In today’s fast-paced consumer landscape, savvy shoppers are constantly on the hunt for ways to stretch their dollars further. enter cashback and rewards programs—two powerful financial tools that can transform your everyday spending into notable savings. Whether you’re swiping your credit card for groceries, dining out, or booking a vacation, understanding how to effectively leverage these programs can unlock a treasure trove of benefits.In this article,we’ll explore the ins and outs of cashback and rewards programs,offering expert tips and insights to help you maximize your savings. Join us as we navigate through the various options available, ensuring that with each purchase, you’re not just spending, but strategically investing in your financial future.

Table of contents

- Understanding Cashback and Rewards Programs

- Choosing the Right Programs for your Spending Habits

- Strategic Tips for maximizing Rewards and Cashback

- Common Pitfalls to Avoid in Cashback and Rewards Strategies

- Final Thoughts

Understanding Cashback and Rewards Programs

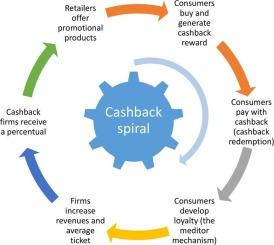

Cashback and rewards programs are powerful tools for savvy shoppers aiming to get the most out of their spending. These programs typically allow consumers to earn a percentage back on their purchases or accumulate points that can be redeemed for various perks. Understanding the differences and benefits of each programme is essential for maximizing savings. Cashback programs offer immediate returns on every qualifying transaction, while rewards programs frequently enough provide points that can be accumulated and exchanged for travel, discounts, and gifts. Many major retailers and financial institutions offer these incentives, catering to different consumer preferences and shopping habits.

To fully capitalize on cashback and rewards programs, consider the following tips:

- Choose the Right Program: Analyze which program aligns with your spending habits.

- Stack Offers: Use cashback websites alongside credit card rewards to maximize savings.

- Stay Informed: Keep track of promotions and bonus earning opportunities that can substantially boost your rewards.

| Program Type | Key Feature | Best For |

|---|---|---|

| Cashback | Immediate cash return on purchases | Frequent shoppers at specific retailers |

| Rewards Points | Accumulate points for future redemptions | Travel enthusiasts or gift shoppers |

Choosing the Right Programs for Your Spending Habits

When selecting programs that align well with your spending habits, it’s crucial to evaluate the types of expenditures you make most often. Begin by keeping track of your monthly purchases—identify which categories dominate your spending, such as groceries, dining out, or travel. The ideal cashback or rewards programs will offer the highest returns in those specific areas.Look into options that provide bonus cashback or points for these categories; this will help you accumulate rewards faster. Some programs offer tiered structures that increase your earnings as your spending grows, so be sure to consider how your expenses might change over time.

Another factor to consider is the redemption options available through different cashback and rewards programs. A program that gives you substantial rewards but has limited ways to redeem them can become frustrating.When examining options, look for programs that offer a variety of redemption choices, including cash, gift cards, or travel perks. Consider the program’s terms and conditions as well; some may have expiration dates for points or rewards, while others might limit the number of redeemable categories. By aligning the program’s benefits with your lifestyle, you can effectively maximize your savings without altering your spending habits.

| Program | Categories | Cashback/points Rate | Redemption Options |

|---|---|---|---|

| Program A | Groceries, Dining | 5% Cashback | Cash, Gift Cards |

| Program B | Travel, Entertainment | 2x Points | Travel Rewards, Gift cards |

| Program C | All Purchases | 1.5% Cashback | cash, Merchandise |

Strategic Tips for Maximizing Rewards and Cashback

To truly unlock the potential of cashback and rewards programs, it’s essential to be strategic in your approach. Start by identifying the programs that align best with your spending habits. Look for options that offer higher rewards on categories you frequently shop in, such as groceries, gas, or dining out. Also, consider signing up for multiple programs to diversify your rewards pool. This way, you can maximize benefits by using specific cards or accounts for specific purchases. Take advantage of bonus offers that many programs have, often providing a higher percentage back on purchases within a limited time frame, ensuring your spending is both intentional and rewarding.

Another vital component is keeping track of your earnings and deadlines. Make use of apps or spreadsheets to monitor your rewards balance, redemption options, and expiration dates. Establish reminders for any special promotions or bonuses that may arise, ensuring you never miss an opportunity to earn more. Additionally, consider consolidating your cashback or rewards onto a single card when possible to attain higher-tier benefits more quickly. Here’s a simple table to illustrate how choosing the right program can impact your potential rewards:

| Rewards Program | Category Bonus | Annual fee |

|---|---|---|

| Cashback Plus | 5% on Groceries | $0 |

| Reward Traveler | 3% on Travel | $95 |

| Dining Delight | 4% on Dining | $0 |

Common Pitfalls to Avoid in Cashback and Rewards Strategies

One of the most significant missteps individuals make is failing to thoroughly understand the terms and conditions of their cashback and rewards programs. Many programs come with specific earning limits, expiration dates, and redemption requirements that can easily catch users off guard. To avoid this, it’s crucial to carefully review program details and stay informed about any changes. Consider the fine print, which may include:

- Minimum spending thresholds for earnings.

- Exclusions, such as specific merchants or product categories.

- Expiration timelines for points or cashback earnings.

Additionally, many fall into the trap of using too many different programs simultaneously, leading to confusion and missed opportunities. Streamlining your approach can enhance the efficacy of your rewards strategy. Focus on a select few programs that align with your spending habits to maximize benefits. Track and manage your rewards efficiently by:

- Setting reminders for expiration dates.

- linking accounts to budgeting apps for easier monitoring.

- Choosing programs that integrate seamlessly with your regular expenses.

Final Thoughts

maximizing your savings through cashback and rewards programs is not just a savvy financial strategy; it’s an opportunity to make your everyday spending work harder for you. By understanding the different types of programs available, keeping your spending habits in mind, and making a few strategic moves, you can significantly enhance your savings potential. Remember to stay organized and informed,as the landscape of rewards and cashback options is ever-evolving.

Take the time to evaluate which programs align best with your lifestyle, and don’t hesitate to switch if better opportunities arise. Whether it’s accumulating points for a dream vacation or simply enjoying a little extra cash in your pocket, the benefits are well worth the effort. So, as you embark on your journey to unlock the full potential of cashback and rewards programs, stay motivated, keep tracking your progress, and watch your savings grow. Happy saving!