Navigating the world of Automated Teller Machines (ATMs) can frequently enough feel like a minefield, teeming with potential pitfalls—from hidden fees to safety risks. As a cornerstone of modern banking, ATMs provide unmatched convenience, allowing us to access our funds anytime, anywhere. However, an essential aspect of making the most of this convenience lies in understanding how to use ATMs safely adn wisely. In this comprehensive guide, we will explore best practices for ATM use that ensure your transactions are not only secure but also cost-effective. Whether you’re a seasoned user or just starting to familiarize yourself with these essential banking tools, our insights will empower you to master ATM usage while minimizing fees and maximizing safety. Join us as we unveil the secrets to becoming a savvy ATM user!

Table of Contents

- Understanding ATM Types and Their Fees

- Essential Safety Tips for ATM Transactions

- Strategies for Finding Fee-Free ATMs

- Leveraging Technology for Smart ATM Usage

- Future Outlook

Understanding ATM Types and Their Fees

When it comes to accessing your funds on the go, understanding the various types of ATMs is essential. Generally, ATMs can be categorized into three main types: bank-owned ATMs, network ATMs, and independent ATMs. Bank-owned ATMs are typically found at branch locations and may offer little to no fees for account holders. Network ATMs, positioned within wider a network (like Allpoint or MoneyPass), can also be low-cost if you belong to the network. Independent ATMs, though, are frequently enough located in convenience stores, bars, and tourist areas, and may charge significantly higher fees for withdrawals and balance inquiries. Always check for signage indicating the fees associated with using these ATMs.

Fees associated with ATM usage can vary greatly depending on the type and location of the machine. Hear’s a quick overview of common fees you might encounter:

| ATM Type | Typical Fee Range | Remarks |

|---|---|---|

| Bank-Owned | Free – $3 | waived for account holders |

| Network | Free – $2 | No fee if affiliated with the bank |

| Independent | $2 – $5+ | High fees, especially in tourist areas |

To minimize withdrawal costs, always consider using ATMs associated with your bank or those in your bank’s network. Additionally, before using an ATM, be sure to check for any prominent signage displaying transaction fees. Familiarizing yourself with ATM types and their corresponding fees will empower you to make smarter, cost-effective decisions whenever you need cash.

