In today’s uncertain economic landscape, securing your financial future has never been more critical. As we navigate the complexities of retirement planning, understanding the tools at our disposal is essential for building a robust financial foundation. Among the most effective instruments are 401(k) and IRA accounts—two powerful savings vehicles designed to help you accumulate wealth for your golden years. However, with various options, rules, and strategies to consider, many individuals find themselves overwhelmed. In this article, we will demystify 401(k) and IRA accounts, guiding you through their unique benefits, tax implications, and strategies for maximizing your savings. Whether you’re just starting your career or are approaching retirement, this complete overview will equip you with the knowledge you need to navigate your retirement planning journey confidently. Let’s unlock the potential of these accounts to secure a more prosperous and stress-free future.

Table of contents

- Understanding the Basics of 401(k) and IRA Accounts

- Strategies for Maximizing Contributions and Employer Matches

- Investment Options and asset Allocation: Building a Diverse portfolio

- Common Pitfalls to avoid and Best Practices for Successful Retirement Planning

- In Summary

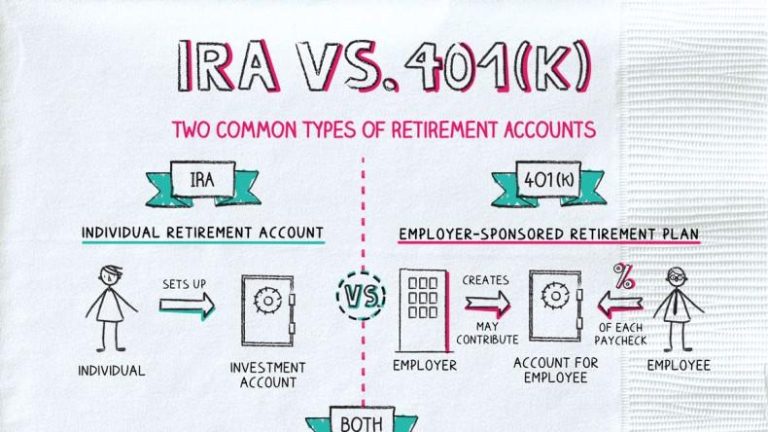

Understanding the Basics of 401(k) and IRA Accounts

When planning for retirement, understanding the intricacies of 401(k) and IRA accounts is crucial.A 401(k) is an employer-sponsored retirement plan that allows employees to save a portion of their paycheck before taxes are taken out. This not only reduces your taxable income but also builds your retirement savings with contributions that can be matched by your employer.Key features of a 401(k) may include:

- Employer Matching Contributions – Many employers contribute additional funds, essentially giving you “free money.”

- Higher Contribution Limits – In 2023, you can contribute up to $22,500 annually, with an extra $7,500 for those aged 50 and over.

- Loan options – Some plans allow you to borrow against your balance, providing flexibility in times of need.

On the other hand, an IRA (Individual Retirement Account) is a personal retirement savings account that offers tax advantages for individuals. Unlike a 401(k), this account is not tied to your employer, giving you greater control over your investments. The two main types are Customary IRAs and Roth IRAs, each with distinct tax benefits. Here’s a swift comparison:

| Feature | Traditional IRA | Roth IRA |

|---|---|---|

| Tax Treatment | Contributions might potentially be tax-deductible | Tax-free withdrawals in retirement |

| Withdrawal Rules | Taxes paid upon withdrawal | Contributions can be withdrawn anytime tax-free |

| Income Limits | No income limit for contributions | Income limits apply for contributions |

Strategies for Maximizing Contributions and Employer Matches

To make the most of your retirement savings, begin by taking full advantage of your employer’s matching contributions. Maximize your contributions to at least the level of the match offered.This is essentially free money that can significantly boost your retirement nest egg. Here are some strategies to consider:

- Know the Match Details: Understand exactly how much your employer is willing to match. Some may offer a dollar-for-dollar match up to a certain percentage,while others might provide a partial match.

- Increase Contributions with Raise: Whenever you receive a salary increase, make it a habit to raise your 401(k) contributions accordingly. This can definitely help you stay on track to reach the maximum limit.

