In today’s fast-paced world, managing your finances can often feel like a daunting task. With multiple credit cards, varying due dates, and the constant influx of bills, it’s all too easy to overlook a payment or two. Missing a credit card payment not only incurs late fees but can also negatively impact your credit score, making future borrowing more challenging and expensive. However, there’s a powerful tool at your disposal that can transform your payment routine: credit card alerts. In this article, we’ll explore how mastering credit card alerts can streamline your financial management, ensuring that you never miss a payment again.From setting up customizable notifications to leveraging mobile apps, we’ll guide you through the practical steps to take control of your credit card due dates, enhance your financial wellbeing, and ultimately, build a more secure future. Let’s dive into the world of credit card alerts and empower you to achieve financial peace of mind.

Table of Contents

- Understanding Credit Card Alerts and Their Importance

- Setting Up Effective Alert Systems for Timely Notifications

- choosing the right Channels for Receiving Alerts

- Best Practices to Ensure You never Miss a Payment again

- In Summary

Understanding Credit Card Alerts and Their Importance

Credit card alerts serve as a crucial safety net for cardholders, providing timely notifications that help manage spending and ensure responsible financial habits. Thes alerts can cover a wide range of events, including payment due dates, transaction alerts, and credit limit reminders. By setting up personalized notifications through your credit card provider, you can avoid late fees and protect your credit score. Understanding and leveraging these alerts may lead to better budgeting practices, encouraging you to stay on top of your finances without the stress of constant monitoring.

Different types of credit card alerts cater to the varying needs of users, making it easy to stay informed and take action when necessary. Consider setting alerts for:

- Due Date Reminders: Get notified a few days before your payment is due.

- Spending Limits: Receive alerts when you approach or exceed your set budget.

- Unusual Activity: Be informed of transactions that are out of the ordinary to report potential fraud.

Leveraging these tools not only helps maintain a healthy credit profile but also instills confidence in your financial decisions. By engaging with these insights actively,you can create a proactive approach to managing your credit habits effectively.

Setting Up Effective Alert Systems for Timely Notifications

Creating an effective alert system requires careful consideration of your preferences and habits.Start by selecting the right channels for notifications—whether it’s through email, SMS, or a mobile app. Each channel has its advantages; as an example,SMS can provide immediate alerts,while email offers a detailed overview of your account activities.Ensure that notifications are set up for key events, such as:

- Payment due dates

- Transaction alerts for purchases

- Balance updates

- Annual fee reminders

By customizing your alert settings, you can tailor notifications to match your lifestyle, minimizing the risk of missing crucial payment deadlines.

Additionally, consider implementing two-factor authentication for added security.This ensures that your alerts are not just timely but also secure from unauthorized access. To keep everything organized, you might want to maintain a simple matrix of your alert preferences and methods. Here’s an example of how you might structure it:

| Alert Type | Method of Notification | Frequency |

|---|---|---|

| Payment Due Date | SMS | 1 day before |

| Transaction Alert | Immediate | |

| Balance Update | App Notification | Weekly |

| Annual Fee Reminder | 1 month prior |

Choosing the Right Channels for Receiving Alerts

When it comes to receiving alerts about your credit card activity,selecting the appropriate channels can significantly enhance your ability to stay informed. each method of communication has its perks and can be tailored to fit your lifestyle. Consider the following channels:

- Email Alerts: Receive detailed notifications directly in your inbox. Ideal for keeping a comprehensive record.

