In today’s credit-driven world, maintaining a healthy credit score is crucial for securing loans, renting a home, and even getting the best insurance rates. One often-overlooked aspect of credit scores is the impact of credit inquiries – those seemingly innocuous checks that lenders perform when you apply for a new credit card or loan. Many consumers are unaware that these inquiries can influence their credit scores in significant ways. In this article, we will delve into the two types of credit inquiries, how they affect your score, and offer practical tips on managing your credit applications wisely. Whether you’re considering applying for a new credit card or simply aiming to understand your financial landscape better, getting a grip on the ins and outs of credit inquiries can empower you to make more informed decisions and ultimately lead to a healthier credit profile.Let’s explore what you need to know about credit inquiries and their role in shaping your creditworthiness.

table of Contents

- Understanding the Different Types of Credit Card Inquiries

- The Impact of Hard and Soft inquiries on Your Credit Score

- Strategies to Minimize the negative Effects of Credit Inquiries

- Best Practices for Managing Multiple Credit Applications Wisely

- Key Takeaways

Understanding the Different Types of Credit Card inquiries

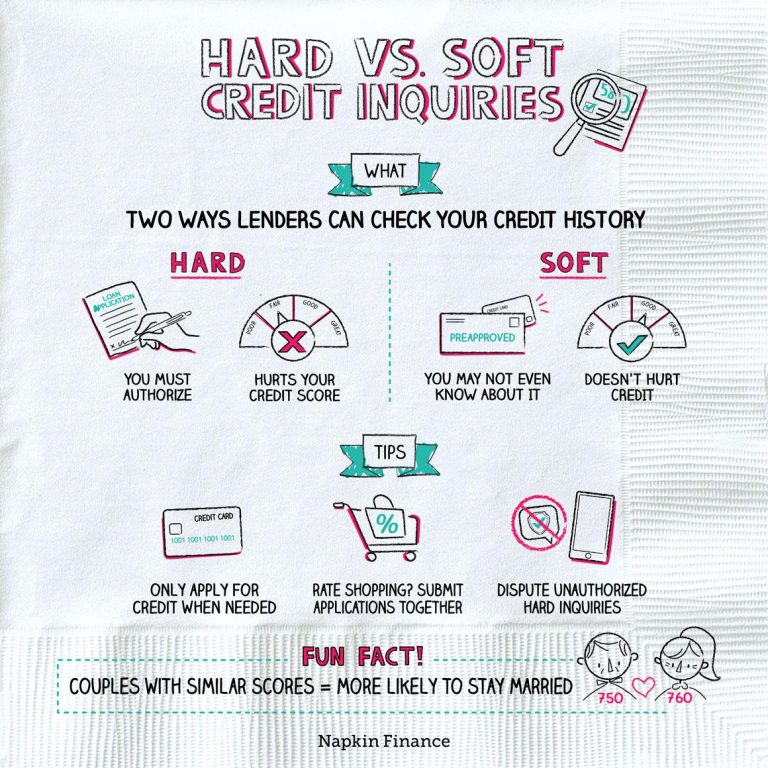

When discussing credit card inquiries, it’s essential to recognize the two primary types: hard inquiries and soft inquiries. A hard inquiry occurs when a lender checks your credit report as part of their decision-making process for lending you money or extending credit. This type of inquiry can have a temporary negative impact on your credit score, typically ranging from 5 to 10 points. It’s generally triggered when you apply for a new credit card, a loan, or a mortgage. On the other hand, soft inquiries occur when you check your own credit or when an employer or lender reviews your credit for promotional purposes. These do not affect your credit score and can even help you keep an eye on your credit health.

understanding when and how these inquiries affect your credit score can definitely help you make informed decisions. Hear’s a brief comparison that highlights the differences:

| Type of Inquiry | Impact on Credit Score | Examples |

|---|---|---|

| Hard Inquiry | May decrease score | New credit card application, loan request |

| Soft Inquiry | No impact | Personal credit checks, promotional offers |

Being mindful of these inquiries is essential for maintaining a healthy credit score. While hard inquiries can signal to lenders that you might be taking on more debt, minimizing unneeded applications for credit can help keep your score stable over time. Remember, too many hard inquiries in a short period can give the impression of financial distress, which can be off-putting to potential lenders.

