As we navigate the complexities of retirement planning, one of the most critical yet frequently enough overlooked aspects is managing healthcare costs. With advancements in medical technology, increased life expectancies, and the unpredictability of health-related expenses, a sound financial strategy is essential for ensuring that retirees can enjoy their golden years without the burden of overwhelming medical bills. In this article, we’ll explore essential strategies for effectively managing healthcare costs in retirement. from understanding Medicare options to creating a thorough health savings plan, these insights will empower you to make informed decisions that safeguard your financial well-being while prioritizing your health. Whether you’re nearing retirement or just beginning to plan, it’s never too early to take charge of your healthcare expenses—let’s dive in and equip you with the tools necessary for a financially secure retirement.

Table of Contents

- Understanding the Impact of Healthcare Costs on Retirement Planning

- Utilizing Medicare and Supplemental Insurance Effectively

- Implementing Preventive Care to Reduce Long-Term Expenses

- Creating a sustainable Budget for Healthcare Needs in Retirement

- Future Outlook

Understanding the Impact of Healthcare Costs on Retirement Planning

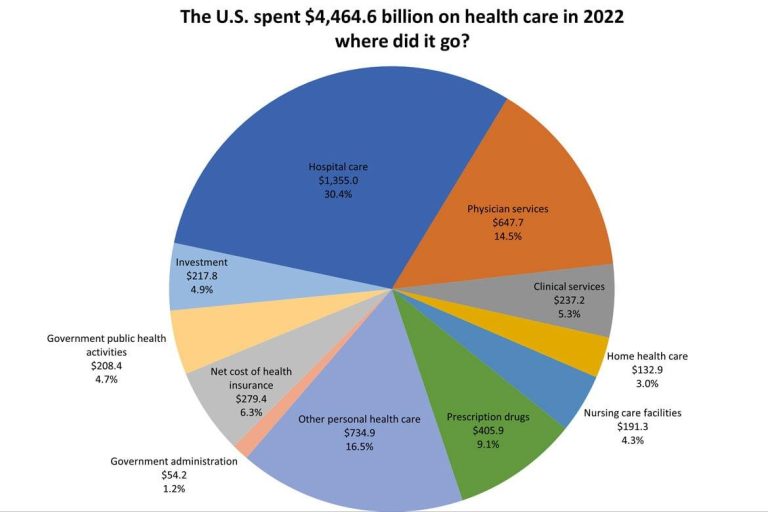

The rising costs of healthcare can considerably influence your retirement strategy, potentially reshaping your entire financial landscape. As individuals transition into this new phase of life, unexpected medical expenses can erode savings if not carefully planned for. With healthcare being one of the largest components of retirement expenses, it is indeed crucial to assess and understand the various factors that contribute to these costs, which can include:

- Premiums for health insurance: Monthly costs for plans that provide coverage.

- Deductibles and out-of-pocket maximums: amounts you must pay before insurance kicks in.

- Long-term care insurance: Protection against expensive custodial care needs.

- Inflation in healthcare expenses: The ever-increasing costs that outpace general inflation.

To effectively address these challenges, retirees should adopt strategies designed to mitigate healthcare spending.Creating a comprehensive healthcare budget is essential and involves making informed decisions about various insurance options. Retirees should also explore potential income sources that can definitely help cover healthcare costs,including:

- Health Savings accounts (HSAs): Tax-advantaged accounts for medical expenses.

- MediGap policies: Plans that help cover gaps in Medicare coverage.

- Contingency funds: Savings aimed at unforeseen healthcare costs.

| Healthcare Expense | Estimated Annual Cost |

|---|---|

| Medicare Premiums | $1,560 |

| Out-of-Pocket Expenses | $3,000 |

| Prescription Drugs | $1,200 |

| Long-term Care Insurance | $2,800 |

Utilizing Medicare and Supplemental Insurance Effectively

To get the most out of Medicare and supplemental insurance, understanding the different parts of Medicare is crucial. Medicare part A covers hospital stays, while Part B takes care of outpatient services, including doctor visits. To fill the gaps left by Medicare, you might consider Medigap policies, also known as supplemental insurance, which can definitely help cover out-of-pocket costs like copayments, coinsurance, and deductibles. Here are some key strategies to consider:

- Review Your Coverage Annually: Make it a habit to reassess your Medicare options during the annual enrollment period, which runs from October 15 to december 7. This allows you to switch your plans based on your current health needs.

- Choose the Right Medigap Plan: Not all Medigap plans are created equal.Understanding the different plan types (Plans A through N) can help you select one that best meets your healthcare requirements and budget.

