In today’s fast-paced world, the economy can often feel like a moving target—with inflation rates fluctuating, job markets evolving, and financial news ever-changing. For many, navigating this shifting landscape can be daunting, especially when it comes to managing personal finances. However, fear not! Adopting smart strategies for managing your money can empower you to not only survive but thrive in any economic climate. In this article, we’ll explore essential tips and advanced techniques designed to help you build resilience against financial uncertainty. Whether you’re a seasoned investor, a budgeting newbie, or somewhere in between, these strategies will equip you with the knowledge and tools to make informed decisions that align with your financial goals. Let’s dive in and discover how to take control of your financial future amidst the complexities of a dynamic economy.

Table of Contents

- understanding Economic Trends and Their Impact on Personal Finance

- Building a Resilient Budget for Uncertain Times

- Investment Strategies to Navigate Market Volatility

- Leveraging Technology for Smart financial Management

- Concluding Remarks

Understanding Economic Trends and Their Impact on Personal Finance

In today’s rapidly evolving economic landscape, understanding the nuances of economic trends is crucial for effective personal finance management.Economic indicators such as inflation rates, unemployment levels, and consumer confidence can significantly influence individual financial decisions. By staying informed about these trends, individuals can make more educated choices related to budgeting, saving, and investing.For example, when inflation is on the rise, it might potentially be wise to reassess investment strategies to protect against the devaluation of savings. Moreover, recognizing market patterns allows for better timing in purchasing big-ticket items or entering the housing market.

To navigate the complexities of a shifting economy, individuals can adopt a variety of smart strategies.These include:

- Diversifying investments: A mix of assets can provide a buffer during volatile periods.

- Building an emergency fund: Having a financial cushion helps manage unexpected expenses without disrupting long-term savings.

- adapting budgets: Regularly adjusting budgets in response to economic changes ensures alignment with current financial realities.

Additionally, utilizing a proactive approach to debt management, such as consolidating high-interest loans or negotiating lower rates, can free up valuable resources. Staying informed about local and national economic conditions empowers individuals to make proactive and informed financial decisions.

Building a Resilient Budget for Uncertain Times

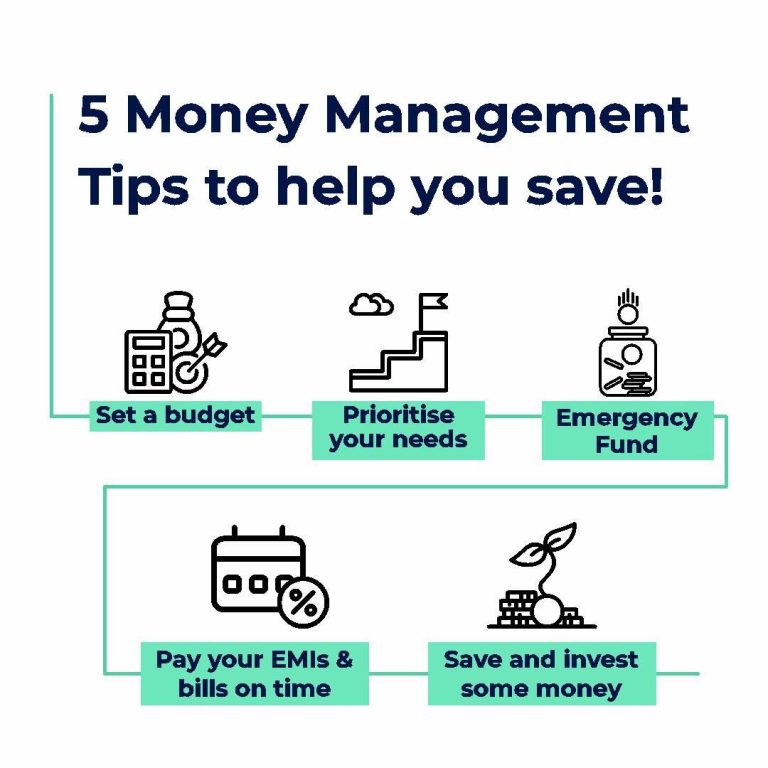

Creating a budget that can withstand economic fluctuations requires a strategic approach to financial planning. Start by assessing your current financial situation,including your income,expenses,savings,and debts. This will help you identify potential vulnerabilities in your budget. Categorizing your expenses into fixed and variable can illuminate areas where adjustments might be necessary. Consider the following tips to enhance your budgeting resilience:

- Prioritize Essential Expenses: Focus on necessities such as housing, utilities, and groceries.

