entering college is a thrilling milestone,marked by new experiences,friendships,and,frequently enough,a fair share of financial challenges. For many students, managing finances can feel daunting, especially when juggling tuition fees, living expenses, and the occasional late-night pizza delivery. However, mastering your finances isn’t just about balancing your bank account; it’s a vital skill that can pave the way for a successful future. In this comprehensive guide, we’ll dive into practical budgeting strategies tailored specifically for college students. From understanding your income and expenses to exploring smart saving tips and useful apps, you’ll learn how to take control of your financial journey. Whether you’re a freshman or nearing graduation, this guide is designed to empower you with the tools and knowledge to navigate your financial landscape with confidence. Let’s get started on the path to financial mastery!

Table of Contents

- Understanding Your Income Sources and Financial Responsibilities

- Creating a Realistic Budget: Tools and Techniques for Success

- Smart Spending: Strategies for Managing Your Expenses Effectively

- Building Credit Early: Tips for College Students to Establish Financial Stability

- To Conclude

Understanding Your Income Sources and Financial Responsibilities

To effectively manage your finances, it’s essential to have a clear understanding of the various income sources available to you as a college student.Common avenues of income may include:

- Part-time jobs: Many students work in cafés, retail stores, or on campus to earn extra income.

- Scholarships and grants: These funds do not need to be repaid and can significantly ease your financial burden.

- Student loans: While these can help cover tuition and living expenses, it’s crucial to borrow wisely.

- Family support: Some students receive financial assistance from parents or guardians to help with schooling costs.

Once you’ve identified your income sources,it’s time to assess your financial responsibilities. Understanding what you owe and what you’re expected to manage can set a solid foundation for responsible budgeting. Key expenses often include:

| Expense Type | Monthly Estimate |

|---|---|

| Rent | $500 – $1,200 |

| Utilities | $100 – $200 |

| Groceries | $200 – $400 |

| Transportation | $50 – $150 |

| Textbooks | $50 – $150 |

By carefully balancing your income against your responsibilities, you can make informed decisions that promote financial stability throughout your college years.

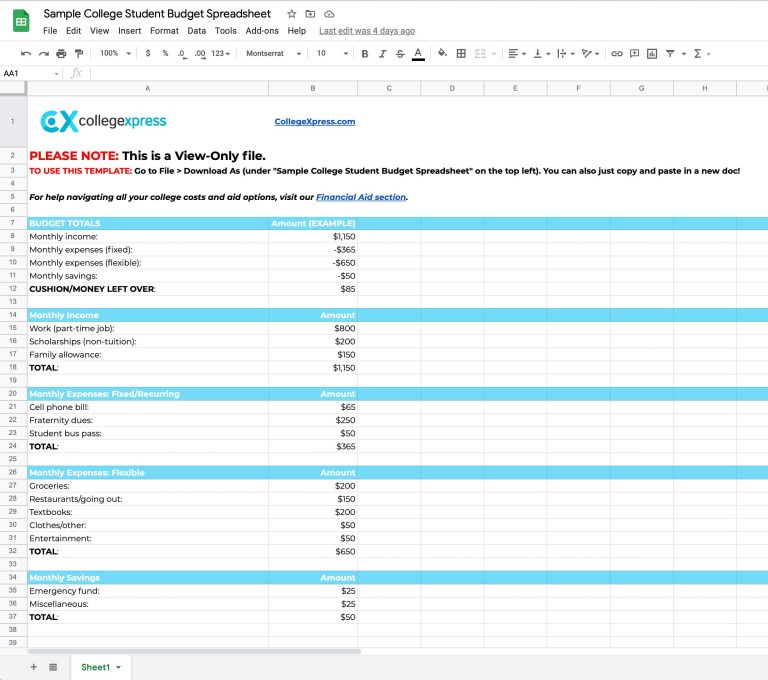

Creating a Realistic Budget: Tools and Techniques for Success

Creating a budget is not just a financial exercise; it’s a roadmap to achieving your academic and personal goals.To start, consider utilizing a mix of digital tools and traditional methods that suit your lifestyle and preferences. Mobile apps like Mint or PocketGuard can track your spending in real time, while spreadsheets offer a customizable framework for those who prefer a hands-on approach. Making use of envelope budgeting for specific expenditure categories, such as food and entertainment, helps in visually managing your funds. Utilize color coding in your spreadsheet to easily identify different categories and monitor your spending at a glance.

