In an era where traditional savings accounts yield minimal returns and the stock market can feel like a double-edged sword, many investors are turning their attention to real estate as a viable means of building wealth. With its potential for stable cash flow, gratitude, and tax benefits, the real estate market offers opportunities that can substantially enhance your financial landscape. However, navigating this terrain requires more than just a desire to buy property; it demands a strategic approach grounded in knowledge, planning, and execution.

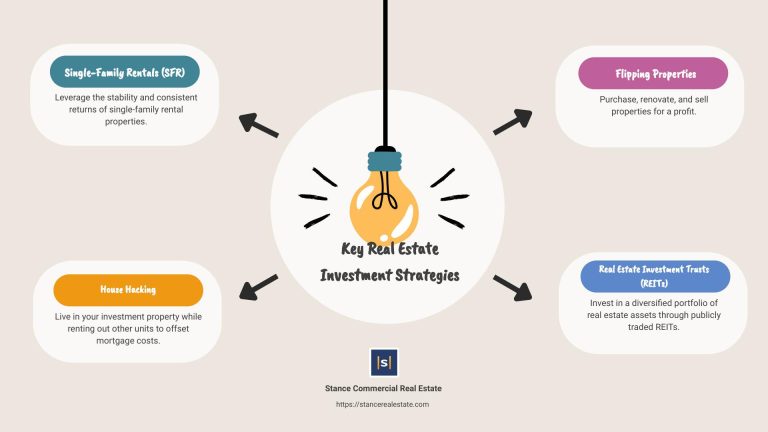

In this comprehensive guide, we will explore various real estate investment strategies that can unlock the door to prosperity.Whether you’re a seasoned investor looking to diversify your portfolio or a newcomer eager to take your first steps into the world of real estate, understanding the nuances of investment options—from rental properties and fix-and-flips to real estate investment trusts (REITs)—is crucial. Join us as we delve into the essential tactics that can help you harness the power of real estate to secure your financial future and achieve your wealth-building goals.

Table of Contents

- understanding the Real Estate Market Dynamics

- Essential Investment Strategies for Beginners

- Maximizing Returns Through Property Management

- Navigating Financing Options and Risk Mitigation

- The Way Forward

Understanding the Real Estate Market Dynamics

The real estate market is influenced by a myriad of factors that create a complex and ever-evolving landscape for investors.Understanding these dynamics requires attention to key elements such as supply and demand, interest rates, and economic indicators. market trends often shift due to variables like population growth, local job opportunities, and housing affordability, which can all significantly affect property values.By closely monitoring these elements, investors can identify optimal times to buy or sell, ensuring they make decisions rooted in solid data rather than emotional impulses.

Additionally, regional variations play a crucial role in shaping the real estate market. Different areas can experience unique price fluctuations and demand levels based on their individual attributes. For instance, urban centers may demonstrate higher rental yields due to increased demand for housing, while suburban areas might attract attention for their affordability and spacious options.Investors should consider location, amenities, and community growth potential when evaluating properties. Here is a simplified overview of factors influencing real estate markets:

| Factor | Impact on Market |

|---|---|

| Supply and Demand | High demand and low supply drive prices up. |

| Interest Rates | Lower rates typically encourage buying and investing. |

| Economic Growth | Stronger economy correlates with higher real estate investments. |

| location | Prime locations see quicker appreciation and better returns. |

Essential Investment Strategies for Beginners

For those new to the world of investing, starting with real estate can seem daunting. However, understanding key strategies can demystify the process and lead to successful outcomes. One effective approach is to focus on buy-and-hold investments, where you acquire property with the intention of renting it out for steady income while also benefiting from potential appreciation. Another strategy is flipping houses, which involves purchasing properties that require renovation, making necessary improvements, and then reselling them at a profit. Both methods can enhance your portfolio and provide meaningful returns if executed wisely.

As you delve deeper, it’s crucial to pay attention to market research. Identifying areas with strong growth potential and understanding local demand can significantly impact your investment’s performance. Networking with real estate professionals, attending local meetings, and utilizing online platforms for data can also provide you with invaluable insights. Additionally, consider diversifying your investments by exploring different property types, such as residential, commercial, or even vacation rentals. This diversification can help mitigate risks and smooth out fluctuations in your income stream.

Maximizing Returns Through Property Management

Effective property management is pivotal for anyone looking to enhance their investment returns in real estate. With the right strategies in place, property owners can significantly increase their bottom line. Consider these essential tactics for smarter property management:

- Regular maintenance: Keeping your properties in top condition minimizes emergency repairs and maximizes tenant satisfaction.

- Market Analysis: Understanding local market trends helps set competitive rental prices, attracting and retaining quality tenants.

- Effective Communication: Building strong relationships with tenants fosters a positive living surroundings, which can reduce turnover rates.

- Technology Utilization: Utilize property management software for streamlined operations, from tenant screening to rent collection.

moreover, savvy landlords frequently enough look beyond traditional management techniques. Incorporating targeted marketing strategies can elevate property visibility and desirability. Here’s a helpful breakdown of marketing channels by effectiveness:

| Marketing Channel | Effectiveness (% of Leads) |

|---|---|

| Social Media Advertising | 35% |

| Real Estate Websites | 30% |

| Word of Mouth Referrals | 20% |

| Local Community Boards | 15% |

Navigating Financing Options and Risk Mitigation

When embarking on your real estate investment journey, understanding the array of financing options available is crucial to achieving your financial goals. From traditional bank loans to government-backed programs, the right financing can pave the way for lucrative investments. Consider these popular financing avenues:

- Conventional Mortgages: Suitable for owner-occupied properties, offering lower interest rates for buyers with good credit.

- Hard Money Loans: Short-term loans from private investors or companies,usually with higher interest rates but quicker access to funds.

- FHA and VA Loans: These government-backed loans provide lower down payment options for eligible buyers,minimizing initial capital requirements.

- Partnerships: Teaming up with other investors can enhance your purchasing power, distributing both the financial burden and risk.

In addition to exploring financing options, diligent risk mitigation strategies are essential to safeguard your investments. smart investors adopt a multi-faceted approach to minimize exposure to potential pitfalls:

- Diversification: Spread your investments across different types of properties and markets to reduce dependence on any single asset.

- Thorough Research: Conduct extensive due diligence on markets, properties, and economic indicators to make informed decisions.

- Legal Protections: Ensure purchase agreements and leases are reviewed by legal professionals to mitigate disputes and liabilities.

- Insurance coverage: Acquire comprehensive insurance to protect against unforeseen damages or losses.

The Way Forward

As we conclude this exploration of real estate investment strategies, it’s clear that the path to unlocking wealth through property isn’t just about having capital; it’s about leveraging knowledge, strategy, and the right mindset.By comprehensively understanding the market,assessing risks,and continually educating yourself,you position yourself for long-term success in the dynamic real estate landscape.Whether you’re a seasoned investor or just starting your journey, remember that every successful investment begins with a well-thought-out plan. The principles laid out in this guide serve as a foundation to inspire confidence and foster informed decision-making. Embrace the learning curve, seek mentorship, and don’t shy away from taking calculated risks.

The world of real estate is full of opportunities waiting to be seized. With perseverance,diligence,and the strategies discussed,you have the potential to unlock not just wealth,but also financial freedom. So,take that first step,dive in,and let your journey into real estate investment begin. Your future self will thank you! Happy investing!