Introduction:

In today’s financial landscape, understanding how to effectively manage your credit score and debt is more crucial than ever. Your credit score acts as a key that unlocks opportunities, influencing everything from loan approvals to interest rates on mortgages and credit cards. Yet, manny individuals find themselves navigating a maze of credit reports, debt obligations, and financial jargon that can be overwhelming. Whether you’re starting from scratch,recovering from financial setbacks,or simply looking to improve your existing credit status,a strategic approach can make all the difference. In this article, we’ll explore essential tips and actionable strategies to not only boost your credit score but also manage debt responsibly, empowering you to make informed decisions for a healthier financial future. Let’s dive into the steps you can take today to enhance your creditworthiness and achieve your financial goals.

Table of Contents

- Understanding Your Credit Score and Its Impact on Financial Health

- Strategies for Timely Payments and Managing Existing Debt

- Effective Ways to Reduce Credit Utilization and Improve Credit Mix

- Monitoring and Reviewing Your Credit Report for long-Term Success

- To Wrap It Up

Understanding Your Credit Score and Its Impact on Financial Health

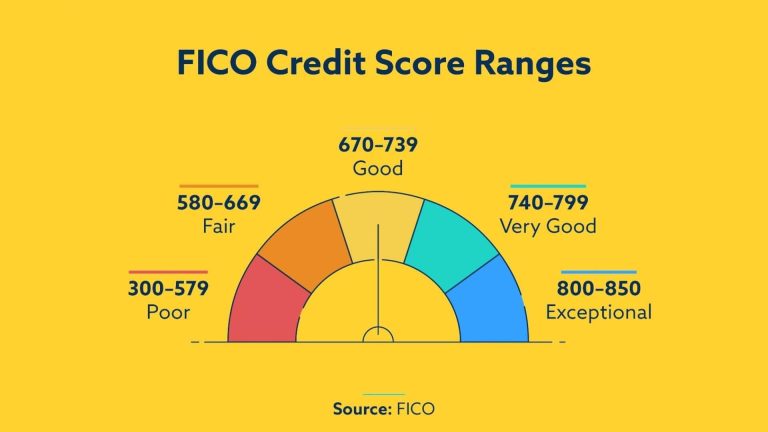

Understanding your credit score is crucial for your financial well-being, as it serves as a key indicator of your creditworthiness. A good credit score can open doors to better loan terms, lower interest rates, and more affordable insurance premiums. Typically, scores range from 300 to 850, with higher scores indicating low risk to lenders. Maintaining a strong credit score hinges on several factors, including payment history, amount owed, credit history length, new credit inquiries, and credit mix.To enhance your financial health, it’s essential to monitor these elements regularly and make informed decisions.

Improving your credit score and managing debt involves adopting strategic habits that bolster your overall financial landscape. Here are some essential practices to consider:

- Pay bills on time: Consistently meeting payment deadlines positively impacts your payment history.

- Reduce outstanding debt: Aim to lower your credit utilization ratio by paying down existing debt.

- review credit reports: Regularly check for errors or inaccuracies that could adversely affect your score.

- Avoid needless credit inquiries: Limit new applications for credit in a short time frame.

- Maintain old credit accounts: Keep older accounts open to build a longer credit history.

| Credit Score Range | Category |

|---|---|

| 300 – 579 | Poor |

| 580 – 669 | Fair |

| 670 – 739 | Good |

| 740 – 799 | Very Good |

| 800 – 850 | Excellent |

Strategies for Timely payments and Managing Existing Debt

Implementing effective strategies for timely payments is essential for maintaining a healthy credit score while managing existing debts. Start by setting up automatic payments for your bills to ensure you never miss a due date. This not only helps in avoiding late fees but also positively impacts your credit history. Additionally, consider using payment reminders through your bank’s app or calendar notifications to stay on top of upcoming obligations. Another effective tactic is to prioritize high-interest debts first; tackling these can reduce the overall amount you pay in interest and help you become debt-free more quickly.

To further enhance your debt management, keep an accurate budget to monitor income and expenses, which will help identify areas where you can allocate more funds to debt repayment. If you find yourself overwhelmed, explore options such as debt consolidation or negotiating lower interest rates with your creditors. Below is a simple table illustrating different debt repayment strategies:

| Strategy | description |

|---|---|

| Snowball Method | Focus on paying off the smallest debts first to build momentum. |

| avalanche Method | Pay off debts from the highest interest rate to the lowest for cost efficiency. |

| debt Consolidation | Combine multiple debts into one loan with a lower interest rate. |

Effective Ways to Reduce Credit Utilization and Improve Credit Mix

Maintaining a healthy credit utilization ratio is crucial for a strong credit score. One effective strategy is to pay down existing debts. Focus on reducing balances on your credit cards, targeting those with the highest interest rates first.Additionally,consider making multiple payments throughout the month to keep your overall utilization low.Another helpful tip is to increase your credit limits. When your credit limits rise without increasing your spending, your utilization ratio naturally improves, which positively impacts your credit score.

Incorporating different types of credit can not only enhance your credit mix but also contribute to a better score. Consider diversifying your credit portfolio by adding installment loans, such as a personal loan or auto loan, to complement your revolving credit accounts. Be mindful, though, that applying for new credit should be approached thoughtfully; too many inquiries can be detrimental. You may also explore credit builder loans, specifically designed for those looking to improve their credit history. These loans can gradually enhance your credit profile by showcasing your ability to manage various forms of credit responsibly.

Monitoring and Reviewing Your Credit Report for Long-Term Success

To ensure your credit score is on the right track, it’s essential to routinely monitor your credit report. This not only helps you understand your financial health but also allows you to spot any discrepancies that could hinder your score. set a regular schedule—whether it’s monthly or quarterly—to review your report and keep an eye on the following critical components:

- Payment history: Ensure all entries are accurate and reflect your timely payments.

- Credit Utilization: Verify that your credit utilization ratio is within the recommended range of 30% or lower.

- Credit Inquiries: Check for any unauthorized inquiries that could indicate fraud.

- Account Age: Consider the impact of your oldest accounts as they contribute positively to your credit score.

In addition to monitoring, it’s crucial to implement a consistent strategy for reviewing your financial behaviors. Create a system that tracks your spending and payment patterns, and identify areas where you can improve. Here are some effective strategies:

| Action Item | Frequency |

|---|---|

| Review Credit Report | Monthly |

| Pay bills on Time | Monthly |

| Reduce Credit Card Balances | Weekly |

| Contact Creditors for Clarification | As Needed |

By establishing these habits,you’ll not only boost your credit score but also foster a healthier financial future. Remember, staying proactive is key to long-term success in managing debt and enhancing your credit standing.

To Wrap It Up

understanding how to boost your credit score and effectively manage your debt is an essential part of achieving financial stability and success. By implementing the tips outlined in this article—such as paying bills on time, keeping your credit utilization low, and regularly reviewing your credit report—you can take proactive steps towards a healthier credit profile. Remember, improving your credit score is a marathon, not a sprint, and it requires consistency and dedication.

Furthermore, managing your debt responsibly is not just about making payments; it’s about creating a enduring financial habitat for yourself. By setting a budget, prioritizing high-interest debt, and avoiding unnecessary expenses, you’ll be well on your way to regaining control over your financial future.if you implement these strategies and remain committed to your goals, you’ll not only see your credit score improve but also gain peace of mind that comes with financial literacy and responsibility. So take charge of your credit journey today—your future self will thank you! For more insights and updates, don’t forget to subscribe to our blog. Happy budgeting!