Essential Safety Tips for ATM Transactions

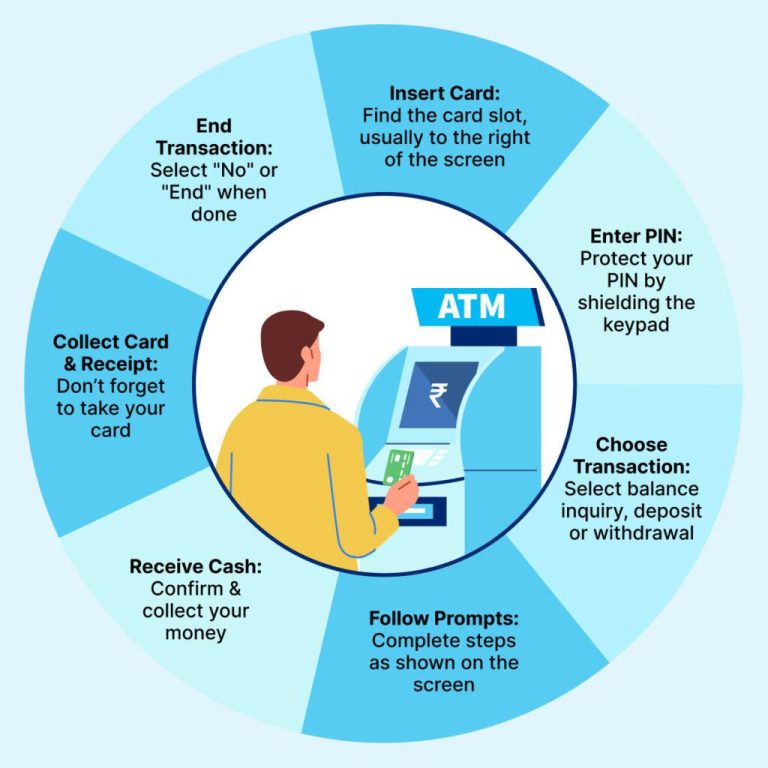

When using an ATM, always prioritize your safety by being aware of your surroundings. before approaching the machine, scan the area for any suspicious individuals or activities. It’s advisable to use ATMs located in well-lit, busy areas, notably during late hours.Never allow yourself to be distracted while conducting your transaction. Keep your PIN confidential and shield the keypad from prying eyes when entering your details. Additionally,look for signs of tampering on the ATM,such as unusual attachments or modifications. If anything seems off, it’s best to skip that machine and find another one.

Another way to enhance your ATM experience is to manage your withdrawals smartly to avoid excessive fees. Many banks charge for using ATMs outside their network, so try to locate machines that belong to your bank or its partner networks. Here are a few tips to minimize your transaction costs:

| Tip | Description |

|---|---|

| Know Your Fee Structure | Familiarize yourself with your bank’s fees for out-of-network ATM usage. |

| Use Your Bank’s App | many banking apps provide locator services for ATMs that are fee-free. |

| Consolidate Withdrawals | Plan ahead to withdraw larger amounts less frequently to cut down on fees. |

strategies for Finding Fee-Free ATMs

When it comes to avoiding ATM fees, being strategic is key. Start by checking with your bank or credit union for a list of their own fee-free ATMs; many institutions have partnerships with broader networks that provide free access. Additionally, utilize online resources or mobile apps that allow you to locate nearby ATMs. These tools often filter search results to display only those that won’t charge you a service fee, making it easier to find a suitable option when you need cash.

Another effective approach is to familiarize yourself with the common ATM networks in your area. keeping in mind the following tips can save you from needless fees:

- stay within your bank’s network: Always prioritize ATMs that belong to your bank’s network.

- Look for co-op ATMs: Many credit unions and banks belong to co-op networks that allow members to use ATMs without fees.

- Check locations in retail stores: Some national retailers offer ATMs that do not charge fees for transactions.

| ATM Type | Fee Status | Example Locations |

|---|---|---|

| Bank-owned ATMs | Fee-Free | your bank branches |

| Co-op ATMs | Fee-Free | Participating credit unions |

| Retail ATMs | Variable Fees | Supermarkets, convenience stores |

Leveraging Technology for Smart ATM Usage

In today’s fast-paced world, technology plays a crucial role in optimizing ATM usage. To enhance your banking experience while minimizing fees and ensuring security, it’s essential to adopt various tech-savvy approaches.One effective method is to utilize mobile banking apps. These apps often provide a comprehensive database of nearby ATMs, highlighting those that are fee-free or affiliated with your bank. Additionally, many apps allow users to locate ATMs equipped with advanced features such as contactless transactions and cash deposits, ensuring convenience and safety while accessing your funds.

Furthermore,consider harnessing the power of two-factor authentication when accessing your accounts via ATMs.This adds an extra layer of security that can significantly reduce the risk of fraud.When using an ATM, remember to always check for signs of tampering or skimmers. Moreover, enabling alerts for transactions on your mobile device allows you to monitor any unauthorized activity in real-time. Here are a few smart practices to keep in mind:

- Use only ATMs in well-lit, populated areas.

- Regularly update your banking app for enhanced security features.

- Set withdrawal limits to manage your spending more effectively.

Future Outlook

mastering ATM use is not just about convenience; it’s a crucial element of smart financial management. by understanding how to navigate your bank’s network and the intricacies of various fee structures, you empower yourself to make better choices that save both time and money. Always remain vigilant about your surroundings and practice safety measures to ensure your transactions are secure.

As you become more adept at using ATMs, you’ll find that the benefits extend beyond just avoiding fees—they also contribute to a more seamless banking experience. Whether you’re traveling abroad or simply withdrawing cash at your local branch, being informed will help you stay ahead of potential risks while maximizing your savings.

We hope this guide has equipped you with valuable insights and practical tips for mastering ATM use. Remember, the more informed you are, the better prepared you’ll be to handle any situation that arises. Happy banking!