The Impact of Hard and Soft Inquiries on Your Credit Score

When you apply for new credit, whether it’s a credit card, loan, or mortgage, financial institutions will often conduct inquiries into your credit history. These inquiries are classified into two categories: hard inquiries and soft inquiries. Hard inquiries occur when a lender reviews your credit for lending purposes, typically following an application. While they are essential for lenders to assess risk, hard inquiries can negatively impact your credit score, typically dropping it by a few points for a limited time. In general, a single hard inquiry will stay on your credit report for up to two years, but the most significant impact is usually felt within the first few months following the inquiry.

In contrast, soft inquiries do not affect your credit score at all.These are often initiated when you check your own credit, a lender checks your credit for promotional purposes, or an employer performs a background check. They serve different purposes but play a crucial role in your overall credit assessment. To maintain a healthy credit profile, it’s importent to be mindful of how often you submit applications for new credit. Here are some practices to consider:

- Limit applications for new credit while planning large purchases.

- Regularly check your credit report to monitor soft inquiries.

- Understand the difference between types of inquiries when applying for credit.

Strategies to Minimize the Negative Effects of Credit Inquiries

To safeguard your credit score from the potential drop caused by multiple credit inquiries, consider implementing a few proactive measures. Limit the frequency of applications for new credit, aiming rather to apply only when absolutely necessary. Consolidating your inquiries into a short time frame—often referred to as a “rate shopping period”—can also help mitigate the impact on your credit score.This strategy allows multiple inquiries related to the same type of credit (like a mortgage or an auto loan) to be counted as a single inquiry by credit scoring models.

Additionally, maintaining a healthy credit utilization ratio is crucial. Keeping your credit card balances low relative to your credit limits can buffer your score against the negative effects of inquiries. Furthermore, it’s beneficial to regularly monitor your credit report for errors, which can adversely influence your score.By ensuring that your credit report reflects accurate data, you minimize the chances of unnecessary score drops due to inaccuracies stemming from past inquiries.

Best Practices for Managing Multiple Credit Applications Wisely

When navigating through multiple credit applications, it’s essential to adopt strategies that protect your credit score.First and foremost, limit the number of applications you submit within a short timeframe. Aim for applying to one or two credit accounts every few months rather than several in a single period, as this can create a red flag for lenders. additionally, researching and understanding the terms and features of each card before applying can save you time and perhaps boost your approval chances.Here are some ways to manage your applications effectively:

- Check your credit report: Always review your report before applying to understand where you stand.

- Use pre-qualification tools: These can definitely help you gauge your chances of approval without affecting your score.

- Prioritize needs over wants: Only apply for cards that align with your financial goals.

Moreover, monitoring the impact of your applications on your credit score can provide valuable insights. it’s recommended to space out your credit inquiries to mitigate potential damage. In fact,many scoring models treat multiple inquiries in a short period for the same type of credit as one single inquiry,which is a favorable aspect to consider. Here’s how different types of inquiries might stack up in your profile:

| Type of Inquiry | Impact on Score |

|---|---|

| Soft Inquiry | No impact |

| Hard inquiry | Temporary decrease |

| Multiple Hard Inquiries (within 14-45 days) | Considered as one inquiry |

Key Takeaways

understanding how credit card inquiries impact your credit score is crucial for managing your financial health. while a single inquiry may have a minimal effect, multiple inquiries within a short period can raise red flags for lenders and potentially lower your score. By being strategic about when and how you apply for new credit, you can protect your score and make informed decisions that benefit your financial future. Remember to regularly monitor your credit report to keep track of your score and understand how your credit usage affects it. With a solid grasp of these principles, you’re better equipped to navigate the world of credit and make choices that align with your financial goals.Stay informed, stay proactive, and watch your credit score flourish!