In today’s financial landscape, a robust credit score is more than just a number; it’s a gateway to better opportunities, favorable loan terms, and financial peace of mind. Whether you’re preparing to buy your first home,secure a car loan,or simply looking to enhance your financial health,understanding the intricacies of credit is essential. In this article, we will delve into the fundamentals of building and maintaining a strong credit score, offering practical tips and insights to help you navigate the complexities of credit management. With a clear strategy and informed approach, you can take control of your financial future and unlock a world of possibilities. Join us as we explore the key steps to mastering your finances and ensuring your credit score works for you, not against you.

Table of Contents

- understanding the Fundamentals of Credit Scores and Their Importance

- practical Strategies for Building a Strong Credit History

- Common Pitfalls to Avoid for Maintaining a Healthy Credit Score

- Monitoring and Managing Your Credit Score Effectively

- In Retrospect

Understanding the Fundamentals of Credit Scores and Their Importance

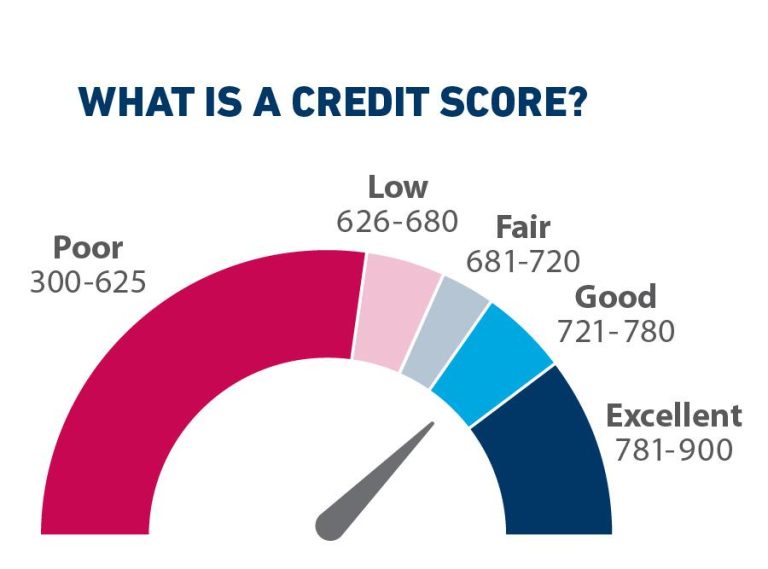

Credit scores are numerical representations of your creditworthiness, derived from your credit history, borrowing behavior, and payment patterns. These scores are pivotal in determining not only your eligibility for loans and credit cards but also the interest rates you’ll be offered. Generally, a higher score indicates a lower risk to lenders, thus leading to more favorable lending terms. Understanding the factors that influence your credit score is essential for managing your finances effectively. Key components include:

- Payment History: On-time payments positively impact your score, while late payments can substantially lower it.

- Credit Utilization Ratio: This is the proportion of your available credit that you are using. Ideally, this should be kept under 30%.

- Length of Credit History: A longer credit history generally boosts your score,showing your reliability over time.

- Types of Credit: A mix of credit types,such as credit cards,mortgages,and installment loans,can enhance your score.

- New Credit Inquiries: Excessive inquiries in a short period can lower your score, as they suggest potential financial distress.

The importance of maintaining a strong credit score cannot be overstated. A robust credit profile can open doors to lower interest rates, better loan terms, and even impact non-financial situations such as employment opportunities and rental applications. Below is a simple table that illustrates the potential financial impact of various credit score ranges on interest rates:

| Credit Score Range | Estimated Interest Rate |

|---|---|

| 300 – 579 | 17% – 30% |

| 580 – 669 | 7% – 18% |

| 670 – 739 | 5% – 7% |

| 740 – 799 | 3% - 5% |

| 800 – 850 | Below 3% |

Practical Strategies for Building a Strong Credit History

One of the most effective ways to develop a robust credit history is to consistently make timely payments on all financial obligations.This includes credit cards, loans, and utility bills. Setting up automatic payments can definitely help ensure you never miss a due date. In addition, keeping your credit utilization ratio low—ideally below 30% of your total credit limit—will positively impact your score. Consider these strategies:

- Request an increase on your credit limits.

- Pay off credit card balances before the statement date.

- Avoid new large purchases before critically important applications.

Establishing a diverse credit mix is another critical aspect of building a strong credit history. This can include a combination of revolving credit (like credit cards) and installment loans (like auto loans or mortgages). Over time, this diversity demonstrates to lenders that you can manage different types of credit. Consider the following ways to diversify:

- Open a secured credit card if you’re starting out.

- Consider student loans or personal loans if they suit your financial needs.

- Make regular payments on different types of credit to show reliability.

Common Pitfalls to Avoid for Maintaining a Healthy Credit Score

Maintaining a healthy credit score involves avoiding certain pitfalls that can derail your financial progress. One of the most common mistakes is making late payments.Payment history is a significant factor in your credit score calculation, so even one missed or late payment can have lasting consequences. Always set reminders for payment due dates or schedule automated payments to ensure timely transactions. Additionally, keeping your credit utilization ratio low is crucial. Using a high percentage of your available credit can signal to lenders that you may be overextending yourself financially.

Another potential trap is closing old credit accounts. While it may seem beneficial to eliminate accounts you no longer use, doing so can negatively affect your credit history length, which is another key factor in your score. Maintaining these accounts,even with minimal activity,helps to bolster your creditworthiness. moreover, applying for multiple credit lines in a short period can also harm your score, as this indicates a higher risk to lenders. Instead, take a cautious approach by only applying for credit when it’s truly necessary.

Monitoring and Managing Your Credit Score Effectively

maintaining a strong credit score requires continuous monitoring and management. Regularly checking your credit report allows you to spot errors or inconsistencies that could negatively impact your score. Take advantage of free annual credit reports provided by major credit bureaus and utilize online tools that help track your score changes. Here are some key actions to incorporate into your routine:

- Set alerts for critically important financial activities, like new accounts or significant score changes.

- Review your spending habits to ensure you’re keeping credit utilization below 30%.

- Schedule monthly check-ins to assess your credit status and make adjustments when necessary.

Additionally, understanding the factors that influence your credit score is crucial for effective management. As a notable example, timely payments make up a significant portion of your score, so prioritize bills and loans with due dates.To illustrate this further, here’s a breakdown of the typical components influencing your credit score:

| Factor | Percentage Contribution |

|---|---|

| Payment History | 35% |

| Credit Utilization | 30% |

| Length of Credit History | 15% |

| Types of Credit Used | 10% |

| New Credit Inquiries | 10% |

in Retrospect

Conclusion

In the journey towards financial mastery, understanding and maintaining a strong credit score is an essential milestone. By diligently managing your credit habits, paying your bills on time, and regularly monitoring your credit report, you are not only setting yourself up for financial success but also paving the way for future opportunities. Remember, a robust credit score opens doors to lower interest rates, better loan terms, and can even positively influence your job prospects and insurance rates.

As you continue to build your financial acumen, consider this a lifelong commitment. Stay informed about changes in credit scoring models,remain proactive in managing your credit accounts,and always be on the lookout for ways to improve your financial standing.with the tips and strategies outlined in this article,you have the tools necessary to master your finances and cultivate a credit score that supports your goals.

Thank you for reading! Here’s to your continued success in the world of finance. If you have any experiences or tips of your own to share, we’d love to hear from you in the comments below!