Introduction:

In today’s fast-paced world, mastering your finances can feel like an overwhelming task, especially for those just starting on their budgeting journey. Whether you’re a recent graduate managing student loans, a young professional saving for your first home, or anyone looking to gain better control over their financial future, the ability to budget effectively is essential for achieving long-term goals. With countless budgeting methods available, finding the right approach can be daunting.That’s why we’ve compiled this guide to the top budgeting methods for beginners. By demystifying these popular strategies and highlighting their key benefits, we aim to equip you with the tools needed to establish a solid financial foundation and pave the way toward lasting financial success. Join us as we explore user-friendly budgeting methods that not only fit your lifestyle but also empower you to take charge of your money with confidence.

Table of Contents

- Understanding the Importance of Budgeting for Financial Health

- Exploring Popular Budgeting Methods: Which One is Right for You?

- Practical Tips for Implementing Your Chosen Budgeting Strategy

- Overcoming Common Budgeting Challenges to Ensure Long-term Success

- The Way Forward

Understanding the Importance of Budgeting for Financial Health

Having a solid budgeting strategy is a cornerstone of achieving financial stability and success. It provides a framework for tracking income and expenses, enabling you to understand where your money goes each month. By prioritizing essential expenses and identifying discretionary spending, budgeting empowers you to make informed decisions about both your present and future financial health. Effective budgeting helps mitigate debt, encourages savings, and puts you on a path toward your financial goals, whether that means buying a home, traveling, or retiring comfortably.

To illustrate the impact of budgeting, consider the key benefits it offers:

- increased Awareness: Budgeting fosters a deeper understanding of your finances.

- Better financial Control: It allows you to tweak your spending habits for more efficient use of your resources.

- Goal Achievement: A budget helps in setting and reaching short- and long-term financial goals.

- Emergency Preparedness: By saving regularly, you can create a cushion for unexpected expenses.

Here’s a simple budgeting breakdown to demonstrate how different expense categories can be managed effectively:

| Category | Percentage of Income |

|---|---|

| Essentials (Rent, utilities, groceries) | 50% |

| Savings & Investments | 20% |

| Discretionary Spending (Dining Out, Entertainment) | 20% |

| Debt Repayment | 10% |

This table exemplifies the typical “50/30/20” budget rule, which can serve as a solid starting point for beginners. Tailoring this framework to your specific situation will enhance your financial literacy and set a strong foundation for a healthier financial future.

Exploring Popular Budgeting Methods: Which One is Right for You?

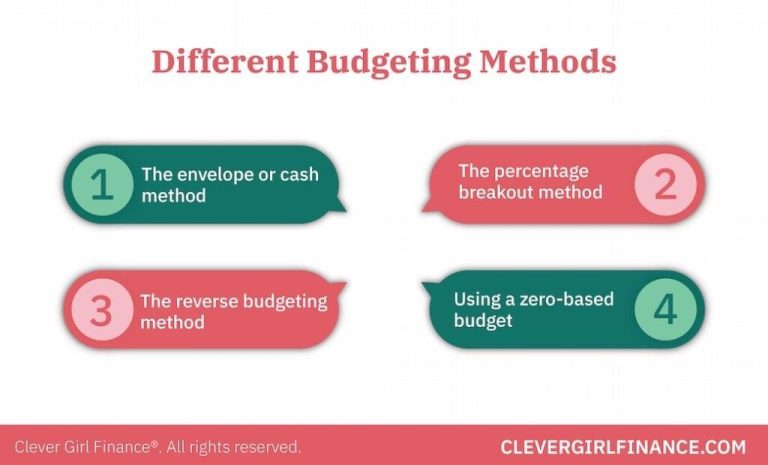

When it comes to managing your finances, choosing the right budgeting method can make all the difference. there are several popular strategies designed to help individuals gain control over their spending and savings. The Zero-Based Budgeting method requires you to allocate every dollar of your income to specific expenses, savings, or debt repayment, ensuring that your income minus expenses equals zero. In contrast, the 50/30/20 Rule breaks down your budget into three main categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment. This approach is straightforward and can be easily tailored to various income levels.

