In the ever-evolving landscape of personal finance,finding the right savings instrument can be a daunting task. With a myriad of options available, from customary savings accounts to high-yield investments, it’s crucial to consider the unique features and benefits of each option. Enter the Certificate of Deposit (CD) – a time-tested financial product that offers both security and potential for higher returns. in this article, we’ll delve into the fundamentals of CDs, exploring their structure, benefits, and how they can play an integral role in your financial strategy. Whether you’re a seasoned investor or just starting your savings journey, understanding Certificates of Deposit can empower you to make informed decisions that align with your financial goals.Join us as we navigate the world of CDs and uncover why they might be the perfect fit for your savings plan.

Table of Contents

- Exploring the Mechanics of Certificates of Deposit

- Key Advantages of investing in Certificates of Deposit

- Navigating Interest Rates and Terms for Optimal Returns

- Strategies for Integrating CDs into Your Financial Portfolio

- To Wrap It Up

Exploring the Mechanics of Certificates of deposit

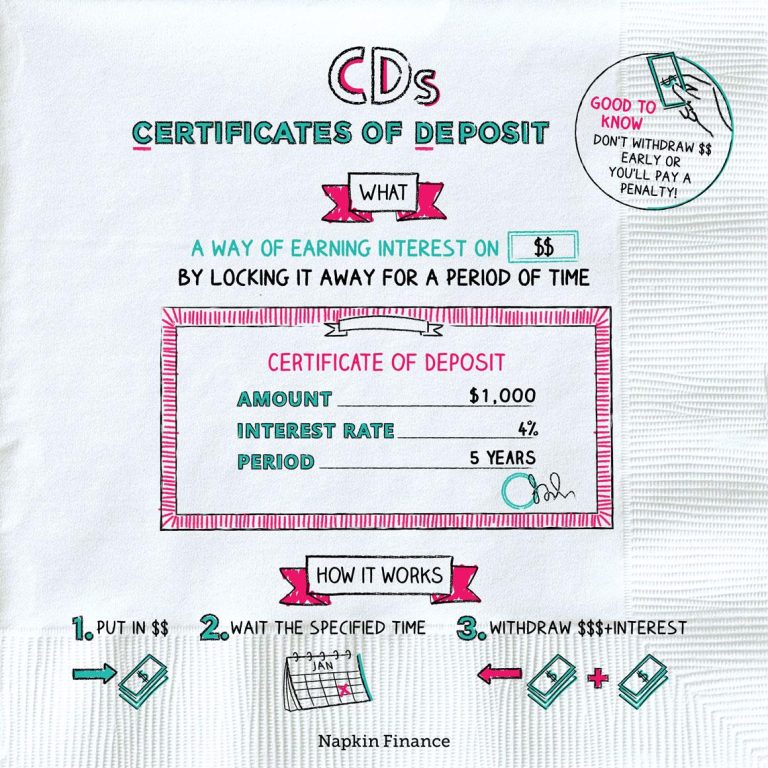

Certificates of Deposit (CDs) are a secure investment vehicle offered by banks and credit unions designed to provide a predictable return on your money. When you invest in a CD, you agree to deposit your funds for a specific term, ranging from a few months to several years, during which your money will earn interest at a fixed rate. This arrangement ensures that your principal is safe, making CDs an attractive option for conservative investors. Additionally, the interest earned is frequently enough higher than that of traditional savings accounts, providing an opportunity for better growth without excessive risk.

Investors should consider several key factors when choosing a CD, including interest rates, terms, and early withdrawal penalties.The following list summarizes the essential details to keep in mind:

- Interest Rates: Higher rates are typically offered for longer terms; shop around for competitive rates.

- Terms: Common terms range from 3 months to 5 years, so align your choice with your financial goals.

- Early Withdrawal Penalties: Understand the consequences of accessing your funds before maturity, as this may erode your earnings.

To illustrate how the interest rates can vary based on term length, consider the following table:

| CD term | Interest Rate (%) |

|---|---|

| 3 Months | 0.50% |

| 6 Months | 0.75% |

| 1 Year | 1.00% |

| 2 Years | 1.50% |

| 5 Years | 2.00% |

By carefully evaluating thes mechanics and options within the realm of CDs, investors can effectively strategize their savings plan. The reliability and structured nature of CDs make them an excellent option for funds that can be set aside for a defined period, allowing for stable growth while maintaining access to predictable returns.

