Planning a wedding can be one of the most exhilarating yet challenging experiences in a couple’s journey. from choosing the perfect venue to selecting a dreamy dress,the excitement can easily lead to overspending if not carefully managed. In today’s world, where social media bombards us with extravagant wedding ideas and stunning visuals, it’s easy to lose sight of a budget that balances dreams with reality. However, with diligent planning and strategic budgeting, your special day can be both memorable and financially sensible. In this article, we’ll explore practical tips and proven strategies to help you navigate the wedding budgeting process, ensuring you celebrate your love story without breaking the bank. Whether you’re just beginning your planning or are deep in the details, these insights will empower you to make informed decisions that align with your vision and financial comfort. Let’s dive in!

Table of Contents

- Understanding Your Wedding Budget and Setting Realistic Expectations

- Prioritizing Essentials vs. Luxuries: Making Informed Choices

- Creative Cost-Saving Strategies for Every Wedding Category

- Tracking Expenses and Staying Disciplined Throughout the Planning Process

- To Wrap It Up

Understanding Your wedding Budget and Setting Realistic Expectations

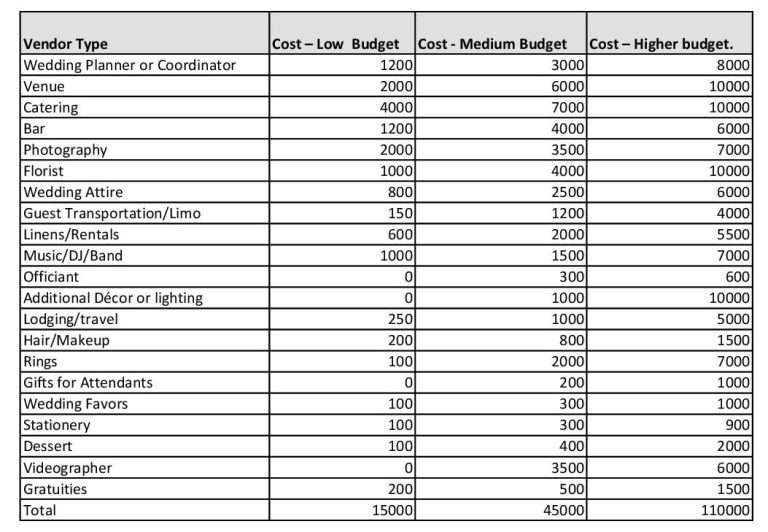

Planning a wedding can feel overwhelming, especially when it comes to managing your finances.Start by creating a complete budget that encompasses all aspects of your wedding, from the venue to the smallest details. Consider these key elements when drafting your budget:

- Venue Costs: This frequently enough takes up the largest portion of your budget.

- Catering and Drinks: Include food, beverages, and service fees.

- Attire and Accessories: Think about the wedding dress, tuxedos, and jewellery.

- Photography and Videography: Capture the memories with quality services.

- Entertainment: Factor in music, DJs, or live bands.

Once you have a clear picture of the costs, it’s essential to prioritize your spending based on what matters most to you and your partner. Setting realistic expectations can help mitigate financial stress. Use the following table to guide your percentage allocations:

| Category | Recommended Percentage of Budget |

|---|---|

| Venue | 30% |

| Catering | 25% |

| Attire | 10% |

| Photography | 10% |

| Entertainment | 10% |

| miscellaneous | 5% |

Prioritizing essentials vs. Luxuries: Making Informed Choices

In the whirlwind of wedding planning, it’s easy to get caught up in the allure of extravagant experiences and lavish decor. To maintain financial sanity, start by clearly distinguishing between your essentials and luxuries. Essentials typically include items that create the foundational experience for your big day. Consider the following key elements as non-negotiables:

- Venue: The location sets the tone for your festivity.

- Catering: Food and beverage are crucial for guest satisfaction.

- Attire: Choices for the couple’s outfits can influence overall style.

- Photography: Capturing memories is vital and often treasured for years to come.