- Leverage Preventive Services: Medicare offers a range of preventive services at no cost.Take advantage of annual wellness visits and screenings to keep track of your health without incurring additional expenses.

Additionally, you may want to explore how your supplemental insurance works in tandem with Medicare. knowing the extent of coverage can prevent unexpected medical bills. For instance, some Medigap plans cover overseas emergencies, which can be beneficial for those who travel. Below is a fast comparison of typical Medigap benefits that may help in your decision-making:

| Medigap Plan | Hospital Deductible | Outpatient Coinsurance | Foreign Travel Emergency |

|---|---|---|---|

| Plan G | Covered | Covered | 80% after $250 |

| plan N | Partially covered | Covered, but with copay | 80% after $250 |

| Plan F | Covered | Covered | 80% after $250 |

Implementing Preventive Care to Reduce Long-Term Expenses

Investing in preventive care is a wise strategy that can significantly diminish long-term healthcare expenses, especially for retirees. Regular check-ups, screenings, and vaccinations can catch potential health issues before they escalate into more costly conditions. emphasizing a proactive approach to health can lead to better outcomes and reduced reliance on chronic disease management. Key elements to consider include:

- Annual Physical Exams: These help identify health risks early.

- Routine Screenings: Monitoring for conditions like diabetes and hypertension.

- Vaccinations: Staying up-to-date can prevent severe illnesses.

- Healthy Lifestyle Choices: Encouraging balanced diets and regular exercise.

Additionally, building a comprehensive care plan tailored to individual health needs can contribute significantly to long-term savings. This plan should incorporate regular consultations with healthcare providers, and also access to wellness programs. Below is an example of how preventive measures can translate into cost savings:

| Preventive Measure | Potential Cost Savings |

|---|---|

| Annual blood Pressure Screening | $200-$500 |

| Diabetes Prevention Program | $2,500/year |

| Flu Vaccine | $40-$80 |

| Colonoscopy (every 10 years) | $1,000-$3,000 |

Creating a Sustainable Budget for Healthcare needs in retirement

To achieve a sustainable budget for healthcare needs in retirement, it is indeed essential to start with a comprehensive assessment of potential medical expenses. Begin by creating a detailed inventory of expected healthcare costs,including medications,routine check-ups,and emergency services. Consider the impact of chronic conditions and specialized care, as these can significantly inflate your budget.To provide further clarity, the following factors should be evaluated:

- Medicare Coverage: Understand what parts of Medicare cover various healthcare services and identify any gaps in coverage.

- Supplemental Insurance: Look into medigap policies or Medicare Advantage plans that can help offset out-of-pocket expenses.

- Long-Term Care Needs: Account for the potential need for assisted living or nursing home care, which can be a substantial financial burden.

once you have established an expected healthcare expenditure, it’s vital to integrate this into your overall financial plan. This can involve setting aside a designated healthcare fund, adjusting your spending habits, or reallocating investments to ensure you have the necessary resources. A practical approach is to utilize the 15/15 rule: save 15% of your income for health-related expenses and regularly re-evaluate this figure. The table below summarizes how to implement a sustainable healthcare budgeting strategy:

| strategy | Description |

|---|---|

| Emergency Fund | Maintain a fund specifically for unexpected healthcare expenses. |

| Health Savings Account (HSA) | Contribute to an HSA for tax-advantaged savings dedicated to medical costs. |

| Regular Budget Review | Review and adjust your healthcare budget annually to accommodate changes in health status or costs. |

Future Outlook

As we conclude our exploration of essential strategies for managing healthcare costs in retirement,it’s clear that proactive planning and informed decision-making are key. By understanding potential expenses, leveraging available resources, and making strategic choices about insurance and care options, retirees can significantly alleviate financial stress and secure peace of mind.

Remember, your health is one of your most valuable assets, and taking steps now to prepare for healthcare expenses can lead to a more pleasant and fulfilling retirement. Whether it’s engaging in preventative care, exploring Medicare options, or setting aside dedicated savings, every little bit helps in crafting a robust financial strategy.

As you navigate this crucial phase of life,remain adaptable and informed. Regularly reviewing your healthcare plan and costs will empower you to make adjustments that align with your evolving needs. By staying proactive and connected with healthcare professionals, you can ensure that you’re ready to embrace retirement—not just with joy, but with financial confidence.

Thank you for joining us in this discussion on managing healthcare costs in retirement. We hope these insights empower you to take control of your health and finances for a secure, thriving retirement. If you have any questions or would like to share your experiences, feel free to leave a comment below. Here’s to making informed choices and enjoying the golden years ahead!