Key Advantages of Investing in Certificates of Deposit

Investing in Certificates of Deposit (CDs) offers several compelling advantages,making them an attractive option for a diversified investment strategy. One of the primary benefits is the predictability associated with yield; CDs typically offer fixed interest rates over a specified term. This means you can accurately forecast your earnings, allowing for better financial planning. Additionally, CDs are insured by the FDIC up to applicable limits, providing peace of mind that your principal investment is protected in case of a bank failure. this blend of safety and stability makes CDs a reliable choice for conservative investors.

Another significant advantage of CDs is their variety in terms and interest rates. Investors can choose from short-term options of just a few months to long-term commitments of several years, allowing personalized strategies depending on individual financial goals. In addition, the potential for higher interest rates compared to traditional savings accounts can result in more considerable gains over time. Below is a simple comparison showcasing typical interest rates based on term lengths:

| Term Length | Typical Interest Rate |

|---|---|

| 6 Months | 0.15% – 0.50% |

| 1 Year | 0.60% – 1.00% |

| 2 Years | 1.00% – 1.50% |

| 5 Years | 1.50% – 2.00% |

Navigating Interest Rates and Terms for Optimal Returns

When considering a certificate of deposit (CD), it’s essential to understand how interest rates and terms can significantly impact your returns. Several factors play into the rate offered by financial institutions, including prevailing market conditions and the duration of the investment. Typically, longer terms yield higher interest rates, making it crucial to align your financial goals with the correct term length. This not only maximizes earnings but also helps you avoid early withdrawal penalties, which can erode your principal and accrued interest. Here are essential points to consider:

- Market Trends: Staying informed about economic indicators can help you choose the right moment to open a CD.

- Rate Comparison: Always compare rates across various institutions to find the best offers.

- Penalty Structure: Know the terms regarding withdrawals to prevent losing your earnings.

to illustrate the relationship between terms and interest rates, consider the following table summarizing potential returns for different CD terms and rates:

| Term Length | Interest Rate (%) | Estimated Return on $1,000 |

|---|---|---|

| 6 Months | 1.50 | $1,007.50 |

| 1 Year | 2.00 | $1,020.00 |

| 2 Years | 2.50 | $1,050.00 |

Understanding these factors can empower you to make informed decisions regarding your investment strategy. By carefully navigating interest rates and term options, you can ensure that your choice aligns with your financial objectives, all while enjoying the stable and predictable growth that certificates of deposit can provide.

strategies for Integrating CDs into Your Financial Portfolio

Integrating certificates of deposit (CDs) into your financial portfolio can be a strategic move to enhance your savings while balancing risk.start by assessing your financial goals and liquidity needs, as CDs work best when you’re planning for a future expense without needing immediate access to your funds. Consider diversifying the terms of your CDs—such as short-term, medium-term, and long-term—to optimize interest rates while maintaining access to some cash flow. This staggered approach, often referred to as a “CD ladder,” allows your investments to mature at different times, giving you flexibility and a steady stream of interest income.

Additionally, it’s wise to compare offerings from various institutions to find the best rates and terms.When selecting a CD, pay attention to the following factors:

- Interest Rates: Look for the highest rates available.

- Minimum Deposit Requirements: Choose options that fit your budget.

- Early Withdrawal penalties: Understand the costs associated with pulling out funds early.

- Special Promotions: Take advantage of limited-time offers from banks.

| CD type | Typical Term Length | Average APY |

|---|---|---|

| Short-term CD | 3 to 6 months | 0.15% – 1.00% |

| Medium-Term CD | 1 to 3 years | 0.40% – 2.00% |

| Long-Term CD | 5 years or more | 1.00% – 2.50% |

To Wrap It Up

certificates of deposit (CDs) offer a unique blend of safety, stability, and predictability for both novice and experienced investors.By understanding their core benefits—such as higher interest rates compared to traditional savings accounts, fixed terms, and federal insurance—you can make informed decisions that align with your financial goals. Whether you’re looking for a way to grow your savings with minimal risk or simply seeking a reliable investment vehicle for a set period, CDs can serve as a valuable addition to your financial portfolio.

As you consider your options, it’s essential to assess your personal situation, including your liquidity needs and interest rate surroundings.With careful planning and research, investing in a certificate of deposit can be a rewarding choice that aids in wealth accumulation and financial security. Remember, the key to a prosperous investment strategy is not just knowing the benefits, but also understanding how those benefits align with your long-term objectives. Happy investing!