In addition to these tools, incorporating a few techniques can further enhance your budgeting success. Start with the 50/30/20 rule, which suggests allocating 50% of your income to needs, 30% to wants, and 20% to savings or debt repayment. Setting up a monthly financial review can keep you accountable; dedicate some time at the end of each month to review your budget,reflect on your spending habits,and make adjustments as necessary. here’s a simple table to help visualize your potential budget breakdown:

| Category | Percentage | Example Amount ($1000 Budget) |

|---|---|---|

| Needs | 50% | $500 |

| Wants | 30% | $300 |

| Savings/Debt Repayment | 20% | $200 |

Smart Spending: Strategies for Managing Your expenses Effectively

Managing your expenses while navigating the college experience can be challenging, but it’s essential for maintaining control over your finances. Identify your mandatory expenses first, which include tuition, housing, utilities, and textbooks. Once you have a clear picture of these fixed costs,you can allocate a specific monthly budget for them. next,prioritize your discretionary spending—this includes entertainment,dining out,and shopping. Consider using budgeting apps to track your expenses in real-time, allowing you to see were your money goes and adjust your spending habits accordingly.

To help streamline your financial strategy, create a detailed expense tracker. This can be in the form of a simple table outlining your monthly income versus expenses.for added clarity, categorize your spending to pinpoint areas where you can cut back. Here’s a sample of what your tracker could look like:

| Category | Monthly Budget | Actual Spending | Difference |

|---|---|---|---|

| Rent | $700 | $700 | $0 |

| Food | $300 | $350 | -$50 |

| Transportation | $100 | $80 | $20 |

| Entertainment | $150 | $200 | -$50 |

| Miscellaneous | $100 | $90 | $10 |

By reviewing this table regularly, you not only gain insights into your spending patterns but also empower yourself to make informed decisions.Identify trends in your spending—perhaps dining out is costing you more than cooking at home, or subscriptions are piling up unnoticed. Implement frugal habits like meal prepping and taking public transport to minimize costs. Remember,each small adjustment adds up,contributing to greater financial health as you continue your college journey.

Building Credit early: Tips for College Students to Establish financial Stability

Establishing a positive credit history while in college is crucial for students aiming to achieve financial stability. Opening a student credit card can be an effective first step; it allows you to build credit responsibly while managing small expenses.Make sure to choose a card with no annual fees and a reasonable interest rate.Using the card for regular purchases, such as textbooks or groceries, and paying off the balance in full each month can enhance your credit score and teach you vital budgeting skills. Remember, timely payments will positively impact your credit rating, while missed ones can set you back significantly.

In addition to credit cards, consider becoming an authorized user on a family member’s credit card. This strategy can help students benefit from the primary cardholder’s credit history,potentially boosting their score without assuming full financial responsibility.It’s also beneficial to keep track of your credit score using free online services that offer updates and insights. Avoid opening multiple lines of credit at once, and limit hard inquiries into your credit, as both can negatively affect your score. Maintaining a low credit utilization ratio—below 30% of your available credit—is key to demonstrating financial responsibility and building a solid credit profile.

To Conclude

As we wrap up this comprehensive guide to mastering your finances as a college student, remember that budgeting isn’t just about numbers; it’s about creating a lifestyle that fosters both academic success and personal growth. The habits you build today will set the foundation for your financial future. By employing effective budgeting strategies, tracking your expenses, and making informed choices, you can navigate the challenges of student life without the added stress of financial instability.

Don’t hesitate to revisit this guide as you progress through your college journey—your financial needs and priorities may change, and your budget should adapt accordingly. Embrace the learning curve that comes with managing your own finances, and don’t be afraid to seek advice or resources when needed. Whether it’s finding part-time work, applying for scholarships, or taking advantage of student discounts, every small step contributes to a more secure financial future.

Ultimately, mastering your finances is about empowering yourself to make choices that align with your goals and values. As you embark on this exciting chapter, keep your financial health in mind, and take charge of your monetary destiny. Cheers to smart spending, saving, and a successful college experience!