In today’s fast-paced financial landscape, understanding the nuances of credit can make a meaningful difference in managing your personal finances effectively. One key concept that often perplexes consumers is the credit card grace period—a critical feature that can save you money if navigated wisely. But what exactly is a grace period,and how can it impact your financial health? In this thorough guide,we’ll unravel the complexities surrounding grace periods,equipping you with the knowledge to make informed decisions on your credit usage. From the mechanics of how grace periods work to tips on how to maximize their benefits, our goal is to empower you with the insights needed to enhance your financial literacy and maintain a healthy credit profile. Whether you’re a seasoned cardholder or just starting on your credit journey, understanding grace periods is an essential step towards achieving your financial goals. Let’s dive in and demystify this vital aspect of credit management.

Table of Contents

- Navigating the Basics of Credit Card Grace Periods

- Importance of Grace Periods in Managing Your Finances

- Strategies for Maximizing Your Grace Period Benefits

- Common Misconceptions About Grace Periods Debunked

- Concluding Remarks

Navigating the Basics of Credit Card Grace periods

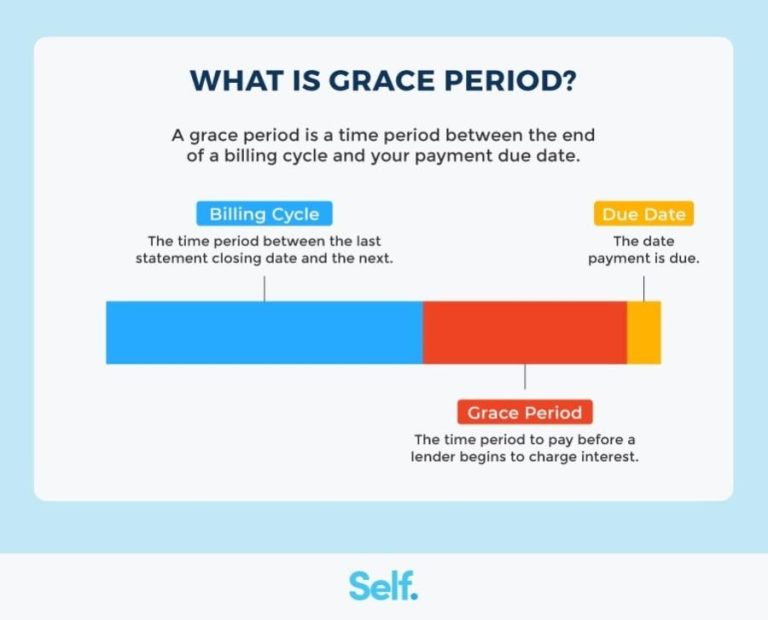

The grace period is a crucial aspect of any credit card agreement, providing cardholders with a breathing space before interest is applied to their outstanding balance. Typically ranging from 21 to 25 days, this period begins on the last day of the billing cycle and continues untill the payment due date.Understanding this timeframe is vital for cardholders who aim to maximize their credit benefits while minimizing interest costs. Key points to consider include:

- Payment Timing: To take full advantage of the grace period, ensure that you pay off your balance in full before the due date.

- Types of transactions: Purchases generally qualify for a grace period, but cash advances and balance transfers might not.

- Impact of Minimum Payments: Making only the minimum payment can result in interest accruing on the remaining balance, eliminating the benefits of the grace period.

Every credit card issuer has different terms, so it’s essential to read the Cardholder Agreement carefully. If you miss a payment or carry a balance beyond the grace period, interest will start accruing on your outstanding balance. So, keeping track of your billing cycles and payment due dates is imperative.Here’s a simple table illustrating how grace periods can work across different card issuers:

| Issuer | Grace Period (Days) | Applies to Purchases? |

|---|---|---|

| Bank A | 25 | Yes |

| Bank B | 21 | Yes |

| Bank C | 30 | No (Cash advances) |

Importance of Grace Periods in Managing Your Finances

The grace period serves as a financial lifeline for consumers managing credit card payments. It provides a temporary reprieve from interest accrual, allowing you to pay off your balance without incurring additional charges. This period typically lasts between 21 and 25 days, depending on the credit card issuer, and starts from the last day of your billing cycle. During this time, making timely payments can significantly enhance your credit score and improve your overall financial health. Understanding when your grace period ends empowers you to strategize your payments effectively and take control of your spending habits.

