In today’s fast-paced financial landscape, securing a agreeable retirement is more crucial than ever. With the rising cost of living and unpredictable market conditions, it’s imperative to take control of your financial future. Two of the most powerful tools at your disposal are 401(k)s and Individual Retirement Accounts (IRAs). Understanding and effectively managing these savings vehicles can significantly enhance your retirement prospects.In this article, we will guide you through the essentials of 401(k)s and IRAs, exploring their features, benefits, and the strategies you can implement to maximize your savings.Whether you’re just starting your career, nearing retirement, or somewhere in between, mastering these accounts can lead to greater financial security and peace of mind. Let’s delve into the world of retirement planning and unlock the path to a prosperous future.

Table of Contents

- Understanding the Basics of 401(k) and IRA: Key Differences and Benefits

- Strategic Contributions: How to Optimize Your Contributions for Maximum Growth

- Investment Options and Strategies: Building a Diversified Portfolio Within Your Retirement Accounts

- Tax Advantages and Withdrawal Rules: Navigating the Complexities for Long-Term Savings Success

- Wrapping Up

Understanding the Basics of 401(k) and IRA: Key Differences and Benefits

When it comes to retirement savings, 401(k)s and iras are two of the most popular options available, each with their own distinct features. A 401(k) is typically offered by employers and allows for pre-tax contributions, meaning your taxable income is reduced in the year you contribute. Employers may also offer matching contributions, which can be a significant boost to your retirement savings. Key characteristics of a 401(k) include:

- Higher contribution limits: Employees can contribute up to $20,500 (or $27,000 if over age 50) as of 2023.

- employer match: Many employers offer matching contributions, enhancing your savings potential.

- Loan options: some plans allow you to take loans against your balance for personal expenses.

Conversely, Individual Retirement Accounts (IRAs) provide individuals more control over their investments and can be established independently of an employer. There are two primary types—traditional and Roth IRAs—each with its unique tax advantages. Consider the following benefits of IRAs:

- Wider investment options: Investors can often select from a broader range of assets, including stocks, bonds, and mutual funds.

- Tax flexibility: Traditional IRAs allow for tax-deferred growth, while Roth IRAs enable tax-free withdrawals in retirement.

- No employer dependence: Individuals can open IRAs regardless of their employment situation.

Here’s a fast comparison of some key features:

| Feature | 401(k) | IRA |

|---|---|---|

| Contribution Limit | $20,500 (up to $27,000 if 50+) | $6,500 (up to $7,500 if 50+) |

| Tax Treatment | Pre-tax contributions | Traditional: pre-tax; Roth: after-tax |

| Employer Match | Frequently enough available | Not applicable |

| Investment Choices | Limited to plan options | Broader range of options |

Strategic Contributions: How to Optimize Your Contributions for Maximum Growth

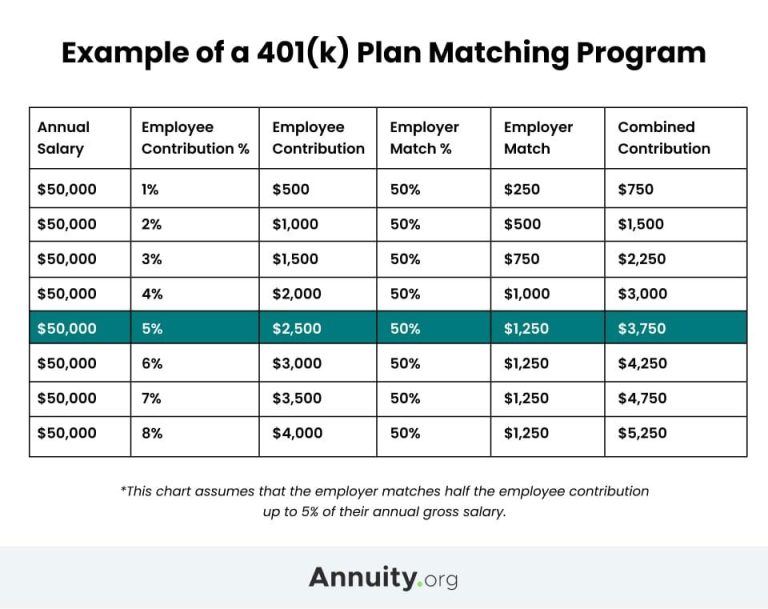

When it comes to growing your retirement funds, the effectiveness of your contributions hinges on strategic planning. Start by assessing your employerS 401(k) match program, as this is essentially free money that can significantly amplify your savings. Here are some strategies to consider:

- Maximize Contributions: Aim to contribute at least enough to take full advantage of any employer match.