For those who prefer a more visual method, the Envelope System allows you to use cash for different spending categories by placing cash in envelopes. Once the cash is gone, no more spending can occur in that category, which can curb impulse purchases. Alternatively, the Pay Yourself First technique advocates for prioritizing savings before any other expenses. This method encourages you to automatically transfer a portion of your income to savings before budgeting for other expenditures. Each method has its unique benefits; exploring and experimenting with them can help you find the perfect fit for your financial goals and lifestyle.

Practical Tips for Implementing Your Chosen Budgeting Strategy

To successfully implement your chosen budgeting strategy,start by setting clear and realistic financial goals. Define what you hope to achieve with your budget, whether it’s saving for a vacation, paying off debt, or building an emergency fund. Break these goals into smaller, actionable steps. For example, if you’re aiming to save $1,200 for a vacation, plan to save $100 each month. Additionally, track your expenses regularly to ensure you stay within your budget limits. Tools such as budgeting apps or budgeting spreadsheets can streamline this process and keep your spending in check.

Establish routines that reinforce your budgeting efforts. Consider setting aside a specific time each week or month dedicated to reviewing your financial progress. During this time, adjust your budget as necessary to reflect changes in income or expenses. Remember to automate savings where possible; for instance, set up automatic transfers to your savings account right after payday. This ensures that you’re prioritizing your financial goals. Here’s a simple table summarizing essential routines to incorporate into your budgeting strategy:

| Routine | Frequency | Purpose |

|---|---|---|

| Review Budget | Monthly | Track expenses and adjust goals |

| Automate Savings | After each paycheck | Ensure savings are prioritized |

| Set Spending Limits | Weekly | Stay within budgeted amounts |

Overcoming Common Budgeting Challenges to Ensure Long-term Success

Budgeting can frequently enough feel like an uphill battle, especially for those just starting on their financial journey. one of the most meaningful challenges is creating a budget that accurately reflects your income and expenses. To tackle this,try to track all your spending for at least a month. This way, you can identify patterns and areas that may need adjustment. Additionally, make sure to factor in irregular expenses, such as annual subscriptions or seasonal costs. Understanding your financial landscape helps in crafting a more realistic budget, ensuring that it effectively works for you rather than against you.

Another common hurdle is maintaining the discipline to stick to your budget. It’s easy to get sidetracked with impulsive purchases or lifestyle creep. To strengthen your resolve, consider implementing a few strategies. Set aside a contingency fund for those unexpected expenses to reduce the temptation of dipping into your budget. Also, establish financial goals—whether short-term, like saving for a vacation, or long-term, like retirement—to motivate yourself. Remember that budgeting isn’t a one-time task; it’s essential to regularly review and adjust your budget as your financial situation evolves.Keeping your goals visible can greatly enhance your commitment to following through.

The Way Forward

navigating your financial journey can seem daunting, but implementing the right budgeting method can make all the difference. As we’ve explored in this guide, whether you choose the traditional envelope system, the zero-sum budgeting approach, or the ever-popular 50/30/20 rule, each method offers unique advantages to help you gain control over your finances. Remember, the key to financial success lies not in a one-size-fits-all approach but in selecting and adapting a budgeting method that aligns with your personal goals and lifestyle.

as you embark on this path towards financial empowerment, keep in mind that budgeting is an ongoing process. Regularly revisiting and adjusting your budget will help you stay on track and adapt to life’s changes. With dedication and discipline, you’ll not only reach your financial goals but also cultivate habits that will lead to long-term prosperity.

If you found this guide helpful, consider sharing it with friends or family who could benefit from a little financial guidance. Your journey towards financial success is just beginning—embrace it with confidence and watch your efforts pay off in the long run!