- Set Up Automatic Increases: Take advantage of features that allow for automatic annual increases to your contributions, wich can happen without you needing to think about it.

additionally, consider maxing out your individual contributions, especially if you’re aiming for long-term growth. Take advantage of catch-up contributions if you’re over 50, allowing you to put additional funds into your retirement accounts.Here’s a quick overview:

| Account Type | annual Contribution Limit | Catch-Up Contribution (Age 50+) |

|---|---|---|

| 401(k) | $22,500 | $7,500 |

| Traditional and roth IRA | $6,500 | $1,000 |

By utilizing these strategies, you can significantly enhance your retirement savings potential and ensure a more secure financial future.

Investment Options and Asset Allocation: Building a Diverse Portfolio

When it comes to investment options, diversifying your portfolio is crucial for managing risk and maximizing returns. Within your 401(k) and IRA accounts, you can choose from a range of assets which can include:

- Stocks: Generally provide higher long-term growth potential but come with increased volatility.

- Bonds: Offer stability and predictable income, helping to balance out the risks associated with equities.

- Mutual Funds: Provide instant diversification by pooling funds from multiple investors to invest in a diversified portfolio of stocks and/or bonds.

- exchange-Traded Funds (etfs): Like mutual funds but trade like individual stocks, frequently enough at lower expense ratios.

- Real Estate Investment Trusts (REITs): Allow you to invest in real estate without buying physical properties, often providing regular income through dividends.

To effectively allocate your assets, consider your investment timeline, risk tolerance, and financial goals. A balanced approach might involve:

| Time Horizon | Risk Tolerance | Suggested Asset Allocation |

|---|---|---|

| Short-term (0-5 years) | Low | 70% Bonds, 20% Stocks, 10% Cash |

| Medium-term (5-10 years) | Moderate | 40% Bonds, 50% Stocks, 10% REITs |

| Long-term (10+ years) | High | 20% Bonds, 70% Stocks, 10% Alternatives |

This diversification strategy allows you to weather market fluctuations while still capitalizing on growth opportunities, ensuring your savings work effectively for your future.

Common Pitfalls to Avoid and Best Practices for Successful Retirement Planning

One of the most significant mistakes individuals make in retirement planning is underestimating their future expenses. It’s essential to account for factors such as healthcare, housing, and lifestyle changes that could impact your budget. Furthermore, failing to regularly review and adjust your savings strategy can lead to severe consequences.Consider these common pitfalls to avoid:

- Neglecting Employer Matching Contributions: Missing out on employer match can cost you thousands.

- Investing Too Conservatively: Inadequate growth potential can leave you unprepared for retirement.

- Delaying Contributions: Starting late means missing out on the compounding advantages of time.

Implementing best practices can significantly improve your retirement outcomes. Start by creating a diversified investment portfolio to mitigate risks while maximizing returns. Regularly contribute to your 401(k) and IRA accounts, and increase allocations as your income grows. Review your financial plan annually to ensure it aligns with your retirement goals. Here are some best practices to consider:

- Set Clear Goals: Establish specific savings targets for your retirement.

- Consult Financial Advisors: Professional guidance can help tailor strategies to your unique situation.

- Utilize Tax-Advantaged Accounts: Make the most of 401(k) and IRA tax benefits.

In Summary

As we close out our exploration of 401(k) and IRA accounts, it’s clear that successfully navigating these essential financial tools requires both knowledge and strategy. By understanding the unique benefits and limitations of each option,you can tailor a retirement plan that aligns with your individual goals and lifestyle. Remember, the journey doesn’t end here—staying informed and making regular contributions can significantly impact your financial future.Whether you’re just starting your career or nearing retirement, the steps you take today can pave the way for a more secure tomorrow. Don’t hesitate to consult a financial advisor to ensure your strategy is in line with current laws, and keep revisiting your plans as your life changes and markets evolve.

By taking control of your 401(k) and IRA, you’re not just saving for retirement; you’re actively participating in your financial destiny. So, take a moment to reflect on your current plan, make any necessary adjustments, and embark on this vital journey with confidence. Your future self will thank you!