In today’s economic climate, teh specter of inflation looms large, affecting everything from grocery bills to gas prices and housing costs. As prices rise, many individuals and families find themselves grappling with financial uncertainty and searching for ways to maintain their standard of living. Understanding inflation and its implications on personal finance is no longer just an academic concern; it has become a practical necessity for anyone looking to secure their financial future. In this guide, we will explore the nuances of inflation, how it impacts personal finances, and practical strategies to manage your money effectively in these challenging times. Whether you’re a seasoned investor or just starting to navigate your financial journey, arming yourself with knowledge about inflation is the first step towards making informed decisions that can help you weather economic fluctuations with confidence. Let’s dive into the world of personal finance amidst inflation and discover actionable insights to help you thrive.

Table of Contents

- Understanding the Basics of Inflation and Its Effects on Personal Finance

- Strategic Budgeting: Adjusting Your Financial Plan in an Inflationary Environment

- Investing Wisely: Adapting Your Portfolio to Combat Inflation

- Practical Tips for Saving Money and Reducing Expenses Amid Rising Prices

- Concluding Remarks

Understanding the Basics of Inflation and Its Effects on Personal Finance

Inflation is the gradual increase in the prices of goods and services over time, which means that the purchasing power of your money declines. Understanding its mechanics is essential for effective personal finance management. Here are some key aspects to consider:

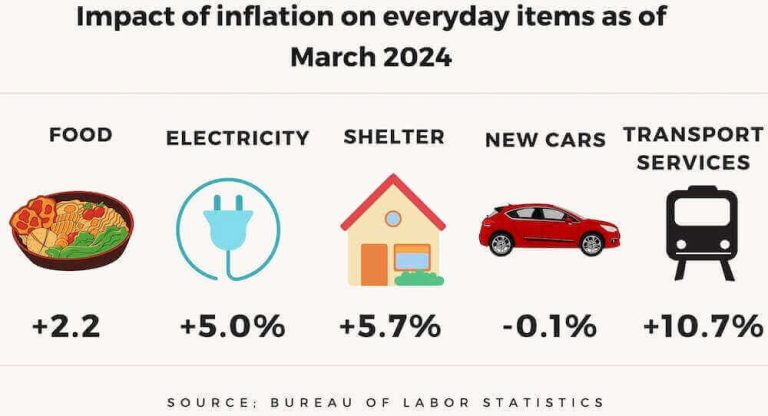

- Cost of Living: As inflation rises, your everyday expenses—such as groceries, utilities, and transportation—tend to increase, impacting your budget and overall financial health.

- Investment Strategies: Inflation affects different asset classes differently. Stocks, real estate, and commodities may provide a hedge against inflation, while fixed-income investments like bonds are at more risk.

To manage the impact of inflation, tracking your expenses and adjusting your budget accordingly is crucial. Creating a strategy that includes:

| Strategy | Description |

|---|---|

| Adjusting Budgets | Regularly revisit and update budget allocations to account for rising costs of necessities. |

| Investing Wisely | Diversify investments to include assets that typically perform well during inflationary periods. |

| Minimizing Debt | Avoid high-interest debt as it can become increasingly harder to manage when inflation is high. |

Strategic Budgeting: Adjusting Your Financial Plan in an Inflationary Environment

As inflation erodes purchasing power, it becomes critical to recalibrate your financial strategy. In this environment, your budget should be proactive rather than reactive. Begin by reviewing your current expenses and categorizing them into essentials and non-essentials. This will help you identify areas where cuts can be made without sacrificing your quality of life. Consider these adjustments:

- Prioritize necessities: Focus on food, housing, and healthcare.

- Evaluate discretionary spending: Limit entertainment and dining out.

- Plan for price increases: Allocate more funds for essential services that might rise in cost.