- Consider Contribution Limits: Familiarize yourself with annual contribution limits for both 401(k)s and IRAs to ensure you’re exploiting every opportunity.

- Diversify Contributions: Don’t hesitate to balance your contributions between your 401(k) and IRA, potentially maximizing tax benefits depending on your income and tax situation.

Along with understanding matching and limits, consider adjusting your investment allocations within these plans. Review your risk tolerance and age to create an investment strategy that aligns with your long-term goals. Here’s a quick overview of recommended asset allocation strategies based on age:

| Age Range | Equity Allocation | Bond Allocation |

|---|---|---|

| 20-30 | 80%+ | 20%- |

| 30-40 | 70%-80% | 20%-30% |

| 40-50 | 60%-70% | 30%-40% |

| 50-60 | 50%-60% | 40%-50% |

Investment Options and Strategies: Building a Diversified Portfolio Within Your retirement Accounts

When constructing a robust retirement portfolio, embracing a diversified strategy is key to mitigating risk and seizing growth opportunities. within your 401(k) and IRA accounts, consider a mix of asset classes to optimize your investment trajectory. A comprehensive approach might include:

- Equities: Invest in a blend of domestic and international stocks for potential capital appreciation.

- Fixed Income: Allocate a portion of your portfolio to bonds or bond funds to provide stability and regular income.

- Real Estate: Consider real estate investment trusts (reits) for diversification and inflation protection.

- Choice Investments: Explore options like commodities or peer-to-peer lending for further diversification.

Additionally, regularly rebalancing your portfolio ensures your asset allocation aligns with your risk tolerance and financial goals. This might involve selling some asset classes that have exceeded their target weight and buying underperforming ones. Utilizing a strategic withdrawal plan during retirement can also enhance longevity of your savings. Below is a simple table illustrating a sample diversified portfolio allocation:

| Asset Class | Target Allocation (%) |

|---|---|

| Domestic Stocks | 40 |

| International Stocks | 20 |

| Bonds | 30 |

| REITs | 5 |

| Commodities | 5 |

Tax Advantages and Withdrawal Rules: Navigating the Complexities for Long-Term Savings Success

Understanding the tax advantages associated with 401(k)s and IRAs is crucial for optimizing your long-term savings.Both account types offer unique benefits that can significantly enhance your retirement portfolio. With a 401(k), contributions are typically made with pre-tax dollars, allowing you to reduce your taxable income in the year you contribute. When it comes to IRAs, you can choose between a traditional IRA, which also provides tax-deductible contributions, or a Roth IRA, where you pay taxes upfront but enjoy tax-free withdrawals in retirement. The decision between the two often hinges on your current tax bracket and expectations for the future.

However, navigating the withdrawal rules is just as important as leveraging the tax advantages. Early withdrawals from a 401(k) or traditional IRA before the age of 59½ may incur significant penalties, generally 10% on top of any income tax owed. In contrast, Roth IRAs allow for tax-free and penalty-free withdrawals of contributions at any time, providing greater flexibility for those who may need access to funds before retirement. To clarify these points further, consider the following table:

| Account Type | Tax Advantages | Early Withdrawal Penalty |

|---|---|---|

| 401(k) | Pre-tax contributions, lower taxable income | 10% plus income tax before 59½ |

| Traditional IRA | Tax-deductible contributions | 10% plus income tax before 59½ |

| Roth IRA | Tax-free withdrawals in retirement | None on contributions; taxes on earnings before 59½ |

Wrapping Up

taking control of your financial future starts with understanding the powerful tools at your disposal—namely, 401(k)s and IRAs. By maximizing your contributions, taking advantage of employer matches, and tailoring your investment strategies, you can significantly boost your retirement savings. Remember, every dollar you invest today can compound into a ample nest egg for tomorrow.

Whether you’re just starting your career or approaching retirement, it’s never too late to enhance your savings strategy. Regularly reviewing and adjusting your accounts in line with your financial goals will ensure you’re on the right path.

So, take the time to educate yourself, seek professional advice when necessary, and make informed decisions. Your future self will thank you for the steps you take today.Happy saving!