Utilizing the grace period can also have broader implications for your budgeting strategy.By effectively incorporating this time frame into your financial plan, you can enjoy the benefits of credit without the immediate pressure of interest rates. Consider the following:

- Cash Flow Management: Align your payment cycles with your income schedule.

- Debt Reduction: Use the grace period to focus on paying down existing debts.

- Emergency Buffer: Allocate additional funds for unforeseen expenses while avoiding interest.

Additionally, keeping track of your grace period can guide your future financial decisions. Maintaining an organized chart allows you to understand your billing cycles better and strategize payment timings optimally.

| Credit Card Issuer | Grace Period Duration |

|---|---|

| Issuer A | 25 days |

| Issuer B | 21 days |

| Issuer C | 30 days |

Strategies for Maximizing Your Grace Period Benefits

To fully leverage the benefits of your credit card’s grace period, it’s crucial to plan your payments strategically. Start by understanding the billing cycle of your card, as this determines when the grace period begins and ends. Typically, a grace period lasts from the end of your billing cycle until your payment due date. Here are some effective strategies:

- Make early purchases: use your card for essential expenses right after your statement period closes to maximize the time before payment is due.

- Pay off balances promptly: Always aim to pay your balance in full during the grace period to avoid interest charges.

- Monitor your statements: regularly check your billing statements for any discrepancies to ensure you’re on track to maintain your grace period benefits.

Additionally, keeping track of your spending can significantly enhance your financial management. Utilizing budgeting tools and apps can provide insights into your cash flow and improve your spending habits. Consider implementing these practices:

- Set alerts: Use notifications to remind you of upcoming payment dates, ensuring you capitalize on the grace period effectively.

- Track your expenses: Break down your purchases by category to identify areas where you can control spending, allowing you to always pay your balance in full.

- Review terms regularly: Stay informed about any changes to your credit card terms concerning the grace period to adjust your strategies accordingly.

Common Misconceptions About Grace Periods Debunked

The concept of grace periods is often misunderstood, leading to confusion for many credit card users. One prevalent myth is that all credit cards offer the same length of grace period. In reality, grace periods can vary significantly between cards and issuers.While some cards may offer a grace period of up to 25 days, others may have shorter or even no grace periods for certain charges.It’s essential to check the terms and conditions of your specific card to know exactly what you can expect. Another common misconception is that payments made during a grace period prevent interest from accruing on already existing balances. This is not the case; grace periods only apply to new purchases made after the last statement date, assuming you pay your previous balance in full by the due date.

Furthermore, many believe that simply making a minimum payment during the grace period will suffice to avoid interest. However, this is misleading. To fully utilize the grace period and avoid interest on new purchases, you must pay off your previous balance in full by the due date. if you carry a balance into the next billing cycle, you may forfeit your grace period privileges, and interest will apply to all new purchases from the moment they are made. Understanding these nuances ensures that you can make informed decisions about your credit card usage and payments.

Concluding Remarks

understanding credit card grace periods is essential for managing your finances effectively and making the most of your credit. By familiarizing yourself with the nuances of this often-overlooked aspect of credit card use, you can save money on interest charges and avoid unexpected fees. Remember to always read the terms and conditions of your specific credit card and stay proactive in monitoring your accounts. Knowledge is power, and by leveraging the benefits of grace periods, you can enhance your credit management strategy.

we hope this comprehensive guide has provided you with valuable insights into how grace periods work and how you can apply this knowledge to your spending habits. If you have any further questions or topics you’d like us to cover, feel free to leave a comment below. Stay tuned for more tips and advice on navigating the world of personal finance!