In today’s fast-paced financial landscape, managing your money effectively is more crucial than ever. Among the myriad of financial tools at your disposal, checking accounts serve as a foundational element in personal finance that frequently enough goes underappreciated. Whether your paying bills, making everyday purchases, or budgeting for future expenses, a checking account provides a convenient and secure method for handling your day-to-day transactions. In this article, we’ll delve into the essential role checking accounts play in empowering individuals to take charge of their finances, explore their features, and discuss best practices for maximizing their benefits. Join us as we uncover why a checking account is not just a simple banking tool, but a key player in building a stable financial future.

Table of Contents

- The Foundation of Personal Finance: Why Checking Accounts Matter

- Key Features of Checking Accounts and Their Impact on Your Financial Health

- Maximizing Your Checking Account Benefits: Tips and Strategies for Success

- Safeguarding Your Finances: best Practices for Managing Your Checking Account

- The way Forward

The Foundation of Personal Finance: Why Checking Accounts Matter

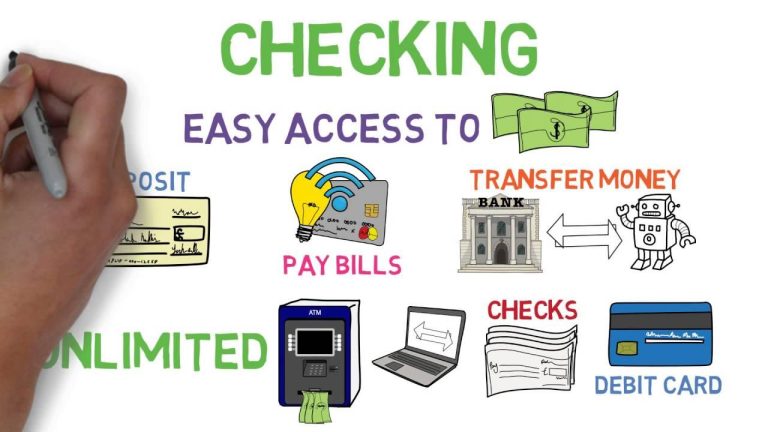

Checking accounts are the backbone of personal finance, serving as a vital tool for managing daily expenses and income. They provide a secure and convenient way to handle cash flow, ensuring that money is readily accessible when needed. Wiht features like online banking and mobile apps, checking accounts allow individuals to track their spending in real-time, categorize expenses, and create budgets effectively. This visibility into one’s financial habits can significantly contribute to improved financial health and awareness.

Furthermore,checking accounts offer essential benefits that can enhance financial stability. A few key advantages include:

- Liquidity: Funds in a checking account are easily accessible, allowing fast withdrawals and transfers.

- No Limits on Transactions: unlike savings accounts that may have transaction limits, checking accounts typically allow unlimited withdrawals.

- Overdraft Protection: Many checking accounts come with options for overdraft protection, helping avoid insufficient fund fees.

To illustrate the impact of managing money through a checking account, consider the following comparison of monthly expenses:

| Expense Category | Monthly Allocation |

|---|---|

| Housing | $1,200 |

| Groceries | $400 |

| Utilities | $150 |

| Transportation | $250 |

| Entertainment | $200 |

key Features of Checking Accounts and Their Impact on Your Financial Health

Checking accounts serve as the basic backbone of personal finance, offering several influential features that help individuals manage their daily expenses and savings effectively. One key feature is easy access to funds,enabling account holders to withdraw cash or make purchases at any time without restrictions. additionally, the availability of online and mobile banking has transformed how users interact with their accounts, allowing for instant fund transfers, bill payments, and real-time tracking of expenses. With features like overdraft protection, individuals can avoid the pitfalls of insufficient funds, thus maintaining financial stability.

Moreover, checking accounts often come with low to no fees, making them accessible for everyone, particularly for those just starting their financial journey. Many institutions offer rewards such as cash back on debit card purchases, enhancing the utility of the account. To illustrate, here’s a comparison of common benefits associated with checking accounts:

| Feature | Benefit |

|---|---|

| Low Fees | minimizes unnecessary expenses |

| Mobile Banking | Convenience for managing funds |

| Overdraft Protection | Prevents missed payments |

| Rewards Programs | Earn money on purchases |

Maximizing Your Checking Account Benefits: Tips and Strategies for Success

To truly harness the advantages of your checking account, it’s essential to delve into strategies that enhance your banking experience. Choose the right account: Look for a checking account that aligns with your lifestyle—consider features like no monthly fees, overdraft protection, and easy access to ATMs.Take advantage of mobile banking tools: Many banks offer user-pleasant apps that allow you to manage your finances on the go. Utilize these tools for things like bill payments,fund transfers,and monitoring your spending habits in real-time. Regularly reviewing your account statements can also help you identify and eliminate unnecessary fees.

Furthermore, maximize rewards and benefits that come with your checking account. Some accounts offer cash back on certain purchases or interest rates that can help your money grow. Utilize budgeting features provided by many banks to categorize your spending, making it easier to stick to your financial goals.Creating a clear plan for your expenses can prevent overspending and keep your finances in check. Additionally, participating in bank promotions or referral programs could yield bonus funds—making your account even more fruitful. Below is a quick comparison of checking account features that could aid in making a decision:

| Feature | Account A | Account B | Account C |

|---|---|---|---|

| No Monthly Fee | ✔️ | ✔️ | ❌ |

| ATM Access | Nationwide | Limited Zone | International |

| Cash Back Rewards | ✔️ | ❌ | ✔️ |

Safeguarding Your Finances: Best Practices for Managing Your Checking Account

To effectively safeguard your finances, meticulous management of your checking account is a fundamental practice. Start by regularly monitoring your account to identify any unauthorized transactions or potential errors. Set up alerts to notify you of significant changes, such as large withdrawals or deposits. This proactive approach not only enhances your financial awareness but also serves as an early warning system against fraud. Additionally, maintaining a detailed budget that aligns with your checking account activity can empower you to track your spending habits and make informed financial decisions.

Another essential strategy is to utilize your bank’s resources to their fullest potential. Many institutions offer tools like mobile banking apps that provide instant access to your account details, enabling you to quickly check your balance, make transfers, and deposit checks digitally. Consider opting for overdraft protection to avoid costly fees, but be mindful of the terms involved to prevent relying on it excessively. Lastly, keep an organized transaction history and regularly reconcile your accounts to ensure accuracy. This not only helps in spotting discrepancies but also strengthens your financial literacy over time.

The Way Forward

checking accounts are more than just a place to store your money; they are a cornerstone of effective personal finance management. By providing a safe and accessible way to manage daily expenses, facilitate transactions, and keep track of financial health, checking accounts play a vital role in supporting your financial goals. As you navigate your personal finance journey,understanding the functionalities and benefits of your checking account can empower you to make informed decisions,avoid unnecessary fees,and optimize your budgeting strategies.

Remember, it’s not just about having an account; it’s about using it wisely. Regularly monitor your spending, take advantage of the tools and resources your bank offers, and don’t hesitate to seek out features that can enhance your financial experience. With a solid understanding of your checking account, you are well on your way to achieving greater financial stability and success. So, take a moment to review your current practices and consider how you can better leverage your checking account as a vital tool in your financial toolkit. Happy banking!