Navigating the world of loans can often feel like a daunting task, especially when it comes to understanding how interest works and how it affects your monthly payments. Whether your considering a mortgage, car loan, or personal loan, mastering the calculations of loan interest is essential for making informed financial decisions. In this extensive guide, we’ll unravel the complexities of loan interest calculations, equipping you with the knowledge to accurately determine your monthly payments. We’ll explore key concepts, provide practical examples, and share helpful tips to empower you on your financial journey. By the end of this article, you’ll not only demystify loan interest but also gain the confidence necessary to tackle any loan scenario that comes your way. Let’s dive in and take control of your financial future!

Table of Contents

- understanding Loan Interest: The Basics of Amortization and Rates

- Calculating Monthly Payments: Formulas and Tools You Can Trust

- Strategies for Reducing Interest Costs: Tips for Savvy Borrowers

- Navigating Loan Terms: Choosing the Right Plan for Your Financial Goals

- final Thoughts

understanding Loan Interest: The Basics of Amortization and Rates

When navigating the landscape of loan interest, two fundamental concepts to grasp are amortization and interest rates. Amortization refers to the gradual repayment of a loan through scheduled payments, which encompass both principal and interest components. As you make payments, the principal amount decreases, resulting in lower interest charges over time. This means that in the earlier stages of the loan term, a larger portion of your payment goes toward interest, while later payments contribute more to the principal repayment. Understanding this progression is essential for effectively managing your loan obligations and anticipating future payment dynamics.

Interest rates play a critically important role in determining the cost of borrowing. They can vary based on factors such as credit score, loan type, and market conditions. Typically classified as either fixed or variable rates, they can greatly influence your monthly payments. A fixed interest rate remains constant throughout your loan term,providing stability and predictability in budgeting. In contrast, a variable rate may fluctuate with market trends, possibly leading to varying payment amounts over time. To illustrate how interest rates impact monthly payments, consider the following table:

| Loan Amount | Interest Rate (%) | Monthly Payment |

|---|---|---|

| $10,000 | 5 | $188.71 |

| $10,000 | 7 | $198.41 |

| $10,000 | 10 | $215.74 |

Calculating monthly Payments: Formulas and Tools You Can Trust

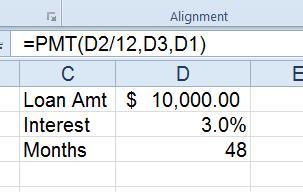

Understanding how to calculate your monthly loan payments can empower you to take control of your finances. Whether you’re taking out a mortgage, an auto loan, or a personal loan, having a reliable formula at your disposal is key. The most common formula used to determine monthly payments is the amortization formula, which takes into account the principal amount, interest rate, and the total number of payments. Here’s the formula you can use:

Monthly Payment (M) = P [ r(1 + r)^n ] / [ (1 + r)^n – 1 ]

Where:

P = principal loan amount

r = monthly interest rate (annual rate divided by 12)

n = number of payments (loan term in months)

utilizing this formula, you can plug in your numbers to find out exactly what you’ll need to pay each month. Additionally, there are several tools and calculators available online that can help simplify this process, allowing you to adjust variables and compare different loan scenarios effortlessly. Here are a few trusted tools:

- Bankrate’s Loan Calculator – Provides a detailed breakdown of your total interest and repayments.

- Calculator.net – Offers customizable options for various loan types.

- Mortgage Calculator – Specifically designed for home loans,including taxes and insurance.

Strategies for Reducing Interest Costs: Tips for Savvy Borrowers

Reducing interest costs is a cornerstone of smart borrowing.One effective strategy is to shop around for the best rates. Different lenders offer varying interest rates based on their policies and your credit score. Leverage online comparison tools to find competitive rates. Additionally, don’t hesitate to negotiate with lenders; they may be willing to adjust terms based on your financial history or if you have offers from other institutions. Consider opting for a shorter loan term, as a lower term typically equates to a lower interest rate, which can result in significant savings over the life of the loan.

Another strategy is to make extra payments towards your principal. This approach reduces the overall balance faster, which in turn decreases the interest you will owe over time. Setting up a bi-weekly payment schedule rather of monthly can also be beneficial, as it results in an extra payment each year without a significant impact on your budget. Alternatively, consider choosing a fixed-rate loan over a variable-rate loan to avoid potential fluctuations in interest costs, which can lead to higher payments down the line.

Navigating Loan Terms: Choosing the Right Plan for Your Financial Goals

When choosing a loan plan, it’s crucial to align it with your financial objectives. Whether you’re looking to fund a home renovation, buy a new car, or consolidate debt, understanding the nuances of various loan options can definitely help you take the next step confidently. Consider the following factors when navigating your choices:

- Loan Term: Longer terms can mean lower monthly payments but higher interest costs over time.

- Interest Rate: Fixed versus variable rates can significantly impact your total repayment amount.

- Fees: Be aware of origination fees or prepayment penalties that may come with the loan.

- Flexibility: Some loans offer flexibility in payments, allowing adjustments based on your financial situation.

To evaluate potential loan plans effectively, consider creating a simple comparison table.This will help clarify your options and highlight the differences. Here’s a sample format you might use:

| Loan Type | Interest Rate | Term (Years) | Monthly Payment |

|---|---|---|---|

| Personal Loan | 6% | 5 | $193.33 |

| Mortgage | 4% | 30 | $477.42 |

| Auto Loan | 5% | 5 | $188.71 |

Monthly payments are estimates based on standard calculations and may vary based on the lender’s criteria.

Final Thoughts

mastering loan interest calculations is an essential skill that empowers you to take control of your financial future. By understanding the intricacies of interest rates, loan terms, and monthly payment calculations, you can make informed decisions that align with your financial goals. Whether you’re planning to buy a home, finance a vehicle, or fund your education, having a solid grasp of these concepts will not only help you secure favorable terms but also ensure that you stay within your budget.Remember, the key to effective loan management lies not just in knowing the numbers, but in utilizing tools and resources that simplify the process. Don’t hesitate to leverage online calculators, speak with financial advisors, or explore educational resources to enhance your understanding further.with the right knowledge and a strategic approach,you’ll be well on your way to mastering the art of loan interest calculations. Thank you for joining us on this journey—here’s to making confident and savvy financial choices!