Introduction:

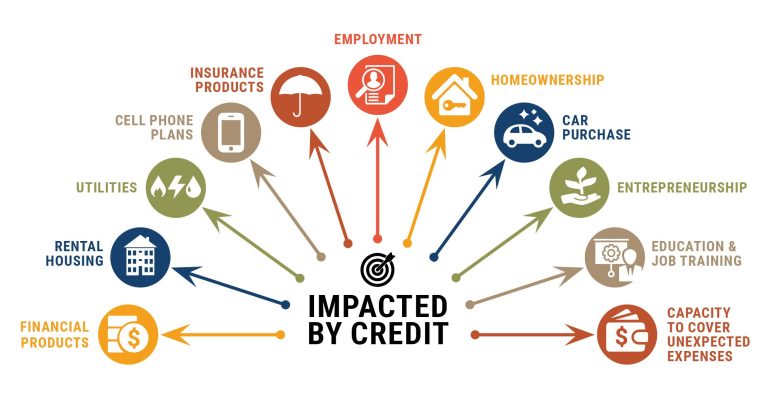

In today’s financial landscape, a strong credit score is more than just a number; it’s a vital key that unlocks a world of opportunities. From securing low-interest rates on loans to renting an apartment or even landing your dream job, your creditworthiness can significantly influence many aspects of your life. Whether you’re starting wiht a blank slate or looking to improve an existing score, building credit may seem daunting at first. However, with teh right strategies and a proactive approach, boosting your credit score is entirely within reach. In this article, we’ll explore practical steps you can take to establish a solid credit foundation, enhance your financial profile, and ultimately pave the way for a brighter financial future.Let’s dive into the essential steps you need to take to take charge of your credit journey effectively.

Table of Contents

- Understanding Credit Scores and Their Importance

- Creating a Solid Credit History Through Smart Financial Practices

- Utilizing Credit Cards Responsibly to Enhance Your Score

- Monitoring Your Credit Report for Accuracy and Improvement Opportunities

- in summary

Understanding Credit Scores and their Importance

Credit scores are numerical representations of an individual’s creditworthiness, typically ranging from 300 to 850. They play a pivotal role in various financial decisions, influencing factors such as loan approvals, interest rates, and even rental agreements. A high credit score signifies responsible credit management, while a low score can limit financial opportunities and lead to higher costs.Understanding the components that contribute to your credit score is essential for making informed decisions and improving your financial health. Key elements include payment history, credit utilization, length of credit history, types of credit accounts, and recent credit inquiries.

Knowing the meaning of your credit score can motivate you to adopt better financial habits. By focusing on how to build and maintain a strong score, you empower yourself to gain access to loans with favorable terms, secure lower interest rates, and even enhance your chances when applying for jobs. Here are some essential steps to safeguard and elevate your credit score:

- Pay bills on time to establish a steady payment history.

- Maintain a low credit utilization ratio by keeping balances below 30% of your available credit.

- Regularly review your credit report for errors and dispute inaccuracies.

- Avoid opening multiple credit accounts at once.

Creating a Solid Credit History Through Smart Financial Practices

Building a robust credit history is crucial for achieving financial stability and accessing better credit options. To begin with, consider applying for a secured credit card, which requires a cash deposit that serves as your credit limit. This method helps you establish credit without the usual risks involved with unsecured credit. Pay your bills on time, as late payments can have a meaningful negative impact on your credit score. Moreover, strive to maintain a low credit utilization ratio by keeping your balances below 30% of your credit limit. This practice shows lenders that you can manage your credit responsibly.

Another essential step is to regularly check your credit report for errors. Mistakes can occur, and disputing these inaccuracies can quickly improve your score. Additionally, consider diversifying your credit mix by responsibly managing different types of credit accounts, such as installment loans and revolving credit. Keeping your accounts open, particularly your oldest ones, can also positively influence your history length. Here’s a simple table summarizing key practices:

| Practice | Description |

|---|---|

| secure Credit Card | Helps establish credit history with a cash deposit. |

| Timely payments | Punctuality on bill payments boosts your score. |

| Credit utilization | keep balances below 30% of your limit for a healthy score. |

| Credit Report Checks | Identifying and disputing errors can improve your score. |

| Diverse Credit Mix | Managing different types of credit accounts is beneficial. |

Utilizing Credit Cards Responsibly to Enhance Your Score

Credit cards can be powerful tools for building credit when used wisely. Timely payments are crucial; by always paying your balance on or before the due date,you can safeguard your payment history,which constitutes a significant portion of your credit score. Additionally, aim to keep your credit utilization ratio low—ideally below 30%. This means if you have a credit limit of $1,000, you should strive to carry a balance of no more than $300. regularly monitoring your spending and making frequent payments can help achieve this goal,leading to a healthier credit profile.

Another effective strategy is to diversify your credit mix. Having different types of credit accounts, such as a credit card alongside a personal loan or an installment loan, can enhance your credit score, but only if you manage them responsibly. It’s also beneficial to avoid opening too many accounts simultaneously, as each application can lead to a hard inquiry on your report, which may slightly lower your score. Rather, focus on acquiring one or two cards that align with your financial goals while taking care to assess their terms and conditions thoroughly before applying.

Monitoring your Credit Report for Accuracy and Improvement Opportunities

Regularly checking your credit report is essential not only for maintaining accuracy but also for identifying areas where you can enhance your credit profile. Start by obtaining a free copy of your credit report from authorized sources. Look for any discrepancies, such as incorrect personal facts, unfamiliar accounts, or payment history errors. To make your review process smoother,consider these key points:

- Report Errors: Dispute any inaccuracies you find with the credit reporting agency.

- Identity thieves: look for signs of identity theft, such as unfamiliar accounts or hard inquiries that you didn’t authorize.

- payment History: Ensure that your payment records reflect your on-time payments accurately.

Once you’ve verified your report, explore opportunities to boost your credit score through positive practices. Keep your credit utilization low by maintaining a balance of less than 30% of your available credit. Additionally, consider diversifying your credit type; having a mix of revolving credit (like credit cards) and installment loans (like personal loans) can be beneficial. Table 1 below outlines various strategies for credit improvement:

| Strategy | Description |

|---|---|

| Automatic Payments | Set up automatic payments to ensure bills are paid on time. |

| Credit Builder Loans | Consider loans designed specifically for building credit. |

| Authorized User | Become an authorized user on a responsible person’s credit card. |

In Conclusion

building and boosting your credit score is not an overnight endeavor; it requires patience, dedication, and a strategic approach. By following the steps outlined in this article—such as establishing a solid credit history, managing debt wisely, and regularly monitoring your credit report—you can set yourself on the path to a healthier financial future. Remember that every small action you take can make a significant difference over time.

As you implement these strategies, keep in mind that consistency is key. Your credit score reflects your financial behavior; the more responsible and informed you are,the better your score will become. Whether you’re aiming for a mortgage, a car loan, or simply want to secure better interest rates, improving your credit score will open doors to countless opportunities.

If you have any questions or need further guidance on your credit-building journey,feel free to reach out or explore additional resources. With determination and the right knowledge, achieving a strong credit score is an attainable goal for everyone. Here’s to your success and a brighter financial future!