each serving different investment goals and risk appetites.

- Net Asset Value (NAV): The price per share of the mutual fund, calculated by dividing the total value of the fund’s assets by the number of shares outstanding.

- Expense Ratio: A measure of how much the fund charges in fees annually, expressed as a percentage of its average assets.

- Risk Tolerance: Reflects your ability and willingness to endure market fluctuations before making an investment choice.

Investing in mutual funds can be an excellent way to build wealth over time, but understanding the potential returns and risks is crucial. Mutual funds can be actively managed, were fund managers select investments based on research and market analysis, or passively managed, tracking a specific index and minimizing trading. Below is a simple comparison table to illustrate the differences:

| Type of Management | Objective | Cost | Investor Control |

|---|---|---|---|

| Active Management | Beat the market | Higher fees | Lower control |

| Passive Management | Match the market | Lower fees | Higher control |

Types of Mutual Funds: Choosing the Right Fit for Your Investment Goals

When exploring the diverse world of mutual funds, it’s essential to match your investment choices with your personal goals and risk tolerance. Here are some popular types of mutual funds to consider:

- Equity Funds: These funds primarily invest in stocks and are suited for investors looking for long-term growth. They come in various styles, such as large-cap, mid-cap, and small-cap funds.

- Debt Funds: Ideal for conservative investors, these funds invest in fixed-income securities like bonds and government securities, offering lower risk and more stable returns.

- Hybrid Funds: Combining equity and debt, hybrid funds provide a balanced approach, allowing investors to enjoy the growth potential of stocks and the stability of bonds.

- Index Funds: Designed to replicate the performance of specific market indices,these funds offer a passive investment strategy with lower fees.

- Sectoral Funds: These focus on specific sectors of the economy, making them suitable for those looking to capitalize on particular market trends.

Understanding these categories can significantly aid in making informed decisions. To further assist in the selection process, consider the following key factors in a summary format:

| Fund type | Risk Level | Investment Horizon |

|---|---|---|

| Equity Funds | High | Long-Term |

| Debt Funds | Low | Short to Medium-Term |

| hybrid Funds | Medium | Medium to Long-Term |

| Index Funds | Medium | Long-Term |

| Sectoral Funds | High | Medium to Long-Term |

Choosing the right type of mutual fund according to your financial aspirations ensures not only compatibility with your risk profile but also places your investments on a path toward success. Take the time to assess each type and align them with your individual investment strategy for optimal outcomes.

How to Evaluate Mutual Funds: Key Metrics and Factors to Consider

When it comes to choosing the right mutual fund, understanding and evaluating key metrics is essential to ensure alignment with your investment goals. Start by examining the Expense Ratio, which indicates how much you will pay in fees relative to your investment. A lower ratio can lead to higher long-term returns, so look for funds that prioritize cost efficiency. Additionally, consider the performance history, typically represented in a fund’s return statistics over various timeframes (1-year, 3-year, and 5-year). A consistent track record can indicate the manager’s effectiveness in navigating market fluctuations.

Another crucial factor is the Risk Metrics,especially the beta and Standard Deviation of the fund. Beta measures the fund’s volatility in relation to the market; a Beta greater then 1 suggests higher volatility, while below 1 indicates less fluctuation compared to the market. Standard Deviation captures the fund’s return variation,providing insight into risk. Moreover, assess the Fund Manager’s Tenure and Beliefs. A seasoned manager with a solid investment strategy can greatly influence a fund’s success. Consider using the following table to summarize your evaluations:

| Metric | Definition | Importance |

|---|---|---|

| Expense Ratio | Annual fee as a percentage of assets | Impacts long-term returns |

| Performance History | Past returns over different periods | Indicates manager effectiveness |

| Risk Metrics | Measures of volatility and variation | Assesses investment risk |

| Manager Tenure | Length of time in charge of the fund | Influences fund performance |

Steps to Invest in Mutual Funds: A Practical Guide for New Investors

Investing in mutual funds can be a straightforward process if you follow a clear path.start by determining your financial goals. Ask yourself what you hope to achieve, whether it’s saving for retirement, a child’s education, or simply growing your wealth. This step is crucial as it helps you decide on the types of mutual funds that align with your objectives. Next, assess your risk tolerance, which will guide you in selecting funds that match your comfort level with investment fluctuations.

Once you have your goals and risk profile defined, it’s time to do some research. Look for various mutual fund options, focusing on factors such as past performance, management fees, and the reputation of the fund manager. Utilize resources such as financial websites and investment platforms to compare different funds. after narrowing down your choices, you can proceed to open an account with a trusted financial institution or fund house. Many platforms offer user-friendly interfaces for new investors. always remember, it’s important to read the fund’s prospectus to understand its strategies and costs.Below is a simple table summarizing key aspects to consider:

| Aspect | Importance |

|---|---|

| Financial Goals | Guides fund selection |

| Risk Tolerance | Affects investment choices |

| Past Performance | Indicator of reliability |

| Management Fees | Affects overall returns |

| Fund Prospectus | Details investment strategies |

To Wrap It Up

Conclusion: Your Journey into mutual Funds Begins Here

As you embark on your investment journey, understanding mutual funds can open up new avenues for wealth creation and financial security. By grasping the fundamentals of mutual funds, including their types, advantages, and potential risks, you’ve taken the first crucial steps toward making informed investment decisions.

Remember, investing is not a sprint but a marathon. Stay patient, stay informed, and continuously educate yourself as you navigate this journey. Whether you’re saving for retirement,planning a child’s education,or simply growing your wealth,mutual funds offer a vehicle that can help you achieve your financial goals.

If you have more questions or need guidance, don’t hesitate to consult a financial advisor who can provide tailored advice to suit your unique situation. your investment journey is yours to define, and the knowledge you’ve gained in this guide is the foundation on which you can build a more secure financial future.

Thank you for joining us in this exploration of mutual funds. Here’s to confident investing and a prosperous future!