- Build an Emergency Fund: aim to save at least three to six months’ worth of living expenses.

- Reduce variable Spending: Identify non-essential expenses that can be eliminated or reduced.

- Adapt Your Budget Regularly: Revisit your budget monthly to accommodate changing circumstances.

In the face of uncertainty, diversifying income streams can provide additional security. Evaluate opportunities for freelance work, side gigs, or investing in skills that may lead to alternative revenue sources. Moreover, creating a simple table to track income and expenses can serve as a visual aid, making adjustments easier to manage:

| Income Sources | Amount ($) |

|---|---|

| Primary Job | 3,500 |

| Freelance Work | 800 |

| Investments | 200 |

| Other Income | 300 |

| Total Income | 5,100 |

Investment Strategies to navigate Market Volatility

Market volatility can be daunting, but with the right strategies, investors can turn uncertainty into opportunity. One effective approach is to diversify your portfolio across asset classes. By spreading investments across stocks, bonds, real estate, and commodities, you reduce the impact of a downturn in any single area. Additionally, consider investing in funds that focus on defensive sectors, such as utilities and healthcare, wich typically perform better during periods of economic uncertainty.

Another strategy to mitigate risk is to implement a dynamic asset allocation model.This means regularly adjusting your investment mix in response to changing market conditions. Tools like stop-loss orders can also help protect gains and limit losses when markets turn turbulent. You might find it beneficial to maintain a portion of your portfolio in liquid assets, allowing you to quickly capitalize on emerging opportunities while maintaining stability. The table below outlines some asset class performance during periods of high volatility:

| Asset Class | Performance (%) | Volatility Level |

|---|---|---|

| Stocks | -10 to +15 | High |

| Bonds | 0 to +5 | Low |

| Real Estate | -5 to +6 | Medium |

| Commodities | -8 to +20 | medium to High |

Leveraging Technology for Smart Financial Management

in today’s rapidly evolving economy, integrating modern technology into financial management practices can make a notable difference in achieving financial stability and growth. With a plethora of digital tools available,individuals and businesses alike can take control of their finances by utilizing budgeting apps,automated investment platforms,and financial tracking software. These tools not only streamline the financial management process but also provide valuable insights through data analysis, allowing users to make informed decisions based on real-time facts. Key benefits of leveraging technology include:

- Increased Efficiency: Automation reduces manual data entry and saves time.

- Accessibility: Cloud-based solutions allow users to access financial data anytime, anywhere.

- Enhanced Accuracy: Technology minimizes human error,ensuring more reliable financial records.

Furthermore, real-time analytics can enable users to set personalized financial goals and monitor progress effortlessly.Consider adopting a financial tool that provides extensive dashboard views, which can definitely help visualize spending habits and investment performance. Below is a simple comparison of popular financial tools:

| Tool | Features | Best For |

|---|---|---|

| Mint | Budget tracking,bill reminders,credit score monitoring | Personal finance management |

| YNAB | Goal setting,real-time budgeting,educational resources | Budgets that adapt on the fly |

| Acorns | Automated investing,rounding up purchases | new investors |

Concluding Remarks

As we navigate through the complexities of a shifting economy,adopting smart money management strategies is more crucial than ever. By staying informed, diversifying your investments, and adjusting your financial habits to meet new challenges, you can secure your financial future and even thrive amid uncertainty. Remember, it’s not just about surviving the fluctuations; it’s about proactively planning for the opportunities they may present.

Whether you’re reassessing your budget, exploring new income streams, or simply enhancing your financial literacy, taking these steps now can lead to greater financial resilience down the road.As you embark on this journey, keep in mind that versatility and adaptability are your greatest allies. Always be willing to learn, pivot, and refine your strategies as the economic landscape continues to evolve.

Thank you for joining us in exploring these smart strategies. We encourage you to share your thoughts and experiences in the comments below and stay tuned for more insights into managing your finances wisely.Together, we can turn challenges into opportunities and navigate the shifting tides of our economy with confidence. Happy managing!