In today’s fast-paced consumer world, managing your finances can often feel like an uphill battle.With enticing sales, ever-evolving trends, and an overwhelming barrage of marketing tactics, sticking to a budget seems easier said than done. Though, mastering your budget is not just about restraint; it’s about making smart, informed shopping choices that allow you to get more value out of every dollar spent. In this article, we will explore practical and effective shopping tips that can help you navigate the marketplace with confidence, ensuring that each purchase aligns with your financial goals. Join us as we delve into strategies that will empower you to take control of your spending, make savvy decisions, and ultimately achieve financial success. Whether you’re a seasoned shopper or just starting to take control of your finances, these insights will prepare you to transform your shopping habits and make budgeting a simpler, less stressful endeavor. Let’s explore how to shop smart without sacrificing the lifestyle you desire.

Table of Contents

- Understanding Your Current Financial Landscape

- Identifying Essential vs. Non-Essential Purchases

- Utilizing Tools and Apps for Effective Budgeting

- Implementing Smart Shopping Strategies for Long-Term Success

- The Conclusion

Understanding Your Current Financial Landscape

Before diving into savvy shopping strategies, it’s crucial to take an inventory of your financial landscape. Understanding where you stand in relation to your income, expenses, savings, and debt is the first step towards effective budgeting. start by evaluating your monthly income, which includes your salary, any freelance earnings, and othre sources of revenue. Then,track your monthly expenses—both fixed (like rent and insurance) and variable (such as dining out and groceries). This assessment helps paint a clear picture of your cash flow, highlighting areas where you can cut back and save.

Utilizing this information allows you to create realistic financial goals and set a budget that is not only achievable but also sustainable. Here are some vital elements to consider:

- Emergency Fund: Aim to save 3-6 months’ worth of expenses for unexpected financial setbacks.

- debt Management: Prioritize high-interest debts to minimize what you pay over time.

- Savings Goals: Set short-term and long-term savings targets to keep you motivated.

- Investment Opportunities: Explore ways to grow your money, such as retirement accounts or stock investments.

| financial Aspect | Recommendation |

|---|---|

| Income | Track all sources of income monthly. |

| Expenses | Maintain a detailed log of monthly expenditures. |

| Debt | Focus on paying off high-interest loans first. |

| Savings | Set aside a percentage of income for savings. |

Identifying Essential vs.Non-Essential Purchases

Understanding the difference between what you need and what you want is crucial for effective budget management. Essential purchases are items or services that are fundamental to your daily life and well-being. These could include:

- Food and Groceries: Basic nutritional needs.

- Housing: Rent or mortgage payments.

- Healthcare: Medical expenses and insurance premiums.

- Utilities: Electricity, water, and gas bills.

- Transportation: Public transit costs or car payments.

On the flip side, non-essential purchases can be categorized as discretionary spending that may enhance your lifestyle but aren’t necessary for survival. Examples of non-essential expenses include:

- Dining Out: Eating at restaurants instead of cooking at home.

- Entertainment: Movie tickets, streaming services, and gaming.

- Luxury Goods: Designer clothing,gadgets,and accessories.

- Travel: Vacations and weekend getaways.

- Hobbies: Sports equipment, crafts, and collectibles.

Utilizing Tools and Apps for Effective Budgeting

Effective budgeting is now more accessible than ever, thanks to a plethora of tools and apps designed to streamline the process. From tracking your expenses to setting savings goals, these digital solutions can help you maintain financial discipline without the hassle of manual calculations.Some of the most popular options include:

- Mint: A free budgeting tool that links to your bank accounts for real-time expense tracking.

- YNAB (You Need A Budget): Encourages proactive budgeting by assigning every dollar a job; it’s subscription-based but offers a 34-day free trial.

- PocketGuard: Simplifies budgeting by showing how much disposable income you have after accounting for bills and goals.

Utilizing these tools not only organizes your finances but also provides insight into spending habits, allowing for informed decisions. Most budgeting apps come with features such as budget categorization, alerts for overspending, and performance tracking over time. For a quick comparison, consider the table below:

| App | Price | Key Feature |

|---|---|---|

| Mint | Free | Automatic bank syncing |

| YNAB | $11.99/month | Goal-oriented budget planning |

| PocketGuard | Free / $4.99/month | Simple disposable income tracking |

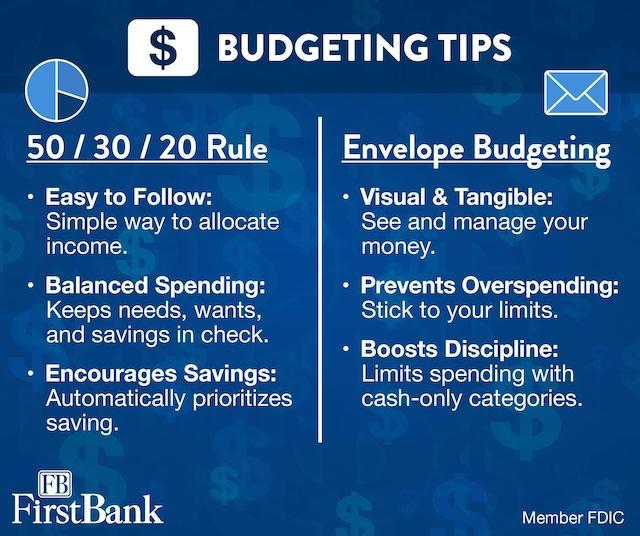

Implementing Smart Shopping strategies for Long-Term Success

To achieve lasting success in shopping, it’s essential to develop smart strategies that prioritize your finances. Start by setting clear budgets for each shopping category, like groceries, clothing, and entertainment. This not only helps to keep expenditures in check but also encourages mindful consumption. Utilize tools such as budgeting apps or spreadsheets to track your spending in real-time and identify areas for potential savings. Consider making a shopping list before you head out or go online, ensuring that you stick to necessary purchases and avoid impulse buys.

Engaging with promotions and rewards programs can also substantially enhance your shopping experience. Sign up for newsletters from your favorite retailers to stay informed on exclusive discounts and offers. Additionally, consider loyalty programs that provide cashback or points for purchases, which can be redeemed for future savings. Incorporating a strategy for seasonal shopping events, such as Black Friday or Cyber Monday, allows for maximized savings on items you’re already planning to buy. Below is a simple comparison of shopping strategies:

| Strategy | Description |

|---|---|

| budgeting | Set monthly limits to control spending. |

| Lists | Create a specific list to avoid impulse purchases. |

| Rewards Programs | Join programs that give back incentives for purchases. |

| Seasonal Sales | Plan shopping around major sales events for discounts. |

The Conclusion

mastering your budget is not just about restricting your spending; it’s about empowering yourself to make informed purchasing decisions that align with your financial goals. By implementing these smart shopping tips, you’re well on your way to transforming your shopping habits and gaining greater control over your finances. Remember, accomplished budgeting is a journey, not a destination. It requires continuous learning and adjustment as you navigate through changing circumstances and opportunities. Embrace the process,stay disciplined,and don’t hesitate to revisit and refine your strategies as needed. With patience and perseverance, you’ll not only see your savings grow but also gain the confidence to make purchases that truly add value to your life.Happy budgeting!