Managing personal finances can often feel overwhelming, especially when juggling multiple bills and due dates. One powerful solution too streamline your financial responsibilities is setting up automatic bill payments. with the right system in place, you can not only simplify your budgeting but also avoid late fees, enhance your credit score, and free up valuable time to focus on what truly matters. In this article, we’ll explore the benefits of effortless finances through automatic bill payments, guide you through the steps to set them up effectively, and provide tips for ensuring that your financial commitments stay on track. Say goodbye to payment headaches and hello to peace of mind as we navigate the world of automated payments together.

Table of Contents

- Understanding the Benefits of Automatic Bill Payments

- Choosing the Right Accounts for Automation

- Step-by-Step Guide to Setting Up Automatic Payments

- Maintaining control and Monitoring Your Financial Health

- Key Takeaways

Understanding the Benefits of Automatic Bill Payments

One of the moast significant advantages of setting up automatic bill payments is the sheer convenience it offers. By automating your payment schedule, you eliminate the hassle of remembering due dates or writng checks, allowing you to manage your finances more efficiently. This not only saves time but also reduces the mental load associated with financial management. Additional benefits include:

- Late Fee Prevention: Ensure timely payments and avoid unneeded penalties.

- Improved Budgeting: Predictable monthly expenses help you manage your budget effectively.

- Environmental Impact: Reduces paper waste by minimizing the need for physical bills and checks.

Moreover, automating payments can enhance your credit score. Consistent on-time payments reflect positively on your credit report, boosting your overall financial health.Many service providers and financial institutions now offer user-friendly platforms to set up automated payments with ease.You can customize payment amounts and frequencies to align with your financial goals. here’s a simple breakdown of typical bills suited for automation:

| type of Bill | Frequency |

|---|---|

| Utilities | Monthly |

| Internet | Monthly |

| Subscription Services | Monthly/Yearly |

| Insurance Premiums | Monthly/Quarterly |

Choosing the Right Accounts for Automation

Selecting the appropriate accounts for automating your bill payments is crucial to ensuring a seamless financial experience. Begin by identifying your recurring expenses, such as utilities, subscriptions, and loan payments.Focus on accounts that offer online banking features, allowing you to set up automatic payments efficiently. Here are some essential elements to consider when choosing your accounts:

- Payment adaptability: Ensure the bank provides flexible payment options that cater to varying due dates.

- No or Low fees: Opt for accounts with minimal fees to maximize your savings.

- Transfer Limits: Check for any limits on transactions that may restrict your ability to pay bills consistently.

Additionally, don’t overlook the importance of account security and customer support.Look for banks that offer robust security measures, including two-factor authentication and 24/7 customer service. It’s also wise to assess account integration features, which can help you link your bank with financial management tools. Below is a table comparing key features of popular banking accounts suited for automation:

| Bank | Payment Flexibility | Monthly Fees | Customer support |

|---|---|---|---|

| Bank A | Flexible | $0 | 24/7 |

| Bank B | Limited | $5 | Business hours |

| Bank C | Flexible | $0 | 24/7 |

Step-by-Step guide to Setting Up Automatic Payments

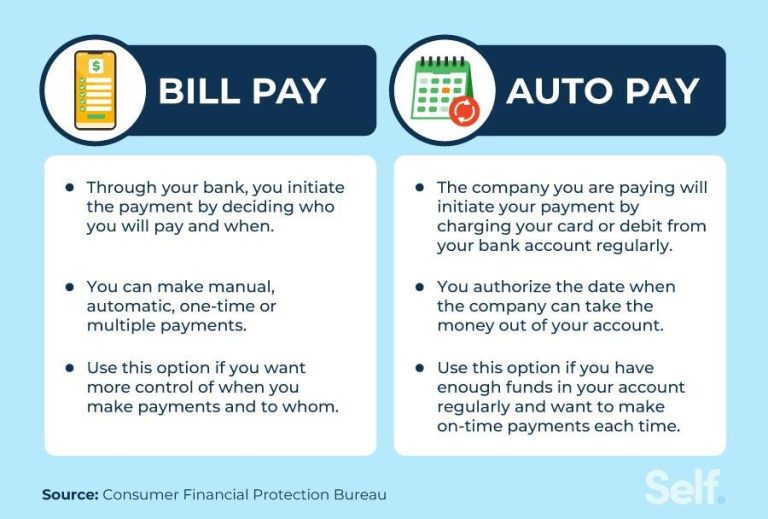

To set up automatic payments, start by gathering your necessary data. This includes details like your bank account number, payment methods (credit/debit cards), and the billing information for each service provider or utility company. Next, log in to your online banking account or payment service app. Navigate to the section that manages automatic payments or scheduled transfers. Here you will initiate the setup by inputting the required information for each bill, ensuring accuracy to avoid any disruptions in service.

Once you’ve entered all the needed details,it’s important to review and confirm your settings. Double-check the billing cycles, payment amounts, and due dates for each transaction to ensure everything aligns with your financial planning.Many services also offer an option to receive notifications about upcoming payments that can definitely help you stay on top of your finances. make sure to test the process by setting a minimal amount for an initial transaction to confirm everything is working smoothly before the actual bills are due.

Maintaining Control and Monitoring Your Financial Health

To effectively manage your finances while setting up automatic bill payments, it’s crucial to keep a close eye on your financial health. Here are some important strategies to consider:

- Set reminders: Even with automatic payments, create calendar reminders before due dates to ensure there are sufficient funds in your account.

- Review Statements: Regularly review your bank and credit card statements to catch any discrepancies or unauthorized charges.

- Utilize Financial Apps: Make use of budget-tracking apps that sync with your bank accounts to keep you informed of your spending habits.

Additionally, consider establishing a contingency plan for unexpected events. for example, if your income fluctuates or you encounter an unexpected expense, having a cushion can prevent late fees associated with declined payments.A simple method to assess your financial standing includes:

| metric | Recommended Action |

|---|---|

| Emergency Fund | Maintain 3-6 months of expenses |

| Debt-to-Income Ratio | Aim for below 36% |

| Savings Rate | Save at least 20% of your income |

Key Takeaways

setting up automatic bill payments is not just a trend—it’s a financial strategy that can lead to greater peace of mind and efficiency in managing your finances. By embracing automation, you free up your time and minimize the stress associated with missed payments and late fees. With a few simple steps, you can take control of your bills while ensuring that your financial obligations are met consistently and on time.

Remember, while automation dose simplify your financial life, it’s essential to keep an eye on your accounts regularly.This allows you to stay informed about your spending habits and make any adjustments as needed. Whether you’re navigating personal finance for the first time or looking to streamline your existing processes,setting up automatic payments can be a game changer.

So why not take the plunge? Start with one or two of your regular bills and gradually expand as you become more pleasant.Your future self will thank you for the time and energy saved, allowing you to focus on what truly matters in life.Here’s to effortless finances and a more organized, stress-free financial journey!