Along with revising spending habits, you should also reassess your savings and investment strategies.With rising costs, it may be wise to set aside a larger emergency fund to buffer against unexpected expenses. Explore flexible investments that can help you stay ahead of inflation, such as stocks or real estate. Here’s a quick comparison of various investment options and their potential benefits:

| Investment Type | Risk Level | Potential Return |

|---|---|---|

| Stocks | High | 8-10% annually |

| bonds | Medium | 2-5% annually |

| Real Estate | Medium-High | 5-7% annually |

| high-Yield Savings accounts | Low | 0.5-1.5% annually |

Investing Wisely: Adapting Your Portfolio to Combat Inflation

As inflation rises, it’s crucial to reassess your investment strategy to safeguard and potentially grow your wealth. Diversification remains a key tactic; by spreading your investments across various asset classes, you can manage risks associated with inflation.Consider allocating more of your portfolio to inflation-hedged assets such as real estate, commodities, and treasury inflation-protected securities (TIPS). These options tend to hold their value or appreciate during inflationary periods, thus providing a buffer against the erosion of purchasing power.

Moreover, it’s significant to be proactive in adjusting your asset allocations to fit your risk tolerance and financial goals. Regularly reviewing sectors such as healthcare, energy, and consumer staples can reveal opportunities well-suited to an inflationary landscape. Below are some suggested asset classes to consider in your portfolio during inflationary times:

- Real Estate Investment Trusts (REITs) – Potential for rental income and property value gratitude.

- Commodities – Assets like gold and oil frequently enough thrive when inflation rises.

- Stocks – focus on companies with pricing power that can pass costs to consumers.

- Bonds – TIPS or shorter-duration bonds can mitigate interest rate risk.

By tailoring your investments to the realities of inflation, you’ll not only protect your current wealth but stand a better chance of achieving future financial objectives. Below is a simple table summarizing the potential benefits of different types of investments in an inflationary environment:

| Investment Type | Benefit |

|---|---|

| Real Estate | Steady cash flow and asset appreciation |

| Commodities | Protection against currency devaluation |

| Stocks | Potential for higher returns despite volatility |

| TIPS | Guaranteed return linked to inflation rate |

practical Tips for Saving Money and Reducing Expenses Amid Rising Prices

In today’s economic climate,finding ways to save money and cut unnecessary expenses is more crucial than ever. Start by evaluating your daily purchases and consider implementing the 50/30/20 rule for better budgeting. This means allocating 50% of your income to necessities, 30% to personal desires, and 20% to savings. Keep track of your spending habits with mobile budgeting apps that offer insights into where your money goes. Additionally, consider creating shopping lists to avoid impulse buys and stick to your intended purchases.

Moreover, it might be beneficial to reassess ongoing subscriptions and memberships. You might be surprised at how much those small monthly fees can accumulate over time. Conduct a thorough review to identify which subscriptions you actively use and which can be dropped. Another way to further scrutinize your expenses is by comparing energy prices, insurance providers, or even grocery stores. Reward programs and discount apps can also provide significant savings if used wisely.Check out the table below for simple strategies to trim down your budget:

| Strategy | Estimated Savings |

|---|---|

| Switch to generic brands | Up to 30% |

| Meal planning | Up to $300/month |

| Cancel unused subscriptions | $10 – $50/month |

| Use public transportation | $100/month |

Concluding Remarks

navigating the complexities of inflation can be daunting, but with the right strategies, you can safeguard your financial well-being and make informed decisions that benefit your long-term goals. Understanding the dynamics of rising prices is essential in today’s economy, and taking proactive measures—such as adjusting your budgeting, exploring investment opportunities, and minimizing debt—can effectively mitigate inflation’s impact on your personal finances.

Remember, the key is to stay informed and adaptable. Regularly reassessing your financial plan and being open to adjustments can empower you to thrive, even in challenging economic conditions. As we continue to face fluctuating prices and evolving market trends, investing time in educating yourself about financial literacy will pay dividends in securing a stable financial future.

Thank you for joining us on this journey through managing the effects of inflation. We encourage you to share your thoughts and strategies in the comments below, and as always, stay connected for more insights and tips on achieving financial health in an ever-changing landscape. Here’s to making savvy financial choices and weathering the storms of inflation together!