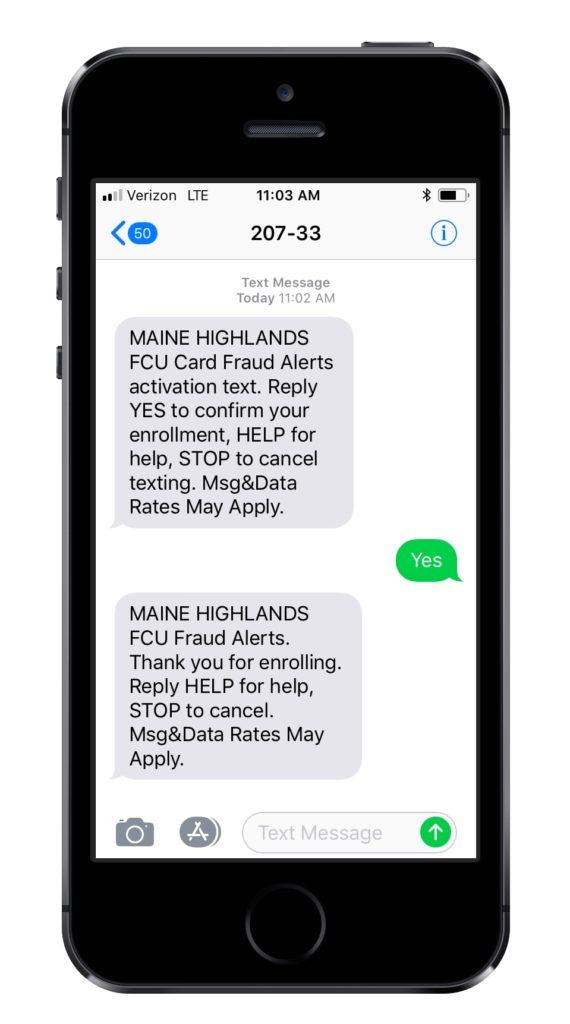

- SMS Notifications: Get instant updates on your phone for immediate action on urgent matters.

- Mobile App Alerts: Monitor your credit card activity in real-time through an app, giving you speedy access and control.

- Push Notifications: Enable alerts on your smartphone to receive timely reminders, ensuring you never miss important updates.

While convenience is key,it is essential to prioritize security amidst these channels. Here’s a brief comparison of available alert channels based on factors such as immediacy, security, and detailed data:

| Channel | Immediacy | Security | Details |

|---|---|---|---|

| Email Alerts | Moderate | High | Comprehensive summary of activity |

| SMS Notifications | High | Moderate | Quick transaction updates |

| Mobile App Alerts | Very High | Very High | Interactive information |

| Push Notifications | High | Moderate | Immediate alerts |

Best Practices to Ensure You Never Miss a Payment Again

Staying on top of your credit card payments has never been easier with the right strategies in place. Start by utilizing your bank’s mobile app to set up payment reminders. Most modern banking apps offer customizable alerts to notify you before your payment is due. You can choose how far in advance you want to be notified—be it a few days or a week.Additionally, consider using a digital calendar or task management app to mark payment due dates. Sync your due dates with an app that sends notifications directly to your phone. This dual approach significantly reduces the chance of forgetting a payment.

Another useful tactic is to create a specific payment schedule based on your paydays. By aligning your credit card due dates with your income, you ensure that funds are readily available for payment. Establish a routine that includes reviewing your statements regularly, which will help you stay aware of upcoming due dates and any changes to your billing cycle. For optimal organization,set up a simple table that tracks your payment dates and amounts:

| Payment date | Payment Amount | Method of Payment |

|---|---|---|

| 1st of Month | $100 | credit Card |

| 15th of Month | $150 | Direct Debit |

| End of Month | $50 | Manual Payment |

In Summary

mastering credit card alerts is a powerful tool in your financial toolkit that can significantly reduce the Stress associated with missed payments. By leveraging technology and setting up customized alerts, you empower yourself to stay organized and proactive, ensuring that your bills are paid on time, every time. Not only does this practice save you from late fees, but it also helps you maintain a healthy credit score, putting you on the path to financial freedom.

Take the time to explore the alert features offered by your credit card provider and personalize them to fit your lifestyle. Whether it’s through email, SMS, or app notifications, make sure these reminders work for you. Remember, the key to successful credit management lies in your willingness to stay informed and engaged with your financial obligations.

By adopting these tips and strategies, you’ll transform alert notifications from mere reminders into essential components of your financial success. So, take charge of your finances today and never miss a payment again! Your credit future is in your hands—make it a bright one.