Once the essentials are outlined, it’s beneficial to evaluate which luxuries genuinely enhance your experience and warrant the expense. These can often include enhancements or personalized touches that reflect your personality as a couple. Here’s a simple overview of potential luxury options:

| Luxury Item | Value Added |

|---|---|

| Live Band | Creates an unforgettable atmosphere. |

| Custom Decor | Enhances overall aesthetic and personalization. |

| Premium Floral arrangements | elevates the visual appeal of the venue. |

| Fancy Wedding Favors | Provides a memorable takeaway for guests. |

Evaluate whether these luxuries contribute considerably to your vision or if they are simply optional dreams. By honing in on the essentials and thoughtfully considering the added luxuries, you can make educated decisions that keep your budget aligned with your wedding goals.

Creative Cost-Saving Strategies for Every Wedding Category

Weddings can be incredibly expensive, but creativity can turn even the smallest budget into a beautiful celebration. For the venue, consider hosting your event during off-peak times, or even selecting a free outdoor location like a park or beach. For catering, explore options like a buffet or a potluck-style meal, where guests contribute their favorite dishes. Utilizing local food trucks or catering companies can also yield savings as they often provide appetizing meals at lower costs than traditional venues.

When it comes to decor,embrace DIY projects using readily available materials.For instance, craft your centerpieces using flowers from your local farmer’s market or repurpose items from thrift stores. in terms of entertainment, consider hiring local musicians or asking talented friends to perform. Generate a memorable experience with a thoughtfully curated playlist rather than investing in a DJ. Below is a table that outlines some clever ideas for various wedding categories:

| Category | Cost-saving Strategy |

|---|---|

| Venue | opt for off-peak dates or outdoor spaces. |

| Catering | Choose buffet-style or potluck catering. |

| Decor | Use DIY projects and repurposed items. |

| entertainment | Hire local artists or use a curated playlist. |

Tracking Expenses and Staying Disciplined Throughout the Planning Process

Staying on top of your wedding expenses requires vigilance and a solid strategy. Begin by establishing a detailed budget that outlines every aspect of your wedding, from the venue to the smallest decorative touches. Utilize a budgeting tool or spreadsheet to track your anticipated costs versus actual spending. Regularly update this document to reflect any unexpected expenses, and categorize your spending into essential and non-essential items. This distinction helps you prioritize where to flex your budget if needed. Set up a time each week to review your progress,and consider having a designated partner or friend assist you in holding each other accountable.

Consider implementing a few practical techniques to maintain discipline during the planning process. Create a “wish list” of vendors and items that you would love to have but may not fit within your budget. This keeps your aspirations intact while highlighting areas where you may need to cut back. Additionally, explore various quotes from multiple vendors before making a decision. You might be surprised at how different companies price similar services, allowing you to make informed choices. A simple table can help compare options clearly:

| Vendor Type | Vendor Name | Quote Amount | Service Included |

|---|---|---|---|

| Caterer | Delicious Bites | $4,500 | Full Service Catering |

| Photographer | Moments Captured | $2,000 | 8 Hours Coverage |

| florist | Blooms & Petals | $1,200 | Centerpieces & Bouquets |

By keeping meticulous records and using tools at your disposal, you can remain focused on your financial goals, ensuring that your big day is both beautiful and budget-amiable.

To Wrap It up

As we wrap up our exploration of smart wedding budgeting, it’s clear that careful planning and a well-thought-out approach can turn your dream wedding into a beautiful reality without breaking the bank. Remember, it’s not just about cutting costs; it’s about making informed choices that align with your priorities and vision. By setting a realistic budget, prioritizing your spending, and keeping an eye on unexpected expenses, you can enjoy the planning process and cherish every moment of your special day.

Take the time to communicate openly with your partner and any family members contributing to the festivities,ensuring everyone is on the same page.With the right strategies, tools, and a clear understanding of your financial goals, you can navigate the wedding planning process with confidence and ease.

So go ahead, embrace the joy of planning your wedding while keeping your budget intact. After all, the most vital thing is celebrating your love story, surrounded by family and friends, regardless of the final tally on the price tag.Happy planning!